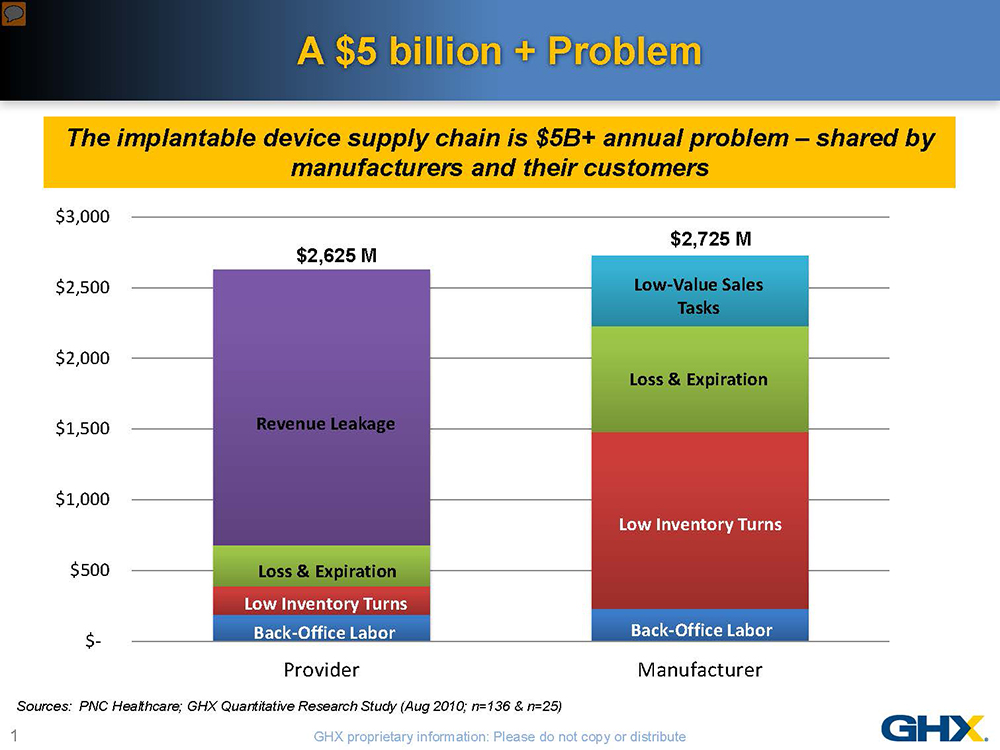

The implantable device supply chain is ripe with waste—more than $5 billion in inefficiencies has been documented in the U.S. alone. This knowledge, however, provides a unique opportunity for medical device manufacturers and their customers to collaborate in reducing these costs. Shared nearly equally by manufacturers and healthcare delivery organizations, these inefficiencies represent more than a 12% overhead on healthcare spending. The problems are even more acute in the orthopaedic device supply chain given the multiplicity of parts, instruments and personnel involved, varying inventory ownership and distribution models and complex pricing structures.

With the medical device excise tax and declining reimbursements, neither manufacturers nor hospitals can afford to do “business as usual.” Hospitals are paying much closer attention to implantable devices, which typically represent 30% of their total supply spend and can account for more than 50% of the cost of some procedures. For many healthcare providers, the answer is to put more price pressure on manufacturers. But a more mutually advantageous approach would be to focus on supply chain inefficiencies, especially when you consider that higher costs-to-serve can contribute 30% to 45% of the total cost of some implantable devices. Without customer involvement, many of the practices that increase costs-to-serve for orthopaedic manufacturers cannot be effectively addressed. Recognizing their shared pain, a group of implantable device manufacturers and healthcare systems are identifying savings opportunities through programs to automate, standardize and optimize the implantable device supply chain.

The problems stem from four main areas:

- Highly manual, duplicative and error-ridden processes

- Lack of standardized processes and data

- Multiple inventory ownership models with high levels of consigned inventory

- Lack of visibility around product demand and usage

Manual Processes: Breed Errors and Inefficiencies

Unlike the supply chain for consumable products, the implantable device supply chain has not been automated. From the moment a case is scheduled, through product delivery and use, until after the procedure is completed, the entire process is painfully manual, disjointed, duplicative and error-prone.

Managing inventory, preparing for cases and documenting and reconciling supply usage involves multiple parties: sales reps, surgeons and circulating nurses, just to name a few. Combine the number of parties with manual, paper-based processes and you have a breeding ground for errors and inefficiencies. All of these personnel—including the sales reps—are also highly trained. One major orthopaedic manufacturer requires its representatives to have 360 hours of clinical training and testing on the company’s products in order to best assist the physician. But both nurses and sales representatives spend considerable time on what are essentially clerical tasks: counting inventory, capturing product usage and making sure their data matches after the case. Since much of the documentation is paper-based and the processes often vary between hospital and manufacturer, discrepancies often arise in the data collected, which can delay purchase orders being issued and manufacturers being paid.

Data Synchronization: The Key to Automation and Accuracy

Lack of data synchronization has been one of the historical barriers to automating the implantable device supply chain. For many hospitals, data on implantable devices is not managed—or not well, at least—in the item master. Non-file items create a lot of confusion about the products used and the correct pricing, all of which can further delay the process and the payment.

Data synchronization is also critical to using electronic data interchanges (EDI) to automate the data flow between manufacturers and customers in the form of purchase orders, invoices and other supply chain documents. A hospital cannot perform charge capture if it does not have the right part numbers, prices and charge codes in a timely and accurate manner. Likewise, a manufacturer cannot reduce inventory turns and non-value added sales expense without good data from the provider.

Shift to Vendor-Owned Inventory Management

Much of the waste and complexity in the implantable device supply chain (and the reason why sales reps are inundated with paperwork) comes down to how inventory is managed. Over the past ten years, as providers have experienced increasing cost pressures, they have turned to suppliers (including orthopaedic device manufacturers) to manage their inventory. As a result, a large percentage of orthopaedic devices are either consigned inventory or stock held by sales representatives—so called ”trunk stock”—with a much smaller percentage owned by the hospitals. Adding to the complexity is the instrumentation used in orthopaedic cases, which are either hospital-owned or corporate loaners. Management of these assets falls heavily on the shoulders of the sales representatives who service the accounts. While manufacturers can reduce freight costs by using this model, they often have limited visibility to millions of dollars in inventory being shifted from hospital to hospital by reps, in transit with third party logistics providers, or sitting on hospital shelves often co-mingled with hospital-owned inventory. No wonder manufacturers report that they can have up to 60% excess inventory and write off seven to ten percent due to loss, waste or expiration!

Visibility…or Lack Thereof

Lack of visibility and coordination between manufacturers and hospitals also obscures demand signals. More timely communication as soon as a case is scheduled can help both parties better prepare the products and instrumentation that will be required. Large volume hospitals generally try to keep enough stock on hand to manage a peak day—say, five hip cases on average—but what if the patient requires an uncommon size, or if each case that day requires the same size implant? Level I trauma centers must also ensure that they can get necessary parts within less than an hour to maintain their certification. They depend upon their manufacturer partners to make sure they have what they need, when they need it.

Even with good planning, unexpected product needs can arise during a case, which can be harder to accommodate without synchronized product data in item masters. As we have said, there is no standard process for supply documentation in the operating room. The same is true for instrumentation. Who owns the tray and what belongs in which tray, or what one surgeon prefers over another, differs by hospital, physician and manufacturer, creating more complexity, confusion and cost.

To address many of these issues, a group of five orthopaedic and cardiac device manufacturers and a dozen or so healthcare systems have been working together to develop best practices, and are conducting pilots to measure the value of data synchronization, process automation, case preparation and product documentation. Below are some of the pilot results to date.

- Data Synchronization: With better synchronization of inventory, contract and catalog data held by providers and their partners, pilots have achieved a 71% decrease in non-item file lines (from 28% to 8%).

- Increased EDI Utilization: Better data synchronization is the first step toward being able to automate supply chain processes using EDI. The second is the ability to include lot and serial numbers in those transactions. By accomplishing these steps, the participating trading partners have increased EDI transactions for implantable devices from five to 100%.

- Automatic PO Reconciliation: By reducing invoice discrepancies and automating processes around sales orders, purchase orders, confirmations and invoices, the pilots have reduced the process cycle time from procedure to payment by 30% (from 29 to 20 days).

- Demand Planning: The pilot participants, which include manufacturers representing more than 30% of the orthopaedic device market, are now working to collaborate on how to better prepare for cases once they are scheduled and create tools that can automate the supply documentation process. By creating a list of products likely to be used, based on synchronized data, suppliers and hospitals can more easily and accurately document products that are implanted, explanted or wasted. With more collaboration and automation, the participating hospitals and manufacturers expect to further improve on the results achieved to date.

Historically, there has been little focus on improving supply chain processes in the orthopaedic world. The manufacturer’s primary relationship existed with the surgeon, not the hospital supply chain. The lack of coordination among the various parties has resulted in manufacturers customizing processes to meet the widely-varied demands of different customers. As with most things, variation only increases costs while lowering quality.

As manufacturers recognize the higher costs associated with the implantable device supply chain, many have started investing in technology to better manage their internal processes, with the expectation that customers will use their solutions when using their products. The problem is that this only introduces more complexity and variation. Customers cannot afford to adopt different practices depending upon which manufacturer is involved in a case.

The key to it all is to help both providers and their device company partners leverage their own technology investments for their own internal purposes, while looking for opportunities to standardize around shared best practices when they are working together.

As Executive Director of Industry Relations for GHX, Karen Conway works with industry associations, standards bodies, government agencies, analyst firms, academic institutions and the media to identify opportunities for hospitals and suppliers to improve business and clinical performance. Conway serves on the board of directors of AHRMM, the supply chain organization for the American Hospital Association; the leadership council of the ASU Health Sector Supply Chain Research Consortium and as co-chair of the HIMSS Supply Chain Special Interest Group.