Dynamo’s Dilemma

Dale Dynamo, owner of Dale’s Miraculous Medical Devices (DMMD), was confused. He had made the decision to adopt lean thinking in the manufacture of his company’s products. As a first step, he wanted to combine the three independent manufacturing processes required to produce his company’s highest volume product into a single manufacturing cell. Intuitively, he understood that DMMD would reap many benefits from cellular manufacturing, but his Controller, Marvin Myopia, provided him with an analysis that appeared to prove otherwise. According to Myopia’s analysis, the cellularization of this product’s manufacture would increase, not decrease, the product’s cost.

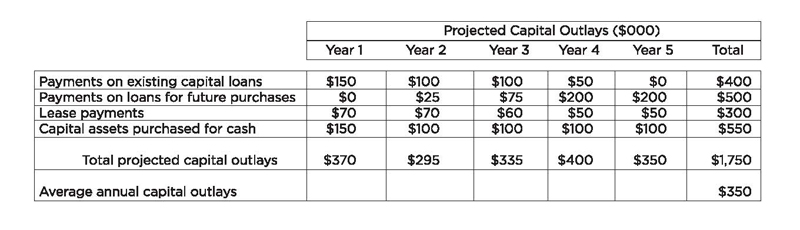

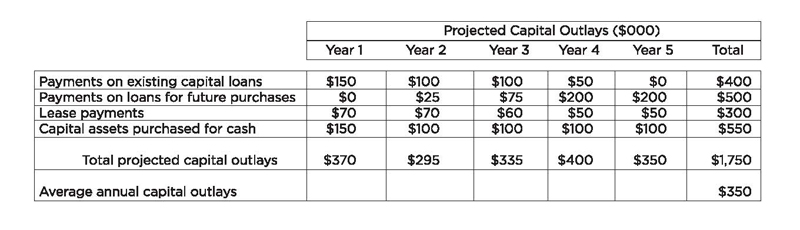

Using the company’s direct labor-based costing system, Myopia’s analysis, showed that cellularizing these three processes would increase the manufacturing cost of the part by 25 percent, from $25.50 to $32.00. (See Exhibit 1.) The problem with cellularization, according to Myopia, was the fact that all processes in a cell have the same throughput rate—the cell only operates as fast as its slowest operation. Since Process #1 can only produce six parts per hour, Process #2 will slow down from ten to six parts per hour and Process #3 from eight to six parts per hour. As Myopia saw it, this less-efficient use of manpower and equipment would result in a higher product cost.

Based on these “facts,” Dynamo began having second thoughts about his plans to create manufacturing cells. Was his intuition faulty, or was there actually something wrong with Myopia’s analysis?

To get a better understanding of the situation, Dynamo decided to create comparative graphics showing the product’s manufacturing flow as it currently stands and as it would be if a manufacturing cell existed. His comparison is shown in Exhibit 2. What he noticed first were the four in-process movements that would be eliminated, as well as the need to store in-process inventory twice. Eliminating the movements would reduce material handling activities by two-thirds and over time cut the cost of indirect labor and benefits, fuel, lift truck maintenance and other costs related to this non-value adding work. Without the need for storage, floor space would be freed up for more productive use and in-process inventory (which he cannot use as collateral for his working capital line of credit), as well as the overall cycle time required to produce the product, were reduced by ten days. Why, he wondered, don’t any of these savings appear in Myopia’s analysis? Could there be something amiss with the way his company costs its products and processes?

He then noted that the chronological time required to produce the part would be cut from three days to one. The manufacturing time for each individual process would remain the same, but since they would take place in a continuous flow, only one day would be required to manufacture an entire part. The “start-to-finish” time of manufacturing the product would be reduced from 13 days (three days manufacturing and ten days storage) to just one day. The ramifications of this reduction in manufacturing cycle time were clear to an operations pro like Dynamo. The added agility cellular manufacturing provides would allow him to react to customer demand much more quickly which, in turn, would reduce the need to keep so much finished goods inventory on hand. In his estimation, his 30-day finished inventory requirement could be reduced to ten days. Instead of beginning the production of a part 43 days before its expected sale, it could begin 11 days ahead of that sale, making the 20-day reduction in his finished goods inventory possible. This reduction would free up additional floor space for more productive use as well as reduce the cost of financing the business.

Why don’t any of these savings appear in Myopia’s analysis? Could there be something amiss with the way his company costs its products and processes?

This added agility also has a ripple effect upstream in the company’s raw material inventory requirements. A forecast of customer demand 11 days in advance will be more accurate than one made 43 days before the potential sale. This means that the safety stock of raw materials required to support manufacturing can be reduced substantially. Instead of the 30-day supply deemed necessary under current conditions, Dynamo estimates that the 11-day cycle time and reduction in “demand risk” would enable the company to limit its raw material inventory investment to a ten-day supply—20 days fewer than it is today. This would free up even more floor space for more productive use and further reduce the cost of financing the business.

Why don’t any of these savings appear in Myopia’s analysis? Could there be something amiss with the way his company costs its products and processes?

The answer to Dynamo’s questions should be clear; there is something wrong with the company’s direct labor-based costing system. Direct labor-based costing fails to reflect the fundamental economics involved in manufacturing. The company’s costing methods omit certain critical costs altogether and bury the cost of important processes in an overhead rate that gets “spread like peanut butter” using direct labor as a convenient, but inappropriate, knife to do the spreading.

Costing Cells & Lines1

Investment is a critical part of manufacturing, yet traditional costing practices, like direct labor-based costing, fail to measure the cost of this investment or assign it to the processes that make the investment necessary. The omission of a “weightedaverage cost of capital” (WACC) from cost calculations totally ignores the impact that tying up both fixed capital and working capital has on the cost of a process or a product.

As can be seen in Exhibit 3, the investment related to the production of a product spans from raw material to cell operations (where fixed capital is part of the investment as well as in-process inventory) and finally to finished goods inventory. I discussed the problem of material price vs. cost in my BONEZONE August article, so I will limit the discussion here to say that understanding the cost of a product produced in a cell or line requires an accurate measure of the “cost,” not just the “price,” of the raw materials, purchased components and outside manufacturing services used in its manufacture. The savings involved in creating cells and lines cannot be accurately measured if the cell’s or line’s impact on the “cost” of materials cannot be measured. For DMMD, creation of the cell reduces raw material inventory requirements and the “cost” of those materials.

The same is true for post-manufacturing costs—the cost of finished goods. Post-manufacturing costs will be the subject of a future article and will not be expanded upon here, but understanding the cost of cells and lines also requires the ability to accurately measure the impact cells have on the cost of activities (including the cost of capital) required to support the customer after the product has been produced. For DMMD, creation of the cell reduced the level of finished goods needed to support customer demand.

Sitting in the center of Exhibit 3 are cell operations—the conversion activity performed to turn the cell’s inputs (e.g. raw materials, components) into the cell’s outputs (e.g., finished goods). Note that I refer to cell operations as an activity, not activities. From a costing perspective, a cell is a single activity made up of multiple components. You would no more cost the individual processes that comprise a cell than you would the individual parts that comprise a CNC machine or an injection molding press. When production is underway, all of the cell’s components parts are working in harmony to turn the cell’s inputs into its outputs at the highest throughput rate possible. As shown in Exhibit 3, the cell attempts to balance the cost of its operation, including its impact on pre- and post-cell costs, with a throughput rate that minimizes the cost per unit produced.

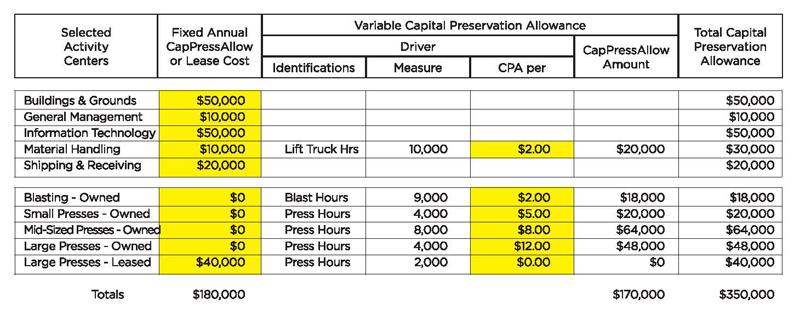

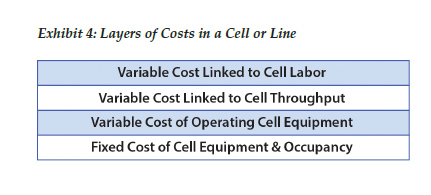

The costs required to operate a cell can be organized into four categories or layers as shown in Exhibit 4.

The first layer of cost is the Fixed Cost of Cell Equipment and Occupancy. Regardless of the cell’s output volume or the number of cell operations actually used (some products may not require all of the cell’s processes), this cost will remain the same. The cost of occupancy represents the cell’s share of the cost of having a facility within which the cell can operate based on its footprint within that facility. If the cell occupies five percent of the facility’s total square footage, it would be assigned five percent of the cost of owning and operating the facility. Even when all of the cell’s processes are not used, the cell will still be tying up the same portion of the facility’s available area. The fixed cost of equipment represents the weighted-average cost of capital related to the equipment located in the cell or the lease cost of any equipment located in the cell. Financial accounting conventions would suggest that time-based depreciation should also be included as a fixed cost, but including it would be a distortion in the actual economics of the cell.2

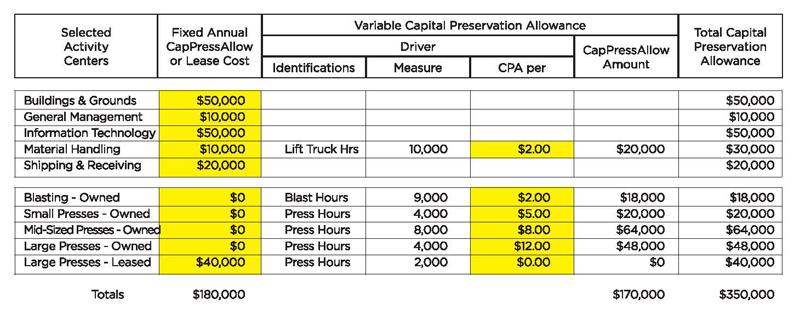

Variable Cost of Operating the Cell would include those costs varying in proportion to the hours the cell is in operation. This would include costs such as utilities, any operating supplies consumed as the cell operates and the cell equipment’s Capital Preservation Allowance.3

Variable Cost Linked to Cell Throughput would include those variable costs that are dependent upon the product being produced in the cell. The most common example of this type of cost is perishable tooling. Each product produced in a cell may require a different amount of perishable tooling; it would not be the same for every hour that the cell is in operation. One option would be to treat these as direct costs—measuring their consumption per unit, treating them the same as raw materials or components and excluding this category of indirect costs altogether. Otherwise, a different cost per hour of cell operation would need to be created for each of the cell’s products.

Variable Cost Linked to Labor would include the wages, taxes, benefits and support cost for those individuals assigned to the cell, whether or not they would normally be categorized as “direct” labor. A material handler or inspector assigned to the cell would be part of the cell’s cost just as if they were actually operating the equipment. These costs could also vary depending upon the product being produced in the cell. Products not requiring all of the cell’s processes would likely require fewer individuals than one needing all of its processes.

In short, a cell or line should be treated as a single process—a single routed step—not as multiple processes. The cost per hour of its operation may vary depending on the product being produced, but it still must be viewed as a single process if the costs of the products produced in the cell are to be accurately measured.

If a company is to understand the benefits that accrue as a result of cellularization, including the “upstream” and “downstream” benefits it generates, it cannot continue to follow an obsolete, direct labor-based costing model, that fails to accurately reflect the fundamental economics that underlie a 21st Century manufacturing firm.

References

- A line is simply an extended cell. Both represent a series of continuous processes with each dependent on all or some of the processes that come before it and where the buildup of work in-process between operations is limited or non-existent.

- A discussion of weighted-average cost of capital, depreciation and lease cost was presented in my article, “Is Depreciation a Misleading Illusion?” in the October 2012 issue of BONEZONE.

- The Capital Preservation Allowance is also discussed in the article referenced above.

During more than 25 years as a consultant, Doug Hicks has championed the development of practical, down-to-earth cost management solutions for small and mid-sized organizations. In that time, he has helped nearly 200 organizations of all kinds transform their history-oriented accounting data into customized, value-enhancing decision support information that provides accurate and relevant intelligence needed to thrive and grow in a competitive world. He shares his experience through seminars conducted throughout the U.S. and in trade and professional periodicals (including Management Accounting, Cost Management, Manufacturing Engineering and Journal of Accountancy) and two books, including I May Be Wrong, But I Doubt It: How Accounting Information Undermines Profitability.