Robotics has the potential to be game-changing technology in orthopaedic surgery, as certain companies and surgeons extol benefits that include efficiency, predictability and consumer appeal that could increase procedure volume for adopters. The number of conversations about these technologies increases each year, especially at industry trade shows and conferences.

When analyzing the robotic technologies market, it’s important to realize that many questions need to be answered and that analysis of the technology is anything but simple.

To be clear, we’re referring to the use of a robotic tool during surgery. Nearly 60 companies, by our count, play in the broad computer-assisted surgery market. Nine of those companies have robots on the market.

To better put into context recent announcements that have taken place in the robotic space, we took a look at the players and their technologies, as well as how they fit into the greater industry context of data, outcomes and adoption. Here we share our findings to provide greater knowledge about your competitors and customers.

Who are the players and what are their technologies?

Robotic technologies come in many different sizes, sophistications and price points. The top five players by revenue, DePuy Synthes, Zimmer Biomet, Stryker, Smith & Nephew and Medtronic (the latter through a partnership with Mazor Robotics), believe robotic technologies are essential to a complete orthopaedic portfolio. It’s expected that their use of robotics will extend to multiple surgical applications and markets.

What about the technology today, though? We recap each company’s technology and market adoption based on their public statements.

- With Mako (approved by FDA in 3Q15), Stryker is the only company to offer robotic technology for total knee, hip and partial knee replacements. Mako utilizes pre-op planning and mapping. The company placed 28 Mako systems globally in 1Q18 (24 U.S.), up from 18 in 1Q17 (11 U.S.), bringing the total number of installed units to 521 globally (438 U.S.). Mako was used in 8,200 total knee replacement (TKR) procedures in the U.S. in 1Q18, up from 1,100 in 1Q17. Additionally, Mako has been installed in ~400 U.S. hospitals. Of ~4,000 U.S. orthopaedic hospitals, Stryker estimates that 50% are candidates for at least one robot—which means a long runway for continued adoption. The company has indicated that 1,000 surgeons had been trained on Mako TKR through 1Q18.

- Smith & Nephew’s NAVIO (approved by FDA in 4Q12 under its developer, Blue Belt Technologies) is used for knee reconstruction, and its robotic aspect pertains to bone preparation. It is a handheld apparatus that uses an intra-op mapping process to create a 3D rendering of the anatomy, eliminating the need for a CT scan but also limiting pre-op planning capabilities. NAVIO offers a wide range of implant options (three primary knee systems, including the new Journey II XR bi-cruciate knee system) and costs roughly 50% less than Mako, according to a Canaccord Genuity research report published in April. Given these factors, NAVIO is seen as an attractive option for ambulatory surgery centers (ASCs), where cost savings is prevalent. Smith & Nephew reports that the number of surgeons trained on NAVIO in 1Q18 was up sequentially, to the tune of 70% growth. Over 500 surgeons were trained on the system in 2017.

- Zimmer Biomet’s ROSA, which features a robotic arm similar to Stryker’s Mako, is used in combination with an intra-operative imaging system. The company is adapting its Rosa robot used for spine and brain procedures to a knee application expected to be available for clinical use in 2H18. An interesting differentiator of ROSA is that is does not require a product specialist to assist intra-operation, a cost that can drive up procedure prices.

- DePuy Synthes acquired Orthotaxy, whose robotic-assisted surgery solution is in early-stage development for total and partial knee replacement, in 1Q18. Johnson & Johnson revealed at its 2018 Medical Device/Consumer investor meeting that Orthotaxy will be commercialized in 2020 in the form of a TKR application, followed by expansion into spine and hip.

- Medtronic sells the Mazor robot for spine. Mazor Robotics’ Mazor Core refers to the four technologies that back Renaissance and Mazor X systems: surgical planning, anatomy recognition, patient/machine connection and a registration tool that can analyze and match images from different modalities and body positions. In 1Q18, Mazor passed 33,000 cases performed overall, up from 30,000 at the end of 2017. By year-end, Mazor expects to start commercialization of a Mazor X platform that combines Medtronic’s Stealth navigation with Mazor’s robotics guidance, playing catch-up to Globus Medical’s ExcelsiusGPS system that already offers both navigation and robotics.

Other players include:

- The aforementioned Globus Medical announced completion of its first spine surgeries with ExcelsiusGPS in 4Q17. Analysts shared estimates between 12 and 15 ExcelsiusGPS units sold in 4Q17. Globus acquired Excelsius Surgical in early 2014 and filed for FDA clearance of the robotic tool at the end of 2016.

- OMNIlife science, which has been at the forefront of robotic-assisted total knee replacement technology since 2010 and in 2017 passed the 17,000 robotic-assisted TKR procedure milestone. Further, in 4Q17, OMNI reported that over 100 cases have been performed with its OMNIBotics Active Spacer in a multi-center U.S. clinical study. The study is assessing the combination of robotic-assisted bone cutting with active soft tissue management at five sites. Results from the first four sites mirror positive outcomes observed in a Australian pilot program underway since 1Q17. Active Spacer is reportedly the only available system that supports predictive balance of ligaments through dynamic, real-time feedback across the entire range of motion, that can deliver computer calculated, robotic-assisted bone cutting.

- Pure-play computer-assisted surgery companies Brainlab, Think Surgical and Tinavi Medical Technologies.

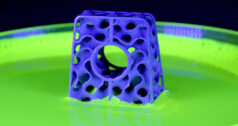

OMNIlife science OMNIBOTICS Robotic Assisted Knee Replacement

As these technologies gain broader market adoption, we’ll be watching how the current players expand applications and how mid- to small-sized players remain competitive, given the resources and market footholds of the major players in the total joint and spine spaces.

Doron Dinstein, M.D., Mazor’s Chief Medical Officer, told us in a previous interview that robotics is impacting spine surgeons by allowing those who aren’t well-versed in minimally invasive surgery (MIS) try the approach, or for those who use MIS for single-level cases to do larger constructs. “We’ve seen surgeons who don’t do minimally invasive move from completely open to completely MIS practices,” he says. “It’s a gateway to change your practice.”

Where is the data?

Peer-reviewed data showing the results of robots is still several years away. Analysts note that the clinical value proposition of robotic-assisted surgery has yet to be fully articulated in total joint procedures (meaningful near-term data for total knees is at least two years out). In the interim, expect that individual surgeons or sites will publish their own data and talk about their anecdotal experience at events like the AAOS or NASS annual meetings.

For instance, at NASS 2017, we spoke with Mazor Robotics about their interim study results, which demonstrated that spine surgeries performed with Mazor Robotics’ Renaissance Guidance System yielded a five-fold reduction in surgical complications and a seven-fold reduction in revisions vs. freehand-based, minimally invasive lumbar fusion. At the time, Mazor noted that this may have been the first multi-center prospective study of robotic-guided spine surgery.

While data may be lacking in actual robotic procedures, it does exist in other areas of computer-assisted surgery integrated into robotics.Take navigation, for example. Clinical data consistently shows that using navigation reduces the incidence of implant malpositioning, but only recently (15+ years after commercialization) has it shown any impact on long-term outcomes. Specifically, the 2017 update from the Australian Joint Registry showed that computer-navigated TKRs had a cumulative 10-year revision rate of 5.1%, compared to 5.4% in the non-navigated group.

While these numbers don’t tell the whole story, they demonstrate the potential that robotics have to improve long-term outcomes, given the added precision of robotic instruments on top of the accuracy of a navigation system. Moving forward, we expect that payors and hospitals will demand greater data on patient outcomes and, we emphasize, cost effectiveness of these tools. That data will determine the technologies’ future adoption.

Where is the push for robotics coming from?

Canaccord Genuity analyst Kyle Rose notes that “in an era of narrow networks and increased competition for patient volumes (from both hospitals and physicians), new and innovative technologies (at least in the eyes of prospective patients) may be worthwhile investments purely from a marketing standpoint.”

Some hospitals and ASCs are acquiring robotic and computer-assisted systems to prevent volume loss to competitors. This scenario has led to even more system placements and could be amplified even further going forward as the consolidation of individual hospitals into large health systems continues.

In general, we believe that the companies we’ve mentioned have yet to prove a sizeable market and the necessity for robotic technologies. Our conversations with surgeons indicate that robotics remains polarizing. Additionally, these technologies are in the very early stages of adoption and many surgeons seek more clinical data before putting a robot in their O.R.

Some companies and analysts point to the potential benefits of robotic technology to preserve patient anatomy, restore natural joint kinematics and reduce recovery time—all important for hospitals and surgeons as patient-reported outcomes become more crucial components for reimbursement.

Other companies are clearly not sold. Many of the executives we’ve spoken with say that the outcomes are not improved enough to rationalize the expense.

During a 1Q18 earnings call, ConforMIS President and CEO Mark Augusti noted that he believes his company’s approach to custom implants demonstrates better clinical and economic benefits. “…while the robot can help with the variability between surgeons, it’s not going to help out with doing any better beyond the traditional off-the-shelf implant.”

NuVasive CEO Gregory T. Lucier, in that company’s 1Q18 earnings call, backed his company’s approach to navigation over robotics. “It takes a little bit of a steady hand to get through the kind of enthusiasm that people have for robotics right now, because it’s a shiny new object,” Lucier said. “We have been consistent in our opinion, that in the world of healthcare, the last thing the O.R. needs in the world of spine is the addition of a $1 million piece of hardware that basically only does one thing and that is help place pedicle screws. And when you actually look at what’s needed in the O.R., we think it’s more sophisticated navigation, radiation reduction and what we would just call smart automation. And smart automation is the right tasks at the right economics.”

The robotics conversation will continue. Stryker and Smith & Nephew have prioritized the narrative of their technologies over other products in their portfolio. DePuy Synthes and Zimmer Biomet will have more announcements as they work toward commercialization. And more players will enter the market. We expect greater understanding of the longevity and relevancy of robotics to prove out over the next decade.

Rob Meyer is ORTHOWORLD’s Senior Editor.