Orthopedic industry revenue reached $51 billion worldwide in 2018 and grew +3.5% over 2017, according to estimates from THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT® published by ORTHOWORLD®.

Orthopedic device companies faced familiar challenges in 2018. Payors, regulators and customers are demanding better clinical and economic outcomes, while legacy product lines are becoming commoditized and price erosion is impacting all segments of the orthopedic market.

These pressures promise to be part of the orthopedic landscape for the foreseeable future, and in 2018 many companies refined their strategies to deal with the ongoing transformation of healthcare. Results were mixed among the largest companies as some stumbled operationally while others overperformed, due in part to early adoption of technology and entry into high-growth segments.

Common strategic themes present in 2018 that will continue as part of the industry’s narrative in 2019 and beyond include connected ecosystems of products, flagship technology (e.g. robotics), portfolio-wide pull through and a growing shift to outpatient procedures.

Large companies are racing to build a connected ecosystem of products with a flagship technology, whether robotic or software-based, at its core. These systems aim to provide comprehensive solutions throughout the episode of care and offer the surgeon tools to improve procedure flow through analytics and pre-op planning; reduce waste; enable predictable, repeatable clinical outcomes and monitor patient rehabilitation.

These ecosystems allow orthopedic companies to monopolize operating rooms and increase the disruptive cost of customers switching to other providers. Flagship technologies, particularly robotics, have been shown to be a significant factor in generating improved sales mix as they facilitate implant upselling and portfolio-wide pull through.

As the ecosystem strategy creates opportunities to take market share and improve sales mix, companies strive to be ready with a robust portfolio of up-to-date implants. Many players will pursue aggressive product launch cadences in 2019. Those with strong balance sheets may opt to buy their way into a differentiated product line, as we saw with Stryker’s acquisition of K2M and Smith & Nephew’s tuck-in acquisitions of Brainlab’s joint recon business, Ceterix Orthopaedics and Osiris Therapeutics in 1Q19.

A focus on outpatient centers offers an alternate growth vector for companies that either lack the resources to develop or purchase a robotics solution, or feel like the significant capital investment required of robotics is not a good fit for their customers. Like robotics, selling strategies for ambulatory surgery centers (ASCs) or hospital outpatient centers is a relatively new endeavor for orthopedic companies. Outpatient procedures, particularly in the U.S., are expected to rapidly grow as surgeons and ASCs demonstrate evidence of safety and efficiency and payors provide favorable reimbursement.

Device company leadership has voiced some uncertainty about the rate of growth. Some surgeons have shared that they’ve received pushback from hospital administrators to not move procedures to an outpatient setting due to lower reimbursement. It’s largely expected that payors will align with the outpatient movement, and once that happens, procedures will move. Companies focusing in this area now will develop advantages over competitors as they’re able to refine outpatient-specific selling strategies.

Wright Medical CFO Lance Berry recently summarized the nuances of selling to outpatient centers, saying, “The cost of the product is part of it, but also, how do they keep their O.R.s full? That’s their biggest cost. And how do they attract the type of procedures and patients that they want to fill up the O.R.? What can you do to help them with their efficiency? And then they want options, and they’re willing to pay fine gross margins for the different options, but they may want a lower-cost option and a higher-cost option that they will make some decisions around. So, it’s not as simple as price.”

Market Performance

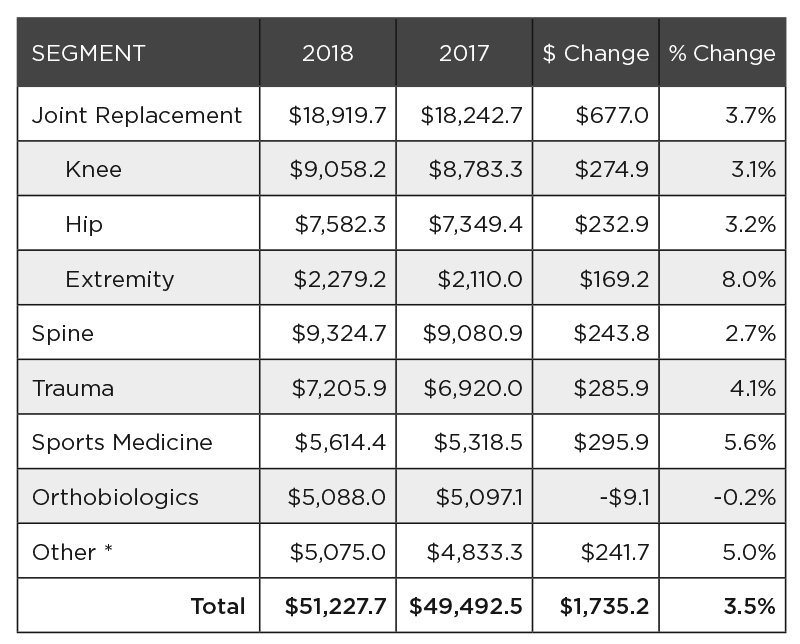

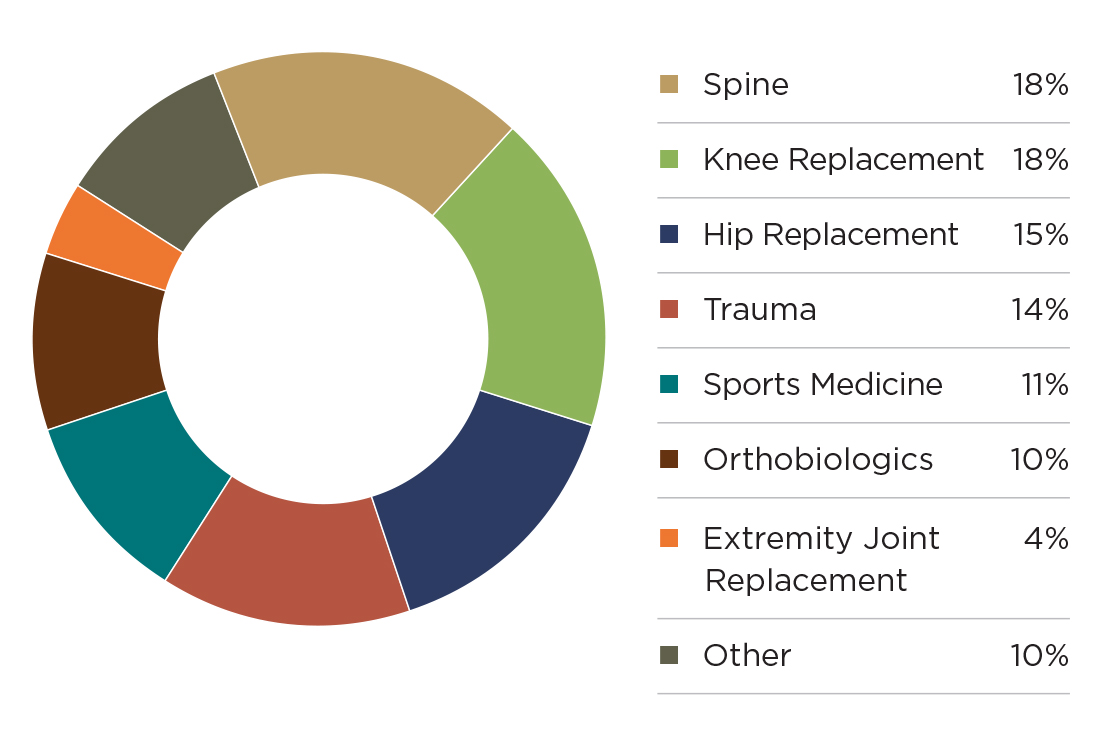

As mentioned, orthopedic industry revenue surpassed $51 billion and grew +3.5% in 2018. Exhibit 1 details product segment sales, while Exhibit 2 shows market share by segment.

Exhibit 1: Product Segment Performance: 2018 vs. 2017 ($Millions)

Exhibit 2: 2018 Orthopedic Product Sales by Market Segment

The spine, knee and hip segments account for just over half of the total market and grew slightly slower than the market total. These are mature segments where many legacy product lines have become commoditized in a crowded market. They are ripe for innovation and companies are shifting their focus to higher-growth areas within those segments, as we’re seeing with cementless knees and artificial discs.

Trauma and sports medicine benefit from increasing demand through patient demographics. The older patient population continues to grow, while younger patients continue to be more educated about their healthcare choices and seek faster returns to active lifestyles.

Orthobiologics faced a difficult 2018 due to payor and regulatory pressures that drove prices down. Many companies observed increased volume in this segment, though not enough to offset eroding prices.

Against this backdrop of market dynamics, Exhibit 3 shows the 2018 performance of companies, while Exhibit 4 shows market share for each company.

Exhibit 3: 2018 Total Orthopedic Sales Performance ($Millions)

Exhibit 4: 2018 Market Share: Top-Tier Players and All Others

Geographic Performance

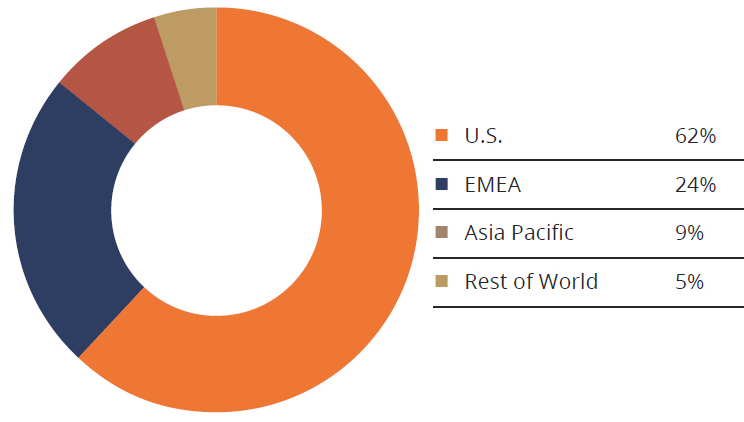

Geographically, the U.S. accounted for 62% of all orthopedic revenue while EMEA totaled 24%. Asia Pacific and the rest of the world were 9.3% and 4.7%, respectively. Exhibit 5 depicts this performance. Compared to previous years, the proportion of U.S.- and Asia Pacific-derived revenue increased while EMEA decreased. European markets were challenging for top-tier companies in 2018, particularly the U.K. and Germany, where issues like regulatory pressure and sales leadership turnover presented headwinds. We expect that Europe will continue to challenge orthopedic companies as they determine which products to keep on the market under the stringent Medical Device Regulation, which is to be enacted in 2020.

Exhibit 5:2018 Sales Performance by Geographic Region

To no surprise, a general theme was the success of emerging markets in 2018, particularly those in Asia. Despite seasonal volatility, these markets allow companies to access new patient populations with legacy products and smaller capital investments. Zimmer Biomet’s Asia Pacific sales have overperformed for several quarters relative to their overall growth. Seikagaku, facing significant hurdles in the U.S., was able to successfully expand into rural and urban areas of China.

Japan and China figure prominently in the international strategies of many companies. Stryker, for instance, is laying the groundwork for future sales by building a training center in Hong Kong in anticipation of significant uptake of Mako in the region starting in 2020.

While top-tier players seek to expand internationally, smaller European companies are pushing hard to gain a foothold in the U.S. Amplitude Surgical performed its first U.S. knee implant procedure in September 2018, and soon after, Scandinavian company Episurf celebrated achieving their long-sought milestone of an FDA Investigational Device Exemption for their Episealer knee implant. ulrich medical continues to launch new products in the spine market, generating double-digit growth in the U.S.

Market Projections

Looking ahead to 2019, we’re projecting orthopedic market growth of +3.5% with growth expected to remain steady in each of the market segments. Our projections are based partially on the following industry dynamics.

The struggles of DePuy Synthes and Zimmer Biomet, and to a lesser extent Medtronic, are felt industry-wide.

The spine, knee and hip segments represent more than half of the total orthopedic market, and the growth rates of all three have decelerated. Increased procedure volumes observed by some companies in 2018 were due, in part, to a strong economy in which more people had healthcare coverage and disposable income for elective procedures. As the economy slows or faces a downturn, some portion of that increased volume will vanish.

These pressures are not new to orthopedic companies, however, and in 2018 many refined their strategies to attain success amid a transforming market. The proliferation of flagship technologies like robotics and navigation as the centerpiece of a connected product ecosystem, as well as the adoption of outpatient selling strategies and product mix, will be the story of the orthopedic industry in 2019 and beyond. The most successful companies will continue to iterate on both their enabling technologies and implantable devices while supporting them with a robust, ongoing pipeline of clinical research.

Medium to small-sized players will also continue to seek higher quality distributors through innovative products and robust portfolios. They’ll seek more control over market access and product pricing by driving exclusivity among their distributors.

ME

Mike Evers is a Senior Market Analyst and writer with over 15 years of experience in the medical industry, spanning cardiac rhythm management, ER coding and billing, and orthopedics. He joined ORTHOWORLD in 2018, where he provides market analysis and editorial coverage.