Nearly a quarter of orthopedic company acquisitions that we tracked through the first nine months of the year afforded large- and medium-sized companies access to new enabling technologies that will boost or complement their robotic, navigation and imaging systems. The quantity of the acquisitions (seven of 30) and the purchasers’ influence, particularly in joint replacement and spine, provides an indication as to how companies are prioritizing M&A activity, as well as portfolio expansion.

Smith & Nephew made two acquisitions that fit this category, while Brainlab, Corin, DePuy Synthes, Exactech and Stryker each made one. We look at the acquisitions and speculate what’s next for these company’s digital tools.

Smith & Nephew’s Purchases Integral to Next-Gen Robot

Smith & Nephew acquired Brainlab’s orthopedic joint reconstruction business and Atracsys, a developer of optical tracking technology. Both acquisitions will propel Smith & Nephew’s next-generation robotics platform, which is due for commercial release in 2020.

The Brainlab acquisition provides Smith & Nephew with pre-op planning, intra-op navigation and tools for post-op evaluation and information sharing, as well as access to cloud computing, tracking, augmented reality, robotics, artificial intelligence, machine learning, image fusion and anatomic segmentation. In announcing the acquisition, Smith & Nephew noted that it would develop applications in joint replacement and sports medicine, potentially expanding to other specialties later.

Smith & Nephew purchased the NAVIO hand-held robotic system from Blue Belt Technologies back in 2016, providing the company enabling technology that is used in total and uni knee replacement. NAVIO 7.0 is expected to be commercially available in 2H19 and includes total hip procedures. Installing Brainlab’s hip software onto NAVIO 7.0 is a main priority of the acquisition integration.

The Brainlab acquisition is expected to play a much larger role for Smith & Nephew, though. Analysts have noted that the company’s next-generation robot is based on Brainlab’s Cirq platform. The new offering would be faster and smaller than NAVIO, and future options could expand to incorporate augmented reality, standalone robotic arms and machine learning technologies.

In the Atracsys acquisition, Smith & Nephew gains access to the fusionTrack 500 optical tracking camera, which will be a core enabling technology within the company’s interconnected system of digital surgery and robotic assets, with its first use in the next-generation robotics platform.

Looking Forward: The NAVIO total hip launch will make Smith & Nephew the third company with a total knee and total hip robotic application. (Stryker and THINK Surgical are the other two.) It will be interesting to see which capabilities acquired from Brainlab will be included in the company’s next-generation robot.

Brainlab Strengthens Spine Capabilities

Less than 10 days after it was announced that Brainlab sold its joint replacement business, the company acquired Medineering, a developer of application-specific robotic technologies. The purchase strengthens Brainlab’s spinal surgery capabilities.

Brainlab had marketed Medineering’s surgical arm under the brand name Cirq for nearly three years prior to the acquisition. Cirq can be aligned in seven degrees of freedom for positioning flexibility; once locked into place, a surgeon can perform the procedure with both hands. Navigation integration works with established workflows, set-up and instrumentation. The combination of base arm and attachable “hand” modules makes Cirq scalable in the future.

The arm will join Brainlab’s open hardware architecture that allows device companies to design their own solutions and applications across numerous subspecialties. Unlike larger robotic systems, the lightweight lower-cost Medineering arm mounts to the side rails of the operating table, making the vendor-neutral platform more accessible for customers, including hospitals and ambulatory surgery centers (ASCs).

Looking Forward: Cirq applications have been in clinical use in Europe and U.S. FDA 510(k) clearance was announced in late September, allowing access to a larger market. Its focus on being vendor-neutral and expanding into ASCs could be an advantage in the spine market, which is saturated with smaller companies.

Corin Enters Robot-Assisted Market

U.K.-headquartered Corin purchased OMNI, makers of the OMNIBotics® robot-assisted total knee replacement system. The acquisition allows Corin to accelerate its growth strategy in total joints via a robotic platform and a greater foothold in the U.S.

OMNIBotics combines a robotic cutting guide with what is billed as “the world’s first robotic tool to measure ligament function.” Combined with Corin’s Optimized Positioning System for hips, OMNIBotics gives the company flagship technologies for total joint replacement segments as they strive to create a connected digital ecosystem from surgical planning to implant positioning to remote patient monitoring.

Corin was already connected with OMNI through its 2018 acquisition of Australia-headquartered Global Orthopaedic Technology (GOT). GOT had exclusive rights to manufacture, market and distribute OMNI’s APEX™ Knee in Australia, South Africa and New Zealand. GOT also acquired rights to market OMNIBotics robotic-assisted total knee and computer-assisted total hip replacement technology in three countries.

Looking Forward: The OMNI acquisition provides Corin with a differentiated technology compared to any other joint replacement player their size, which could allow them to compete with larger companies in the U.S. and ex-U.S. The purchase also allows Corin to penetrate a larger portion of the U.S. market.

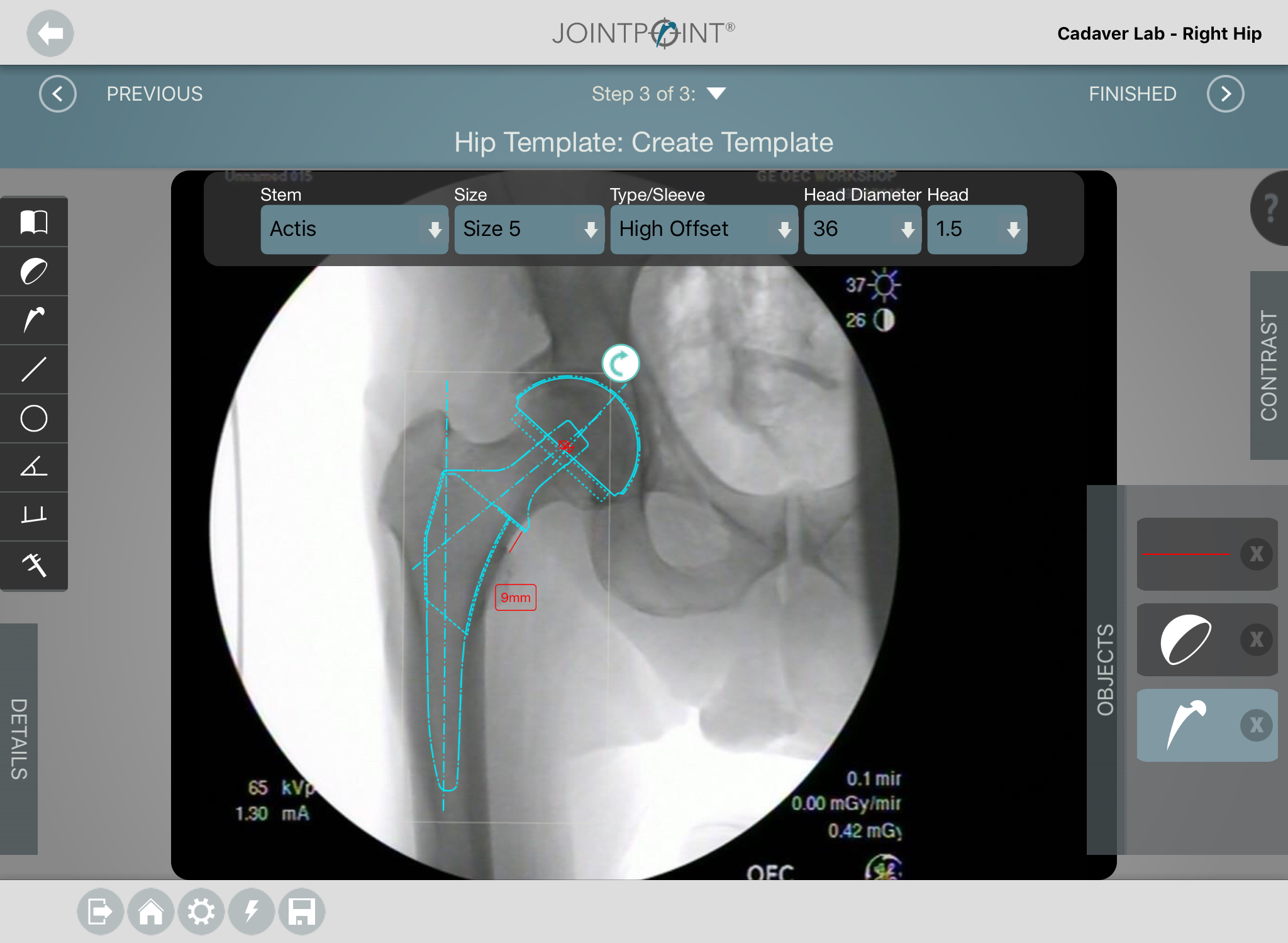

DePuy Synthes Acquires Assets from JointPoint

DePuy Synthes signed a definitive agreement with JointPoint to acquire its navigation software designed for use in hip replacement. The transaction is expected to close within 2019. DePuy Synthes plans to continue to develop and broaden JointPoint for additional orthopedic procedures.

JointPoint Navigation Software offers non-invasive computer navigation, pre-surgical digital templating and case planning to support precise analysis of implant selection and positioning. It features OneTrial®, which is used to optimize implant combinations based on pre-surgical goals with just two images, and to reduce O.R. time by limiting retrialing.

DePuy Synthes and JointPoint have held an exclusive agreement to market JointPoint in the U.S. since 2017. The platform will become a DePuy Synthes-owned component of the ANTERIOR ADVANTAGE approach, which combines DePuy Synthes implants and instrumentation, technologies to optimize the surgical experience for the patient and a professional surgeon education program.

Looking Forward: As the exclusive user of JointPoint, DePuy Synthes should be able to quickly integrate the technology and forgo a learning curve on ways to expand it to other applications. Orthotaxy, DePuy Synthes’ robotic-assisted system, is expected to launch in 2020 and thus far has been the center of much of the buzz about the company’s expansion into digital tools.

Exactech Leverages Soft Tissue Balancing Instrumentation

Exactech acquired XpandOrtho, a designer of soft tissue balancing instruments for knee replacement. The technology will be used to enhance Exactech’s ExactechGPS® computer-assisted navigation for shoulder and knee replacement.

XpandOrtho gained FDA 510(k) clearance for the XO1 Knee Balancing System in 2017. XO1 is a tool intended for adjustment of soft tissue to reduce instability from flexion gap asymmetry in total knee replacement. The intra-articular device uses sensors within the joint to guide ligament balance, and a pneumatic-based bellows system to wirelessly communicate with a display to provide the surgeon with gap balancing feedback throughout the knee’s range of motion. ExactechGPS® was originally launched in 2014.

Looking Forward: Soft-tissue balancing has become a greater topic of interest, recently. This acquisition allows Exactech to update its current application with instrumentation that is important to surgeons without building a whole new platform.

Stryker Boosts Spine Portfolio with Imaging Technologies

Stryker is expected to acquire Mobius Imaging and its sister company, Cardan Robotics, in an effort to bolster its spine division. The purchase, which is expected to close in 4Q19, gives Stryker immediate entry into the intra-operative imaging segment to complement its implant and navigation offerings.

Mobius Imaging is focused on integrating advanced imaging technologies in the surgical workflow. Their Airo TruCT scanner provides real-time diagnostic quality CT imaging. Cardan Robotics had been developing robotics and navigation systems for surgical and interventional radiology procedures, specifically, the Orion spinal robotic system.

While Stryker expanded its spine product offerings with the acquisition of K2M last year, this acquisition makes clear that leadership felt a need to be aggressive in transactions to level the playing field with competitors such as Globus Medical, Medtronic and NuVasive which also offer an array of enabling technologies.

Looking Forward: In announcing the acquisition, plans were not disclosed for the launch of a spinal robotic. However, Stryker plans to follow up on its success of MAKO in hips and knees by adopting robotics in other orthopedic segments.

This year’s M&A activity demonstrates that large- and medium-sized companies see growth potential in surgery-assisting robots, intra-operative navigation, pre-op planning, etc. and will continue to invest in outside expertise to build their technology platforms.

Images courtesy of OMNI, DePuy Synthes and Mobius

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.