PEEK and titanium dominate the spinal fusion market—two materials with roots in the aerospace industry. In November 2019, DiFusion received FDA 510(k) clearance to market the Xiphos-ZF Spinal interbody, which is made of ZFUZE, a new polymer engineered specifically for orthopedics.

“After 10 years of research, hundreds of in vitro cell assays and three major animal studies, we achieved a goal no large company would dare to even undertake,” said Derrick Johns, DiFusion’s Founder and CEO. “We are the only ones out there with a new cleared material. Everyone else is just talking about pore size and stiffness, nobody addressed the underlying material.”

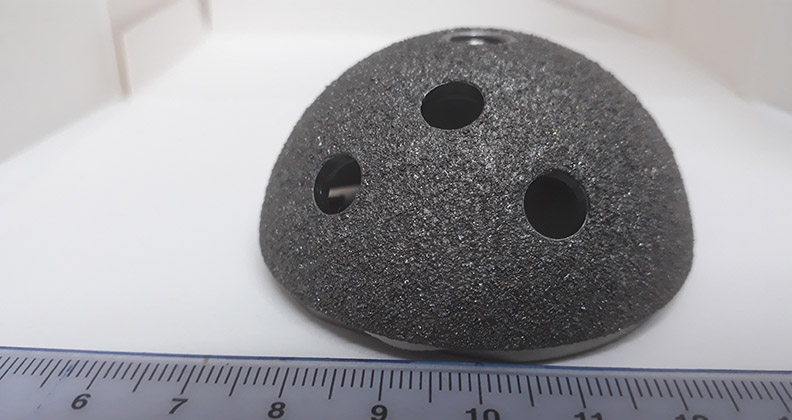

ZFUZE was born when DiFusion added zeolite molecules to PEEK, changing the material to a negatively-charged substance that cultivates osseoconduction while preserving the polymer’s benefits of visualization, modulus and strength. The material also addresses major concerns about host rejection of implants, which is often dependent on the immune response. ZFUZE tests confirm that the material elicits favorable immunomodulation, key to normal tissue regeneration and avoiding fibrous encapsulation.

“It’s going to take time for the industry to get it,” Johns said. “It’s a totally different paradigm from how we’re used to thinking about it.”

DiFusion officially launched the Xiphos-ZF Spinal interbody in early 2020.

A Lengthy Testing and Regulatory Process

While the overall industry remains biased toward existing materials and alloys to avoid regulatory burdens, DiFusion took the challenge head-on. The three-year process started in 2016 and included two pre-submission meetings to gain FDA 510(k) clearance. Because ZFUZE is a new biomaterial, DiFusion submitted a master file to FDA that then supported the company’s 510(k).

DiFusion conducted studies in rabbit femur and sheep cervical models and performed in vitro ISO 10993 biocompatibility analyses. The biocompatibility testing comprised 30 different tests for aspects such as safety, cytotoxicity and neurotoxicity.

“You have to have a technology that is patentable, works and can get through a regulatory proceeding. It also has to be biocompatible with the body, with all of the biomechanical characteristics of pure PEEK or titanium, because you need to be in the same range as ASTM standards,” Johns said.

The process was trying at times, especially during the non-plated cervical sheep model. FDA’s big question for DiFusion was, since this is a new material, what issues would arise if debris moved systemically to other organs. Johns wanted to show FDA the worst-case scenario and opted to do a non-plated device.

“I took a lot of heat from our surgeons and my board,” Johns said about the decision. “That was a hold-your-breath moment. If we didn’t get the data we got, we would have been dead on the street again. We’ve gambled a couple big ones and came out on top.”

Immune Response

Implants that can harness a positive immune reaction can achieve shortened healing timelines, aid recovery and actively fight infections. ZFUZE is the first synthetic biomaterial to have tested positively from a favorable immunomodulation standpoint, according to DiFusion.

Stephen F. Badylak, DVM, Ph.D., M.D., Deputy Director of the McGowan Institute for Regenerative Medicine at the University of Pittsburgh, is among the foremost experts on the immune response to biomaterials. He conducted a third-party macrophage study on ZFUZE and was shocked by the way that it elicits a pro-reparative M2 macrophage response and significant reductions in cytokine markers for prolonged inflammation and associated fibrous tissue formation. The macrophages look identical under a microscope, so only recently have researchers come to recognize two different types. Macrophages are not distinguishable through immunomodulation shifts, only through genetics and the cytokines they elicit. Johns remembers Dr. Badylak’s enthusiasm.

“He did the macrophage study and called me up and said, ‘I’ve been doing this for more than 20 years and I’ve never seen immunomodulation in anything but a natural molecule,’ ” Johns said. “ ‘I don’t believe what I’m seeing, and I need to do it two more times to make sure that it’s correct.’ So we did that, and it was absolutely correct.”

Johns said it’s a benefit and a challenge to explain the new paradigm around osteoimmunology and how titanium and PEEK react with the immune system. However, he says the collected data has aided surgeon adoption.

Paul Kraemer, M.D., a practicing surgeon at Indiana Spine Group and a member of DiFusion’s scientific advisory board, has been working with DiFusion since 2012 and using the implants released earlier this year.

“The market has gyrated from PEEK to titanium and back with a million minor changes to the surfaces,” he said. “ZFUZE combines the best features of both the modulus of PEEK and healing power of titanium. We are expecting it to basically be PEEK that fuses, because there’s only one thing wrong with PEEK – it doesn’t fuse – so we fixed that.”

Ready to Take Off

DiFusion began selling its Xiphos-ZF Spinal interbody in January and was experiencing strong sales until elective procedures were halted. Johns is confident that the company will do well in the long run.

DiFusion is selling devices direct, but aims to be acquired by a larger company that can use the material to move market share. Johns says device manufacturers with whom he’s spoken like that ZFUZE implants are about 70% cheaper to produce than PEEK and come in the same rod stock as the traditional material.

In DiFusion’s pipeline is an ACL screw, and it is also pursuing an antimicrobial material and looking at loading its polymer with magnesium to increase its benefits. Johns says an acquirer would gain a master file for the materials’ use across orthopedics and a platform for antimicrobial as well as osteogenic applications with added magnesium.

“An acquirer of ZFUZE would be able to overhaul its entire PEEK material overnight and relaunch those same implants without obsolescence of any of their instruments, which is tens of millions of dollars for bigger companies,” he said.

However, Johns is proud that DiFusion has been privately financed for over a decade without any venture capital. He believes the private investments have allowed the company to remain nimble and accomplish commercialization quickly.

“Our biggest strength is being a small company without the bureaucracy of a large one,” he said. “We would have been dead years ago if we hadn’t been able to turn and react to things critically and quickly. That speed and innovation, you don’t see it in big companies, but it’s what we had to do out of desperation and survival. For us, we had no choice.”

Kathie Zipp is an ORTHOWORLD Contributor.