Direct material, direct labor and manufacturing overhead are the three categories into which expenses have been segregated to arrive at the cost of a manufactured product for over a century. Direct material represents the price paid to vendors for materials, components and purchased manufacturing services; direct labor represents the wages and benefits paid to those individuals who touch the product during a process that enhances its value; and overhead represents the myriad of manufacturing costs that cannot be attributed to a specific product, but are necessary to support the manufacturing process.

The practice of segregating costs in this manner was devised over 200 years ago by the 19th century British Economist David Ricardo, who created it as a model of the agricultural industry in England. Ricardo’s model was developed to account for corn—not manufacturing. It was not adopted by manufacturers because it was believed to be accurate, but rather because it was a methodology that already existed and was deemed to be the most practical model for implementation in an era when all data collection was done manually, and the technology to support computations consisted of abacuses, mechanical adding machines and comptometers.

As information technology began its spectacular advance during the latter part of the 20th century, accountants at manufacturing firms were quick to capitalize on the increased data manipulation and computational power to perform the calculations behind their corn-growing model more quickly and efficiently. However, despite the well publicized concerns that were raised about the inappropriateness of Ricardo’s cost model in a modern manufacturing environment, few accountants paid any attention to the fundamental structure of the cost model itself. They became super-efficient number crunchers, developing critical decision support information that was both inaccurate and misleading.

The Cost of Raw Materials, Components and Manufacturing Services

One area in which the deficiencies of Ricardo’s model have led to inappropriate decisions and deprived companies of millions of dollars in profits is non-labor direct costs. These are the amounts paid to outside organizations for raw materials, components and manufacturing services—items commonly included by accountants under the heading of “direct materials.”

Under Ricardo’s model, the cost of direct materials equals the price paid for them. Over the years, this definition has been expanded by some manufacturers to encompass “landed costs,” the price paid for a purchased item plus any freight, insurance, duties, taxes or other costs needed to get the item to the buyer’s receiving dock. Although an improvement from the simple “price paid” measurement, landed costs still ignore many of the critical factors that determine the true “cost” of a direct item purchased by a manufacturer.

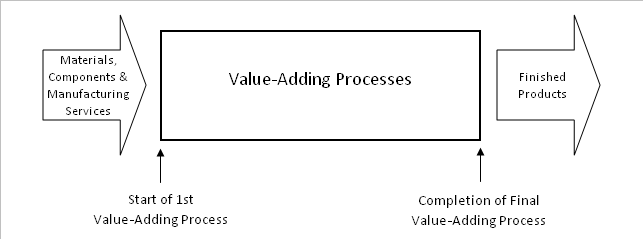

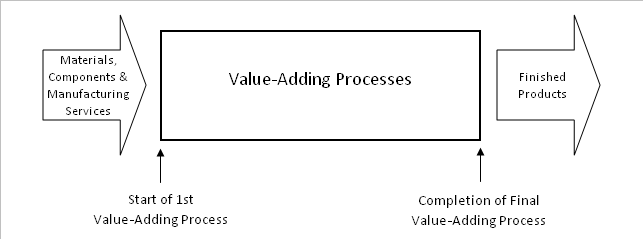

The basic role of a manufacturing firm is to purchase raw materials, components and manufacturing services and then use a variety of value-adding processes to turn them into a finished product. Exhibit 1 shows this basic flow of manufacturing. Manufacturing does not begin until the start of a company’s first value-adding process. Before manufacturing can begin, however, a considerable amount of work is required to make sure the required purchased items or services are available when they are needed at the place they are needed. Materials and components do not appear by magic; neither do qualified contractors magically appear when required. Treating the price paid for such purchases as their only cost fails to take into account the work performed to insure that they are where they need to be when they need to be there. To fully understand “the cost” of a purchased item, all these costs must be included as part of that item’s cost. Have a look at the manufacturing flow illustrated in Exhibit 1.

Exhibit 1: Basic Manufacturing Flow

Consider the types of activities involved in obtaining quality materials, components and manufacturing services. Engineering, information systems, materials management, purchasing, receiving, quality control, warehousing, accounts payable and material handling are just some of the activities that spend at least a portion of their time insuring the right items are available at the right place and the right time. They all contribute to the cost of the items being purchased.

Linking Activity Costs to Purchased Items

Obviously, varying degrees of effort and resources are required to support different categories of purchased items. Consider the different purchasing, receiving, quality, storage, obsolescence, carrying and other support costs related to these categories:

Bulk vs. Packaged Materials – A high-volume material used in a wide variety of products can be purchased in bulk with very few purchasing transactions, often has an automated material handling system, has a low probability of obsolescence and high inventory turnover. The same quantity of low-volume material will encompass multiple part numbers, numerous purchase orders, receipts, invoices and other purchasing transactions, extensive manual material handling, a higher probability of obsolescence and lower inventory turnover. Each unit of bulk material will require less support cost than a unit of packaged material.

Off-the-Shelf vs. Custom Components – Off-the-shelf components have already been designed, don’t require the purchase of a special tool for manufacture, can be ordered as needed or even be vendor-managed and resold if it turns out some were not needed. Custom components, on the other hand, must first be designed, often require the purchase of a special tool and management of a production ramp-up process before the first part is available, and they have no secondary market. Custom components will require a much higher support cost add-on than off-the-shelf items.

Purchased vs. Consigned Items – Whether purchased or not, all materials and components require handling and storage—there are costs that need to be assigned to consigned items. Storage costs are often greater for consigned items than would have been the case had they been purchased. Since dollars don’t appear on the balance sheet for consigned inventories, they tend to be poorly managed resulting in higher inventory levels. Unlike consigned items, however, purchased items do require the support of purchasing, accounts payable and others involved in the procurement process.

Just-in-Time or Vendor Managed Purchases vs. Purchases Requiring Investment in Inventory – Materials that do not arrive until needed or are not invoiced until consumed will obviously require less inventory carrying cost than those that must be purchased, stored and paid for in advance of their use. As a consequence, the cost may be lower when a company pays a higher price for a just-in-time or vendor-managed item than when it pays the lower price for an inventory item.

Outside Manufacturing Services – Interrupting the production process to send an in-process item to an outside processor increases inventory, doubles or triples handling costs, adds transportation costs, increases costly administrative headaches and adds many more costs in addition to the price paid to the outside contractor. To understand the cost of outside manufacturing services, the cost of all these activities must be added to the price paid for the contractor’s services.

Hidden Costs of Offshore Purchases

When looking offshore and salivating over the “price” savings that can be gained by sourcing overseas, even more costs must be considered. Among the items not described already that should be incorporated into the cost of offshore items are the costs of:

- A local presence in the country of manufacture and the additional travel required

- Inefficiencies due to time differences, language problems and different cultural assumptions

- The lost benefits of concurrent engineering due to separation of engineering from manufacturing

- Funds tied up in advance payments and letters of credit

- Added inventories due to unreliable delivery and wider delivery windows

- Extra handling, sorting, repackaging and relabeling

- Tracking foreign content and maintenance of dual part numbers for the same item

- Part salvaging efforts due to the lengthy return and replace cycle

- Supply chain interruption and currency fluctuation risks

- Hamstringing the company’s ability to adopt just-in-time, lean or mass customization strategies

Failure to consider these costs when evaluating the potential benefit of an offshoring decisions has led to many inadvisable offshoring actions and cost companies millions of dollars.

The Cost of Capital

One final item that is seldom considered in measuring “the cost” of a raw material, component or purchased manufacturing service is the cost of capital. Occasionally, a company will impute a marginal borrowing rate and assign the imputed interest to its inventories, but marginal borrowing rates are not the cost of capital. Investors’ money is not free. In order to fully understand the cost of funds tied up in the inventory of raw materials and components as well as inventory tied up at a company providing outside manufacturing services, a weighted-average cost of capital (WACC) must be employed. A company’s WACC represents the average return on assets it must earn if it is to meet the requirements of all of its security holders, both debt and equity.

Conclusion

The cost of raw materials, components and manufacturing services purchased from outsiders is not the same as the price paid for them. Each type of item purchased—even those items consigned—generates a certain amount of work for the company’s employees, and the cost of that work must be added to the price paid to measure the true ”cost” of the item. In addition to the work generated, most categories of purchased items also require a certain amount of investment. Failure to tie the cost of capital related to this investment also leads to an understatement of the item’s cost.

Some of these costs are difficult to measure, and not all of them are issues at all manufacturers. However, failure to take into account those that are significant to any individual 21st-century manufacturer can lead to inappropriate and unprofitable pricing, investment, value chain and other critical decisions.

Doug Hicks started this conversation with his article, The Dangers of Direct Labor-Based Costing at Orthopaedic Device Manufacturers.

During more than 25 years as a consultant, Doug Hicks has championed the development of practical, down-to-earth cost management solutions for small and mid-sized organizations. In that time, he has helped nearly 200 organizations of all kinds transform their history-oriented accounting data into customized, value-enhancing decision support information that provides accurate and relevant intelligence needed to thrive and grow in a competitive world. He shares his experience through seminars conducted throughout the U.S. and in trade and professional periodicals (including Management Accounting, Cost Management, Manufacturing Engineering and Journal of Accountancy) and two books, including I May Be Wrong, But I Doubt It: How Accounting Information Undermines Profitability. He can be reached at