Editor’s Note | January 19, 2021: This article contains business-critical highlights from THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®. We are presently compiling the 2021 installment of the report. You can download last year’s installment by becoming an ORTHOWORLD Member. Your Membership dues will include access to the upcoming installment, scheduled for release in early 2Q21.

COVID-19 continues to spread across the globe, taking a great human and economic toll. The postponement of orthopedic procedures has led to monumental revenue loss for hospitals, surgeons, OEMs and contract manufacturers, all of whom face significant business disruption and uncertainty. We expect ripple effects from the pandemic through 2022 and beyond. That said, we remain bullish about orthopedics’ return to growth.

Orthopedic Trends Prevail

As with all challenges, opportunities will emerge. As executives, administrators and surgeons reorient themselves to a new normal, we expect the following trends to take hold.

- Sophisticated Use of Technology: Social distancing has forced nearly everyone to adopt some form of virtual communication for connecting with colleagues, vendors, customers and, of course, doctors and patients. Telemedicine, webinars, online conferences and virtual reality training for procedures are just a few examples of our recent crash courses in 21st-century communication. All of this technology brings the likelihood of lasting economic benefits, which means that they will be a part of your new day-to-day.

- Stronger Supply and Care Delivery Chains: As providers work through the backlog of surgeries, they’ll require a higher level of transparency and efficiency in logistics, product sterilization and the O.R. This shift could bear out in greater automation of the supply chain and surgical process and an uptick in single-use sterilized products. It will also result

in even more orthopedic procedures moving to ASCs and to hospitals partnering with ASCs to streamline the flow of otherwise healthy patients to these cost-reducing, efficient sites of care. In addition, traditional sales rep roles that involve bringing product and serving as an advisor in the O.R. will be under intense scrutiny.

We expect the following, well-established trends to endure after a period of confusion and delay.

- Robotics in the O.R.: Orthopedics’ largest players shifted R&D investment and strategies to enabling technologies in 2019. The purchase of capital equipment is expected to be stunted through 2021, as hospitals recover from the revenue hit they take responding to COVID-19. Robots currently in use are likely to be deployed in surgeries. We expect device companies to continue to invest in robotics, imaging and planning, but these technologies will become more versatile and significantly cheaper.

- Proliferation of Additive Manufacturing: The adoption of 3D printing will continue to grow in orthopedics due to companies of all sizes being able to leverage the technology. Numerous small companies, primarily in spine, are building portfolios solely focused on 3D printing. These companies may be at a disadvantage for growth due to their limited

portfolio offering. Additionally, we expect orthopedic companies and contract manufacturers will tighten their purchase of equipment and will pause investments in new machines. - Continued Rise of ASCs: Once the ban on elective surgeries is lifted, ASCs are expected to return to normal/max procedure volumes before hospitals due to their nimbleness as well as their orthopedic focus. During the COVID-19 recovery period, patients will seek limited exposure to other patients and choose this setting over a hospital. Companies with dedicated outpatient strategies will benefit from this focus in the short term.

Before we consider COVID-19’s impact on orthopedics’ growth, we review the market’s performance in 2019.

Orthopedic Product Segment Review

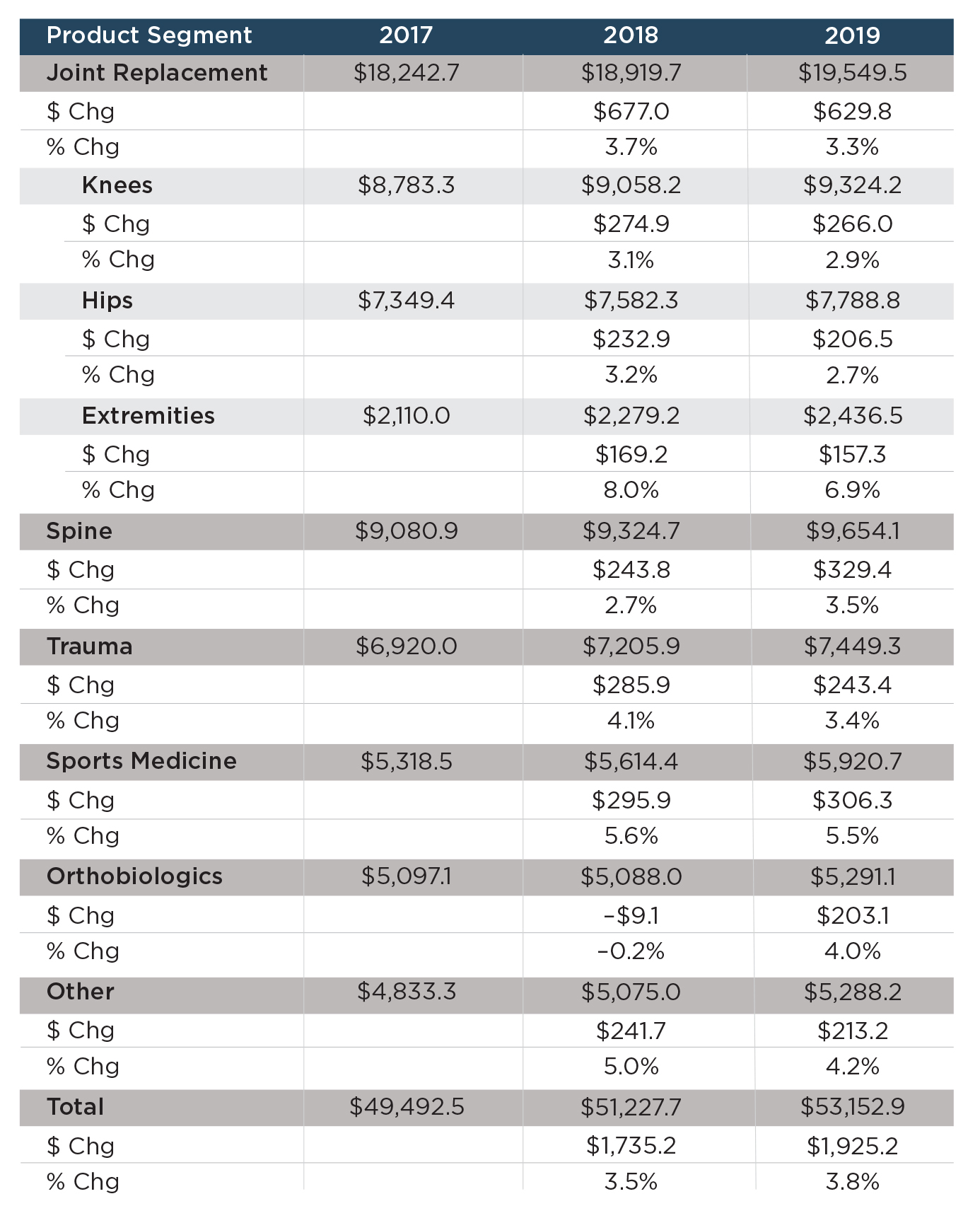

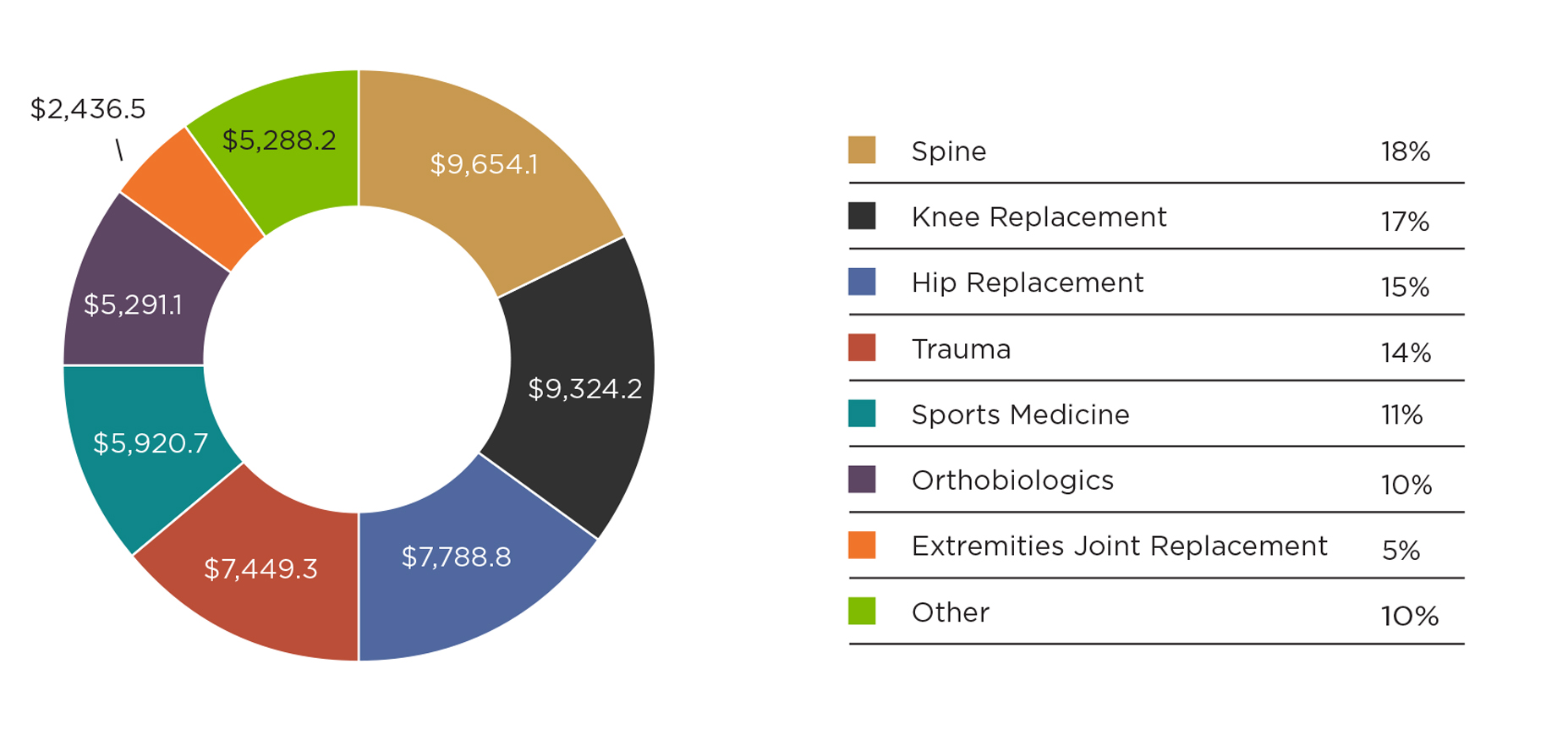

Global orthopedic sales totaled $53 billion in 2019, an increase of +3.8% over 2018. Growth was realized across all market segments, including orthobiologics, which we estimated lost ~$9 million in revenue in 2018 compared to 2017. Exhibit 1 details product segment sales while Exhibit 2 illustrates market share for these segments.

Exhibit 1: Orthopedic Product Segment Sales – 2017 to 2019 ($Millions)

Exhibit 2: Orthopedic Product Segment Sales by Market Share ($Millions)

- Joint replacement decelerated slightly (+3.3% vs. +3.7%) in 2019 due to mixed performance across the segment by the top players.

- Spine growth was driven by the adoption of new enabling technology and implants.

- Trauma’s decline is primarily attributed to supply chain issues or delayed orders experienced by the top companies.

- Sports Medicine’s growth is primarily due to a continued focus by the top players on integrated operating rooms that connect cameras, screens, positioning systems, etc.

- After sputtering to a -0.2% decline in 2018, the segment rebounded to +4% growth in 2019. More orthobiologics were sold while price pressure on commoditized parts of the segment, like viscosupplements, stabilized compared to the prior year.

Orthopedic Company Performance

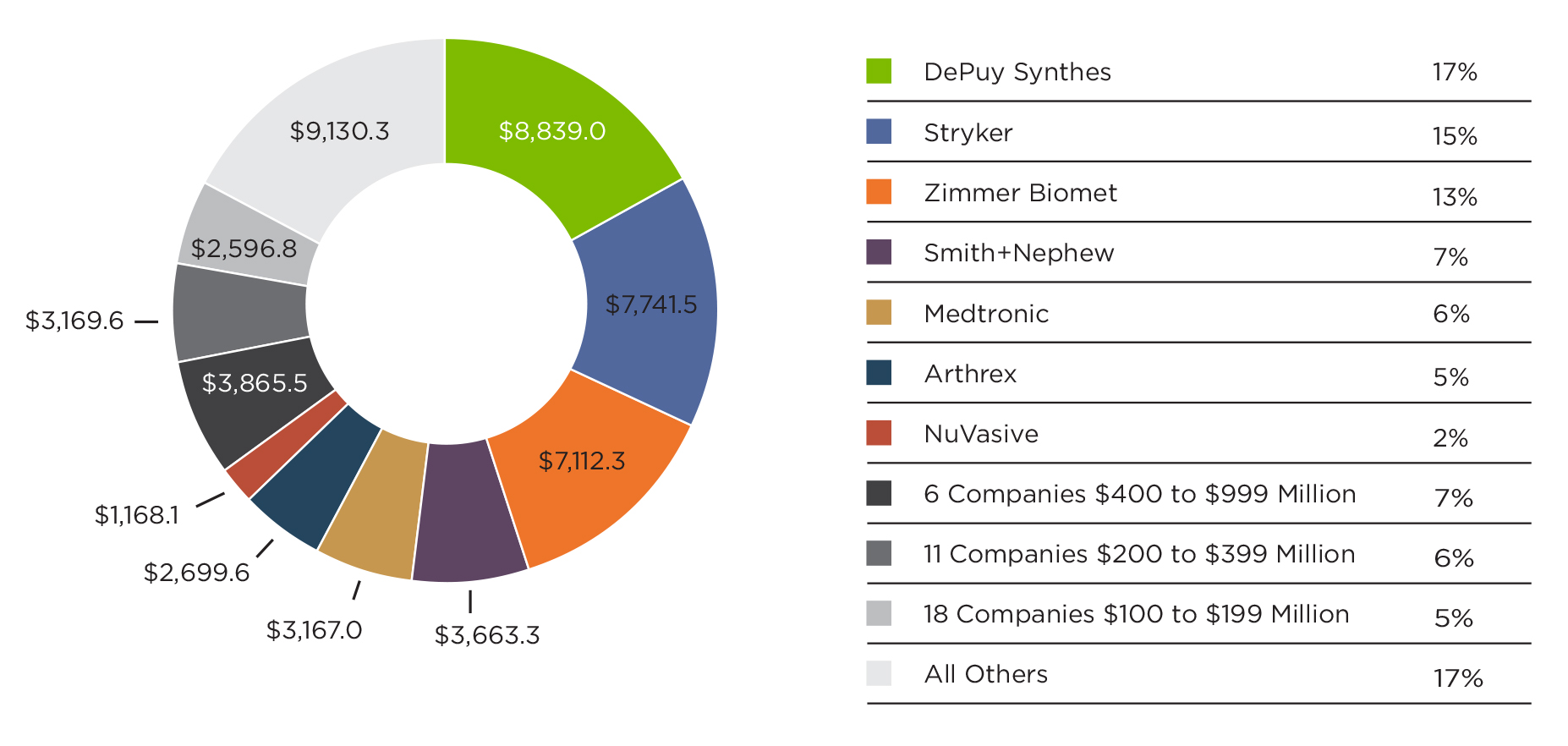

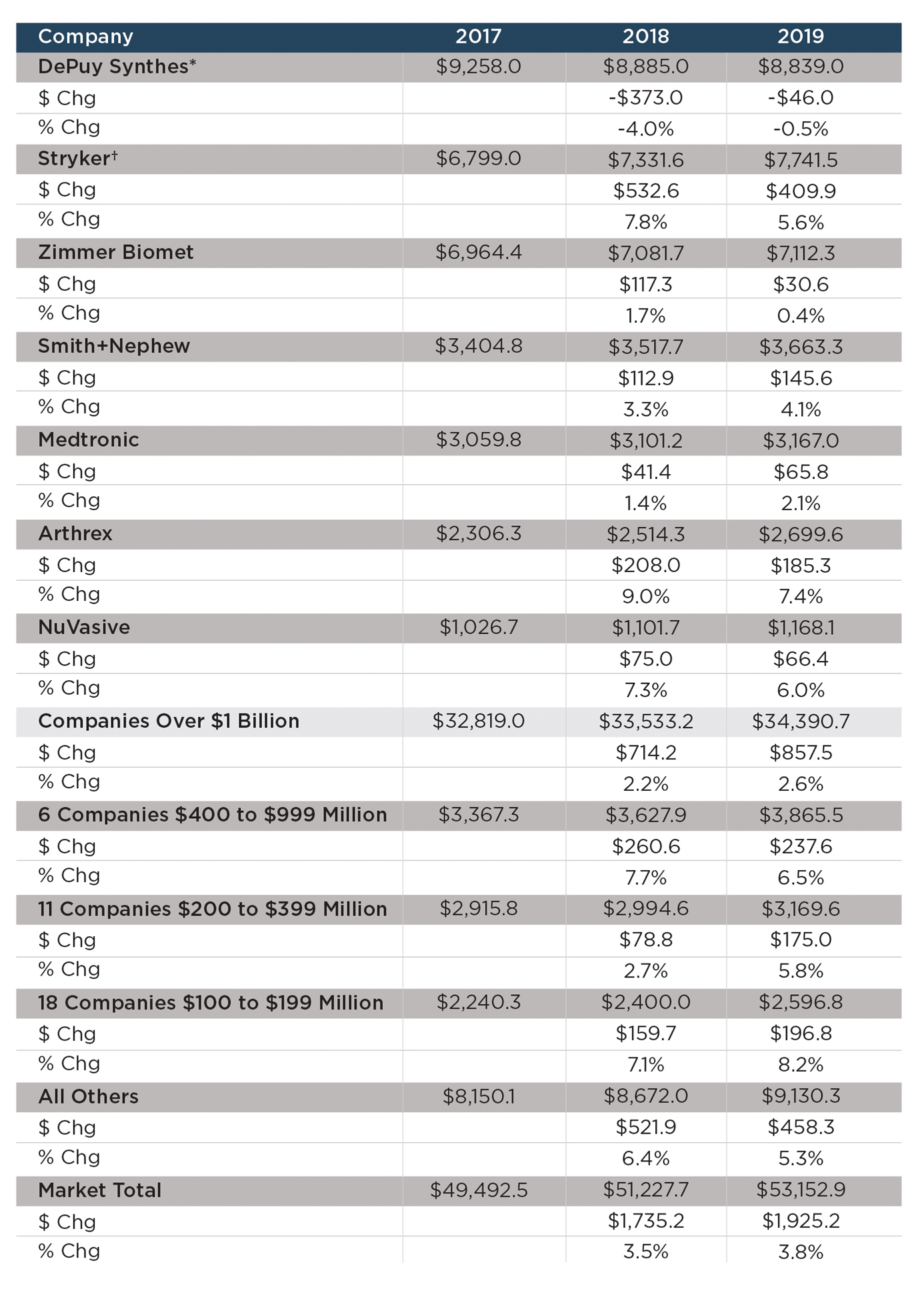

Seven companies control 65% of the total orthopedic market. As can be observed, they’ve had varying degrees of success. Exhibit 3 details 2019 sales of the largest players, while Exhibit 4 provides a graphical representation.

Exhibit 3: Total Orthopedic Product Sales – 2017 to 2019 ($Millions)

*We’ve updated our DePuy Synthes revenue for 2017 and 2018.

*We’ve updated our DePuy Synthes revenue for 2017 and 2018.

†Stryker’s revenue for 2017 and 2018 includes K2M sales.

Exhibit 4: Market Share – Largest Players and All Others ($Millions)

- DePuy Synthes has not experienced consistent growth since its large acquisition of Synthes in 2012. The company made progress in their recovery efforts in 2019, but still failed to stop the slow bleed. Despite these struggles, it is the only company to maintain a top-five position in every orthopedic market segment.

- Stryker benefited from Zimmer Biomet’s continued underperformance and surged to the number two rank in total orthopedic sales.

- Zimmer Biomet performed at the top of its 2019 guidance range of -0.5% to +0.5% as it worked toward recovery from manufacturing quality and supply chain challenges that have plagued the company since Zimmer and Biomet combined in 2015.

- Smith+Nephew drove growth through an updated sports medicine portfolio and enhancements to its joint replacement robotic technology.

- Medtronic faced operational issues around order and purchase timing that slowed 2019 sales and vied to reorganize operations to reduce end-of-the-month headwinds.

- Arthrex maintained its domination of the sports medicine segment through the breadth of its portfolio, and continued expansion in the joint replacement and trauma markets.

- NuVasive demonstrated that it could drive significant growth through proceduralization, essentially taking more share of a surgery through integrated cross-selling and single position surgical approaches in spine.

Orthopedic Market Forecast: 2020-2021

No one knows exactly how COVID-19 will impact orthopedics. We expect procedures will resume in late second quarter of 2020, and we think that the adjustment period will be sporadic, ambiguous and long-lasting.

It’s important to note that procedure volumes will be impacted not only by the postponement of elective procedures, but the following:

- High unemployment rates, economic upheaval: Would-be patients without insurance will delay and cancel treatment, and those with jobs will reconsider taking time away for fear of losing them.

- Apprehensive patients: The fear of contracting COVID-19 will linger.

- Operating room competition: Non-orthopedic specialties are vying for scheduling time too.

Taking all of that into consideration, our forecast calls for a stark -17.4% or -$9.2 billion decline in 2020 revenue to reach $43.9 billion. We project a modest 21% growth in 2021 before the market begins to level off in 2022 and reaches $56 billion.

Again, we maintain that orthopedics remains an attractive market due to demographics and the room for innovation. However, orthopedics is entering a new normal. Extraordinary times require orthopedic companies and individuals to diligently respond to market needs by relying on fundamental business principles. Success will come to those that:

- Communicate with customers. The market forecast through 2021 is complex. Those that understand their customers’ problems and their customers’ customers’ problems will be better positioned to help solve problems, and in turn, be situated for success.

- Embrace change. COVID-19 upended decades-long business practices in a matter of weeks. Companies need to ask: How should we adapt to the new environment? And then respond accordingly. Those that recognize the fast pace in change will be better positioned to react to market needs.

- Reimagine their role. Everyone in orthopedics will be impacted by the pandemic – from R&D’s prioritization of new products to supply chain’s collaboration with manufacturing partners. It’s an essential time to consider how the changing landscape affects your responsibilities. The better job we do, the more effective and valuable we are.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.