Andy Elsbury is the President of Nexxt Spine, a device company that designs and manufactures virtually all of its products in-house. We asked Mr. Elsbury how the industry has changed since the company’s formation in 2009, where he sees the market going next, and what advice he’d give to his peers and colleagues in orthopedics.

What has changed most about the industry since Nexxt Spine was founded in 2009?

Mr. Elsbury: I think product differentiation has been the biggest change. In 2009, the industry was more marketing and sales-driven, whereas now it’s more product-driven to succeed. You have to have differentiated products, be they 3D-printed, or expandables, navigation. I think it’s all the technologies that are making a difference for companies.

What is the main differentiator of Nexxt Spine’s products?

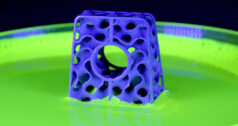

Mr. Elsbury: For us, it’s been 3D-printed products. We do all of our own manufacturing in-house. We began as an engineering and manufacturing-focused company. Innovation was the driver, and we had to, for the first six or seven years, develop all of the standard meat and potato products. Then we could start focusing on what’s differentiating us. Given that we do all of our own in-house manufacturing, we brought the 3D printing in-house and perfected its utilization to get the best out of the implant. A lot of companies operate in the 3D-printed world, the titanium interbody world, but there’s a vast difference among the products. We took our time to learn the best clinical outcomes and what is needed to achieve those clinical outcomes, and then designed an implant that can meet those needs. That’s been our differentiator.

When we started, we did what everybody else did, having outside sources print and test products, and it’s a slow eight-week, 10-week cycle time between every iterative test. Then we got it down to print today, test tomorrow, print today, test tomorrow until we really perfected these implants. For us, 3D printing is our bread and butter now.

What are some of the challenges and opportunities that come with doing nearly all of your manufacturing in-house?

Mr. Elsbury: Let’s start with the opportunities. It’s not a cost savings, so to speak, because you don’t have the super high volumes of other places. But an improvement is that you can make exactly what you need when you need it, and you can develop products much faster. This applies to both implants and instruments. As we gather feedback from the field, we continually improve the instruments. After we put out a new system, and complete alpha launch and get the feedback, we can put a beta launch out in weeks instead of months. We’re going from alpha to beta very quickly. When you design implants and instruments and have the manufacturing right here in-house, you work together to make sure that you can maximize the capabilities. If you don’t know what your capabilities are, what the machiners can do, you’re very limited in your design. But when they’re side-by-side, you get…better bells, better whistles, better feel. You can design an instrument on the screen and it looks good, but it doesn’t have an aesthetic feel once it’s made. We can make a prototype, adjust it, adjust the weight, adjust the feel. What looks good on the screen doesn’t look good when you actually make it many times. Having everything right here in-house, it’s just a speed to perfection. It’s quicker.

Challenges? There’s a ton of challenges. Trying to hire enough good quality programmers, good quality employees. Once we attract them, we don’t lose them very often, but trying to hire enough good programmers. We have six positions open right now. I’m trying to hire for Swiss machining, standard mill machining, sterilization room—those three on the manufacturing floor. Programmers, engineers. And that does not even include what we’re trying to add for, what I’m going to call the support. The inventory management and the customer service, shipping and receiving. We have a lot of positions open. The biggest challenge is hiring people to do all of these things.

Is there a problem with the pipeline of skilled labor? Is there enough education or infrastructure to get people into those fields?

Mr. Elsbury: The schools are there. The infrastructure is there. The interest from the students, the younger generation, the interest is not there. Not as many people want to go into machining. The infrastructure is absolutely there; it’s just getting the people into it, and it’s not easy. It is very challenging work. Programming and running these machines is…it’s not an average turn on the machine and parts pop out. It’s very intricate, and programming, setup and monitoring are very technical processes. A lot of contract manufacturers are making the same things over and over in volume, so there’s not as high of a skill level required. We’re redesigning and making 20 instruments at a time on all these different machines. It’s constantly resetting up, reprogramming, remaking new products. Half of our equipment in our facilities is only product development. The other half is making what we sell. When you have over 50% new product development, it is a challenge.

If we look ahead five or ten years in the spine industry, what excites you most?

Mr. Elsbury: From a selfish viewpoint, innovation; I’m an engineer. The engineering aspect, product development aspect, innovation of better products, that’s what excites me. We’re putting all of our eggs into that one basket. As far as the industry, I think that’s going to hold true. A lot of startup companies were making me-too products. The hospital approval process is hard, so these smaller companies that are just popping up and only have one or two products; I think those companies are going to cease to exist.

I think that the companies that will succeed in the future are the ones with new innovations. Many of those companies are built to be acquired. They’re developing a technology to be acquired, and the acquisitions will continue to happen. There will be consolidation of some of the smaller players into the larger. But, innovation is going to continue to drive the industry. Right now it’s 3D printing. I’m not sure what’s going to be next, but it will be product and innovation driven, in my opinion.

I think there will be a weeding out of the additive market as the education increases. As people learn what is growing bone, then we’ll see some of these products die off because they’re not all created equal. Surgeons are going to move away from PEEK and coated PEEK to 3D-printed titanium; we’ll continue to see that shift as the education grows. As the data comes out, more studies come out, we’ll start seeing the differentiation there.

With regard to additive, it will be used in more clinical needs. It’s very limited to spine interbodies, but it will migrate into other fields like extremities. People will ask, where else can we utilize this technology?

What has Nexxt Spine’s COVID-19 experience been like?

Mr. Elsbury: We had the right in Indiana to keep manufacturing, but we shut down for seven weeks and only had certain machines running. The 3D-printing machines kept running because you set them up, and then they can run unattended for 24 hours. For us, it was a seven-week period. We kept everybody on full pay. Again, it goes back to the labor. You want to get the best employees. They got paid to stay home. Our sales dropped about 30%. In the last three weeks, they’ve come back up to normal volume. I’m expecting that by the third quarter, we make up for what we lost in the second quarter for the number of surgeries. For us, engineers kept working from home, so our new product development is fully loaded with new products to come to the field.

What long-term changes do you see in orthopedics from the pandemic?

Mr. Elsbury: I think it’s more of a money situation. We get phone calls from distributors whose manufacturers that they’re representing are not financially stable, and COVID hit them hard. If you don’t have the money to pay the distributors and reps, you’re going to be in trouble. What we’re seeing is some distributors coming to us, employees who want to switch over to us, just because they weren’t financially strong to start with, and when COVID kicked in, it killed them. Cashflow is king. There will be a dip in the number of companies, I think, that are in a strong position. Even from the big ones that furloughed employees or implemented hiring freezes, we are getting more applications now. For us, timing-wise, it works out well that we have all these positions open while other companies are struggling because that means the supply of employees is stronger than it’s ever been. We’re getting more resumes. One of our positions had 150 applicants in a week, which is amazing.

What is something that you wish all of your industry colleagues and peers knew? What advice would you give them?

Mr. Elsbury: Great question. Network and work together. I’ve been in this business 20+ years. We’ve helped colleagues that I worked with 20 years ago, and it has helped their companies and helped us working together. Both on sharing innovation, sharing best practices. It’s helped us tremendously over the years. We had to learn it from somebody, and they’ve learned from us. Your chance of success goes way up if you build a network of colleagues.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.