Orthopedics’ adoption of additive manufacturing has led to a flood of new players and technologies, which in turn has raised the questions: How big is the market? How big will it get? And what will drive its growth? The information is hard to obtain for orthopedics and the entire medical device market.

AMPOWER, a young and growing consulting firm based in Germany, received the same questions. They decided to put numbers to the size of the metal additive manufacturing market and track key trends in a report. Co-founder Maximilian Munsch, Dr.-Ing, said his team saw how obtaining accurate market data would help clients and the overall industry.

“As we worked on projects, we realized that our customers struggled to obtain independent, trustworthy data on the state of the AM industry for metal applications,” he said. “We decided to combine our network, experience and technical know-how to create our report. Our goal is to provide deep market insight but also background on various AM technologies to benefit both experienced and inexperienced readers.”

To deliver a comprehensive set of data, AMPOWER collected the majority of its information through personal interviews with more than 250 additive manufacturing machine and material suppliers, service bureaus and users in various industries, including medical. We asked Dr. Munsch to share insight gleaned from the report to provide a better understanding of additive’s potential in the medical market as well as the ripe areas for growth.

Additive Manufacturing Market and Growth Potential

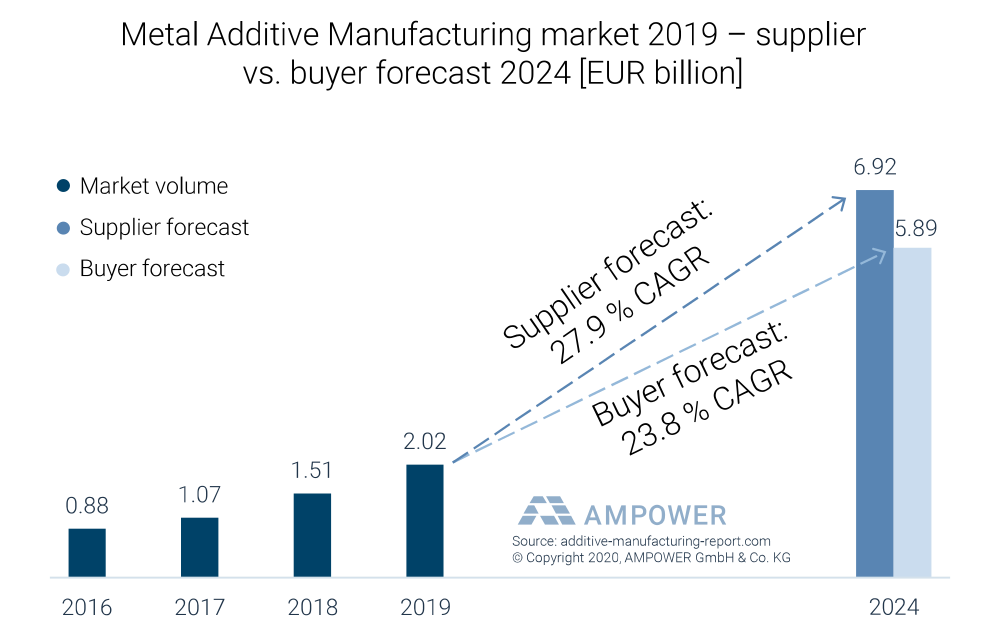

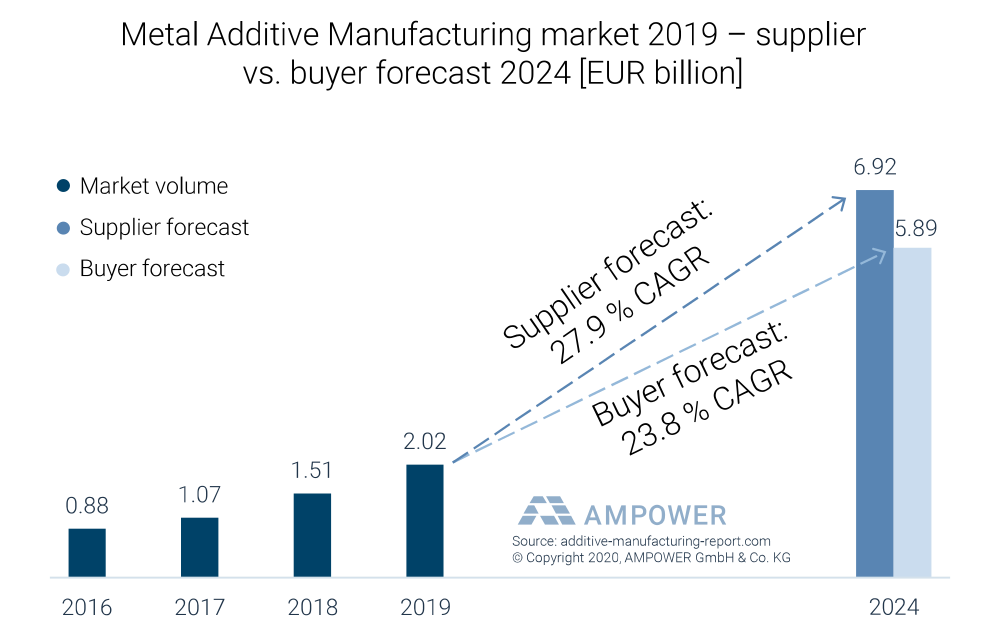

AMPOWER valued the global additive manufacturing market, including systems, materials and service bureau parts, in 2019 at €2.02 billion (USD $2.26 billion). About 20% of 2019 sales were derived from the medical and dental market.

In interviewing additive manufacturing suppliers and buyers, AMPOWER found that companies in the industry project the entire market to have a compound annual growth rate (CAGR) of +20% from 2019 to 2024.

Suppliers, those selling products and services (i.e., machine vendors, material producers and services bureaus), projected CAGR of nearly +28% from 2019 to 2024, creating a €6.92 billion (USD $7.66 billion) additive manufacturing market. Buyers, those purchasing machines like orthopedic device companies and contract manufacturers, projected the additive manufacturing market to be €5.89 billion (USD $6.59 billion) in 2024, a +24% CAGR from 2019 to 2024. Exhibit 1 illustrates market history and growth for the entire metal additive manufacturing industry.

Exhibit 1: Metal Additive Manufacturing Market Size

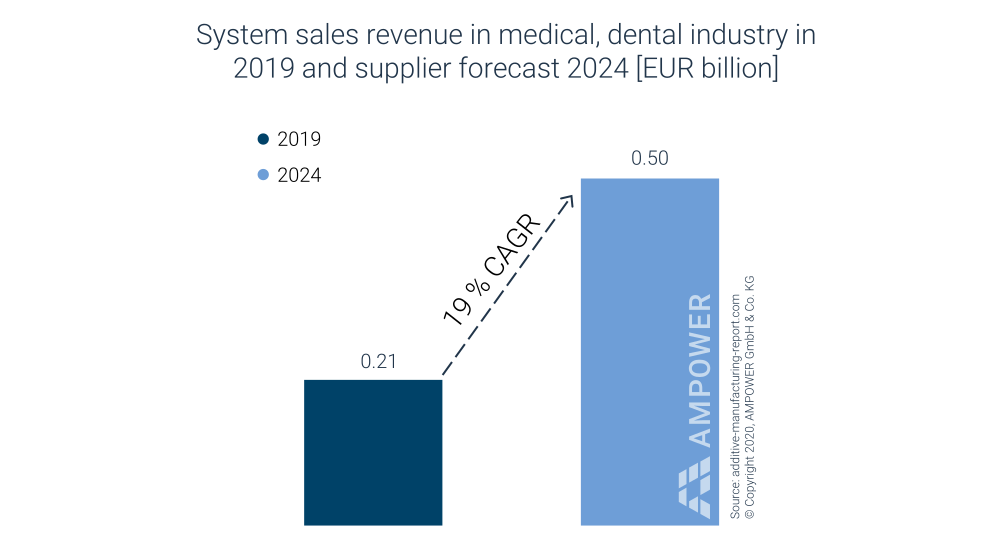

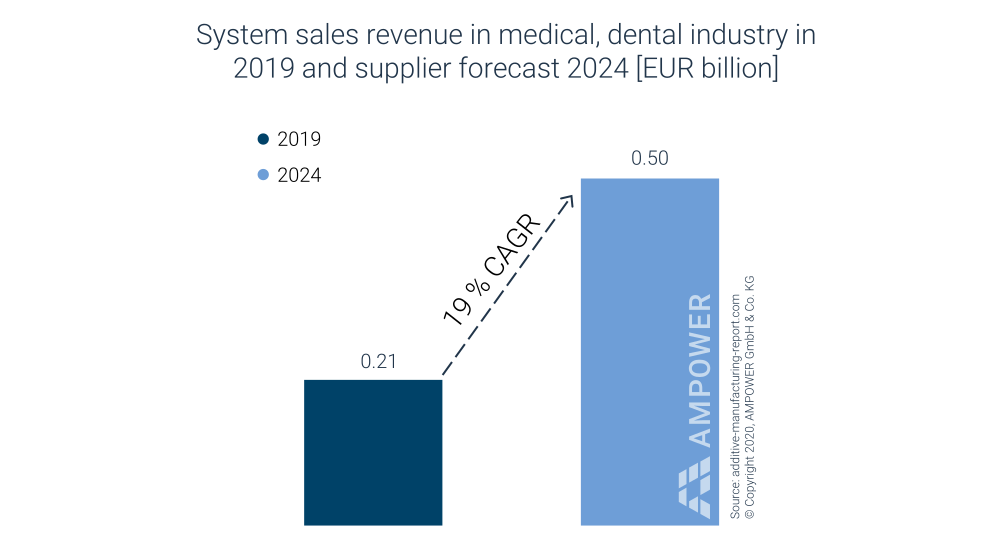

In looking at additive manufacturing system sales, €210 million (USD $235 million) were attributed to the medical and dental markets in 2019. AMPOWER expects system sales for the medical market to grow +19% CAGR to €500 million (USD $560 million) by 2024, as is illustrated in Exhibit 2.

Exhibit 2: System Sales Revenue for Medical and Dental

While the general outlook from both suppliers and buyers promises continued strong growth, the negative impact of COVID-19 on the additive manufacturing industry is challenging to predict. Dr. Munsch noted that the medical market could remain strong because, unlike other sectors where additive manufacturing is mainly used for R&D prototyping, medical has fully embraced additive manufacturing as a production technology; think hip cups and spinal devices.

“In medical, especially in orthopedics, AM is an established technology,” Dr. Munsch said. “Designers see AM as equal to other manufacturing technologies like forging and CNC machining, not necessarily better. Each [company] must consider AM as a manufacturing option. Companies that have realized this will be successful. Some are introducing AM more slowly than others, but I doubt there is any medical company that has not looked into AM by now.”

Additive Manufacturing Trends to Affect Orthopedics

Orthopedic companies seeking to expand their use of additive manufacturing are closely watching trends with machines, software and material enhancements. As more companies enter the space, the competition will likely accelerate technology advancement. Dr. Munsch called out multiple updates shaping additive manufacturing in orthopedics.

Machines are getting faster and more mature. While the majority of machines feature laser beam or electron beam powder bed fusion, there are 18 different metal technologies deployed today. AMPOWER reports that about 2,000 machines were installed for medical use in 2019, a number that is expected to triple by 2024.

“Generally, the machines become bigger, faster and more robust and reliable,” Dr. Munsch said. “Pushing to increase machine productivity and getting more machine for dollars spent in terms of manufacturing capacity is very important for the industry.”

Suppliers are improving machine speed by adding multiple lasers. However, additional lasers have created some uncertainty in relation to meeting regulatory requirements.

Also, finding a cost-efficient and reliable way to clean powder debris from machinery remains an industry-wide challenge.

Software is integrating. Additive manufacturing is moving away from single-function software toward robust solutions. Large companies like Siemens, Autodesk and Dassault Systèmes are integrating into the software chain to provide larger packaged solutions. These single software solutions incorporate functions such as data preprocessing and lattice design to deliver a file for easy machine transfer.

Startup companies will also find software a prime opportunity to innovate in data preparation, lattice design and customization, said Dr. Munsch.

New alloys are emerging. The standard titanium alloy Ti-6Al-4V is high strength, biocompatible and works well in powder bed fusion machines, making it the first choice for additive manufacturing in orthopedics. However, that hasn’t stopped companies from finding new and potentially better alloys to differentiate from the competition.

For example, orthopedic device manufacturers are researching other titanium alloys or resorbable materials like magnesium and iron to eliminate the need to perform a second surgery to remove implants like spacers or screws, Dr. Munsch said. He expects orthopedic device manufacturers to continue to use polymers for additive manufacturing, too. Printing of polyamide patient-specific instrument jigs and guides for orthopedic surgeries is a well-established and successful process. Also, polyetheretherketones such as PEEK and PEKK, while a much smaller market than metals, are being used in orthopedics today, he noted.

Feedstock will more than triple. While units of laser bed and powder bed fusion machines did not increase across all manufacturing industries in 2019, AMPOWER reported a +71% year-over-year growth in tonnage of feedstock. They expect the amount of feedstock used to triple by 2024. The increase of feedstock but not machines is due to the more efficient use of printers, said Dr. Munsch.

Overall, a streamlined, efficient additive manufacturing process is imperative to the technology’s growth in orthopedics. While medical device manufacturers were reluctant to provide the number of implants sold, AMPOWER was able to use secondary data to estimate that about 140,000 hip implants are produced through additive manufacturing annually. Approximately 10% of global installed electron beam powder bed fusion capacity is dedicated to printing hip implants, with the potential to increase to 800,000 by 2024.

Looking Forward at Market Dynamics

Additive manufacturing will not completely replace traditional manufacturing techniques, said Dr. Munsch. But it will help grow areas of orthopedics like custom implants, which provide higher profit margins and lower product cost.

Market dynamics and regulatory hurdles will likely impact additive manufacturing’s growth in orthopedics.

“While we’ve seen smaller companies innovate over the years, especially in terms of spine implants, it will be harder for startups to make moves in established areas like hip cups. The main reason is not AM difficulties, but the regulatory framework they’ll need to overcome,” Dr. Munsch said. “To do so would require changing the whole way a company runs, adding costly regulatory and quality management teams. To me, additive manufacturing has huge potential. However, the regulatory framework may hinder innovative companies from providing new, better solutions for better patient outcomes.”

Companies of all sizes face uncertainty without being able to rely on established standards. However, Dr. Munsch said the joint work of international and U.S. standard committees is very promising.

Additive manufacturing is the only industry that has a joint group for standardization by ISO and ASTM on an international level. When a new standard is written and published, it gets a new ASTM number equal to the ISO number and vice versa.

“It’s unique that AM has both standards under the same roof,” he said. “The medical industry is talking more about AM, which is a good sign. People are opening up and sharing about their experiences—there’s no secret. The willingness to work together seems to be having a positive effect on what’s happening in the medical world.”

Kathie Zipp is an ORTHOWORLD Contributor.