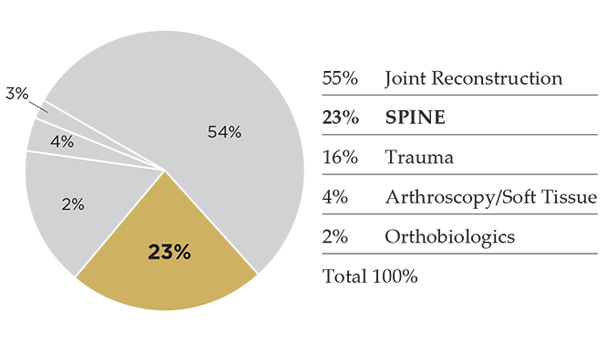

The majority of the spine market—just about 80%—is controlled by companies with annual spine revenue above $100 million.

For 2016, ORTHOWORLD estimated revenue from spinal implants and instrumentation at $8.8 billion, up 2% vs. 2015. (This figure excludes orthobiologics.) When we published the ORTHOPAEDIC INDUSTRY ANNUAL REPORT® in May, we projected 2017 spine revenue of $9.0 billion—an increase of about another 2%, supported by increased reimbursement for novel devices, M&A among larger companies, utilization of MIS and surgical assistance technologies, etc.

What has the 80% been up to, this year? Within the article below, we chose to highlight nine of these companies based on their market activity in 2017.

We’ll start by looking at them all together, offerings-wise. The matrix in Exhibit 1 gives a general snapshot: who has what hardware, who’s employing additive, where are the robots. You can see that all nine companies play in the traditional fusion and MIS spaces. We highlight their presence in additive, expandable interbody, robotics and navigation based on the traction these technologies have gained by spine companies of all sizes, and especially these nine, in recent years.

Medtronic

Medtronic is one of the world’s largest medical technology companies, serving diverse markets: cardiac and vascular, diabetes and restorative therapies, under which its spine revenue resides. Medtronic claims #1 spot in global spine market share standings, by ORTHOWORLD estimates. Its overall spine portfolio of hardware and biologics addresses anterior cervical fusion, artificial discs, cervical laminoplasty, surgical navigation, instrumentation, bone graft, etc. Medtronic’s spine division has posted four straight quarters of positive growth after four consecutive quarters of growth decreases. Leadership affirms that spine is turning around, and recent earnings announcements indicate that to be true.

By the Numbers

2016 Spine Revenue: $2,429.0 million

2017 Spine Revenue Estimate: $2,480.0 million

Strategic Highlights

- Medtronic’s Prestige LP cervical disc and Zimmer Biomet’s Mobi-C are the only two cervical discs approved for 2-level cervical disc replacement in the U.S. Seven-year follow-up data from a 2-level study of Prestige LP vs. ACDF demonstrated favorable clinical outcomes and patient satisfaction with Prestige.

- In August 2017, Medtronic entered Phase II of its strategic partnership with Mazor Robotics, gaining exclusive global distribution rights to the Mazor X surgical robotic assistance platform. The companies had established their relationship in 2Q16, partnering on product co-promotion and co-development. The move to Phase II occurred ahead of the planned 1Q18 timeline, in light of higher than expected global market acceptance and demand for the Mazor X system, as well as early achievement of certain sales and marketing milestones by both companies. Medtronic has invested $72MM in Mazor since 2Q16.

- For the remainder of the company’s FY18, product plans include a refresh of its Synergy TLIF line and launch of the Prestige LP disc in Japan.

- InductOs BMP (the EU version of INFUSE) has returned to the market after a shipping hold that took effect in late 2015/early 2016.

DePuy Synthes

DePuy Synthes is the largest company in orthopaedics, and its spine hardware franchise held the #2 spot in 2016 global spine market share, trailing Medtronic by ~$870 million. DePuy’s spine portfolio addresses degenerative, deformity, MIS, interbody fusion, disc replacement, vertebral fracture, etc. The company experienced spine revenue loss in 2015 and 2016 in part due to gaps in its product portfolio and soft demand in ex-U.S. countries, according to leadership.

By the Numbers

2016 Spine Revenue: $1,558.5 million

2017 Spine Revenue Estimate: $1,540.5 million

Strategic Highlights

- DePuy is optimistic about 2H17 spine growth in light of VIPER and EXPEDIUM Fenestrated Screw Systems and launch of an expandable interbody cage acquired from Interventional Spine—the latter particularly filling a product gap. (DePuy also received a facet screw system for open and percutaneous spine surgery, in the transaction.)

- The acquisition of Sentio brings another new capability to DePuy: nerve localization technology used in minimally invasive spine procedures. Sentio’s platform eliminates the need for a neuromonitoring specialist and has a minimal footprint in the operating room, and could help to reach more customers in the ambulatory surgery setting.

- The KICK portable spine imaging system, launched in late 2016, also provides access to affordable advanced imaging technology with real-time navigation for pedicle screw placement. KICK is compatible with VIPER and EXPEDIUM implants.

- DePuy entered into an agreement to sell its prodisc assets to Centinel Spine. The acquisition is expected to close in mid-4Q17, according to Centinel’s leadership. The announcement leaves DePuy solely with the INMOTION lumbar artificial disc.

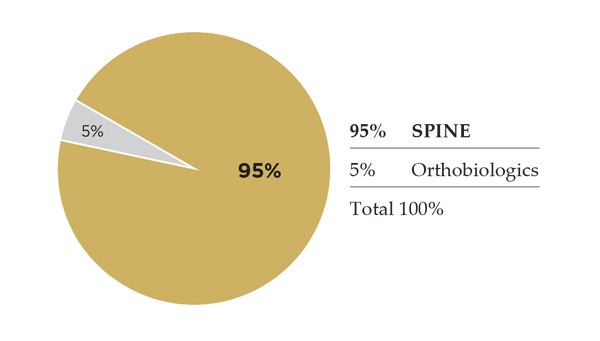

NuVasive

NuVasive’s spine revenue growth has not dipped below the teens since posting 12% growth in 1Q16. ORTHOWORLD estimates place NuVasive at #3 in global spine market rankings. Its spine portfolio includes access instruments; spinal hardware and biologics; software for surgical planning, navigation and imaging; magnetically-adjustable implant systems for spine applications and intra-op monitoring. Once a pure-play spine entity, the company has a very slight dilution with products acquired from Ellipse Technologies that have application in both spine and orthopaedic treatments. NuVasive is expected to exceed $1 billion in revenue for 2017, which would make it the eighth current orthopaedic company to surpass that mark.

By the Numbers

2016 Spine Revenue: $801.9 million

2017 Spine Revenue Estimate: $890.0 million

Strategic Highlights

- NuVasive acquired Vertera Spine, a developer of porous-PEEK-based spinal interbody fusion devices, and is now the sole device company offering both PEEK and titanium porous interbody devices to suit surgeon preference and encourage bone ingrowth. NuVasive will sell COHERE cervical and COALESCE lumbar interbody fusion systems in the U.S., and plans to apply porous PEEK technology to its product development pipeline.

- Outside of products, NuVasive is releasing numerous systems that address overall procedural solutions— such as iGA (Integrated Global Alignment, addressing surgical planning, real-time feedback and post-op data tools), recently-launched LessRay software to minimize exposure to radiation, etc.

- NuVasive is fully embracing pediatric spine; 2017 launches have included the RELINE Small Stature pediatric posterior fixation system that is used with MAGEC magnetic growing rods. Other initiatives for the niche include establishment of a pediatric-specific salesforce and a pediatric spinal deformity-centric program, “Embracing the Journey Together,” addressing research, education and event support.

Stryker

Stryker’s spine division addresses a range of products for fusion, vertebral fracture repair, MIS, interbody devices, vertebral body replacement, visualization, navigation, biomaterials, etc. It stands at #4 in the overall spine market, by ORTHOWORLD rankings. The company’s spine revenue finished 2016 ahead of 2015 by 1.7%, but 1H17 has posted negative growth in light of lingering effects from U.S. supply issues—which appear to be moderating, per leadership’s comments in the 2Q17 call.

By the Numbers

2016 Spine Revenue: $712.5 million

2017 Spine Revenue Estimate: $715.0 million

Strategic Highlights

- Stryker Spine introduced the 3D-printed Tritanium Posterior Lumbar Cage in 2Q16—its first use of additive techniques for spine. Later that year, pre-clinical study results demonstrated that use of the cage led to a statistically superior range of motion, bone in-growth profile and greater average construct stiffness vs. PEEK and titanium plasma-sprayed PEEK cages.

- Strategically, the company has made few investments in M&A to support its spine segment, recently. The latest moves included 2016 acquisitions of SafeWire’s product portfolio for minimally invasive spine surgery, and Becton Dickinson’s vertebral augmentation business, including all AVAmax, AVAflex, AVAtex and AVAprep branded products.

- Stryker’s Mako robotics technology hasn’t broken out of joint recon yet, though it’s certainly reasonable to expect that it could be developed for spine years in the future. Stryker Navigation markets SpineMap 3D software to support minimally invasive approaches for spine surgery, and in the U.K., Stryker has a partnership to market EOS imaging’s planning and navigation products to spine customers.

- In late 2016, Stryker launched Ascential to offer an implant and delivery solution for lower acuity spinal procedures in ambulatory surgery center and hospital settings. Ascential offers sterile-packaged implants manufactured by Stryker, customized service levels and streamlined distribution.

Globus Medical

Like NuVasive, Globus is another formerly pure-play spine company that is adding trauma products to its line-up. In spine, however, ORTHOWORLD estimates Globus at #5 among top segment players, and we expect that, like NuVasive and K2M, its above-market growth is taking share from Medtronic and DePuy. The company’s spine revenue jumped from low-single-digit growth at the end of 2016 to low double digits at 1H17, benefitting from product sales and the acquisition of Alphatec Spine’s ex-U.S. operations. Globus’ portfolio addresses treatment of the whole range of spine disorders, including a robotic surgical navigation system. Globus was the first major spine company to introduce an expandable interbody; today, it’s on its third generation of the technology.

By the Numbers

2016 Spine Revenue: $537.7 million

2017 Spine Revenue Estimate: $585.5 million

Strategic Highlights

- Globus experienced a slight delay in securing FDA clearance for Excelsius GPS robotic and navigation system, so clearance was bumped from 1H17 into 3Q17; however, the company still expects to recognize some amount of revenue from the system within 2017.

- The level of surgeon interest in Excelsius is noted as being unprecedented in company history of products, and its launch is a priority focus.

- The company acquired KB Medical, a robotic developer of the AQrate Robotic Assistance system, gaining strength in product development, personnel and intellectual property. AQrate received CE Mark Approval in 2Q16 and was indicated for use in general spinal surgery, and clinical trials in spinal fusion have been performed in Europe, but Globus doesn’t plan to commercialize the robot. Rather, the acquisition will shape future enhancements to Excelsius GPS.

- Revenue from Globus’ Alphatec Spine international business acquisition has grown each quarter; it contributed $13.8MM in 4Q16 (the first quarter after transaction) and has climbed to $15.2MM and $15.5MM in 1Q and 2Q17, respectively.

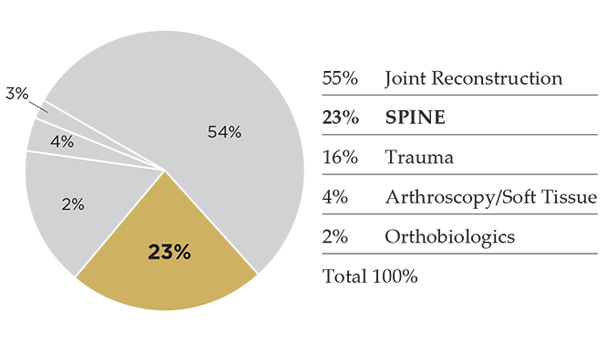

Zimmer Biomet

Of the nine companies profiled here, spine occupies the least of Zimmer Biomet’s overall revenue—coming in at just under 5% of orthopaedic sales in 2016. A large boost came to the company’s spine portfolio with its 2016 acquisition of LDR, maker of the Mobi-C cervical disc. It also edged into the arena of robotics for spine with its purchase of Medtech’s Rosa system in 2016.

By the Numbers

2016 Spine Revenue: $338.5 million

2017 Spine Revenue Estimate: $410.0 million

Strategic Highlights

- ORTHOWORLD estimates that the company’s acquisitions of LDR and Medtech contributed ~$100 million or 1.4% of 2016 orthopaedic revenue—significant, considering that its full-year revenue grew by 2.5% vs. 2015. The Mobi-C cervical disc, acquired with LDR, is a consistently-named growth driver for spine. The commercial integration of LDR is now complete, per leadership commentary in the company’s 2Q call.

- FDA 510(k) clearance was received for Rosa Spine in early 1Q16. We’ve not heard much about the Rosa robotic system since its acquisition in 2016—save a small voluntary field action, through which it was shown that Rosa is running for spine at only a few locations. The company is prioritizing a total knee application for the robot.

- In September, Zimmer Biomet Spine is opening a new 101,000-square-foot facility a few miles from the Lanx location (acquired in 2013), including a machine shop, mechanical testing lab and cadaveric training lab.

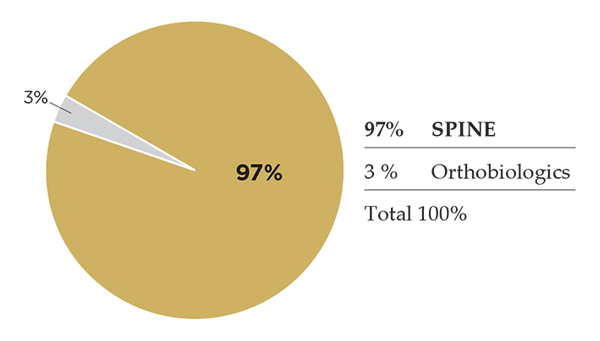

K2M

K2M is an actual pure-play spine company focused on the treatment of complex spine disorders and degenerative conditions, offering implants, disposables, instruments and minimally invasive solutions. The company has embraced additive techniques; today, K2M has ten FDA-cleared 3D-printed products, including the first ever 3D-printed expandable interbody device. New U.S. surgeon users and products continue to support K2M’s revenue growth, which ended 2016 in high single digits and 1H17 in low doubles.

By the Numbers

2016 Spine Revenue: $229.1 million

2017 Spine Revenue Estimate: $253.0 million

Strategic Highlights

- The company’s first major announcement in 2017 was launch of Balance ACS (BACS), a platform to drive quality outcomes for spine patients by addressing each anatomical vertebral segment with a 360-degree approach to the axial, coronal and sagittal planes. BACS services include insurance preauthorization tools, pre-operative planning, 3D anatomical modeling and post-op data management and reporting to facilitate quality outcomes.

- K2M’s RHINE elastomeric cervical disc is approved under the CE Mark; the company intends to target ex-U.S. markets initially to gauge performance and interest. Over 300 procedures have been completed in the EU (both single- and multi-level), where enrollment is underway for a 166-patient prospective, observational clinical study.

- The company has launched its first expandable interbody, the SAHARA AL, and alpha launched MOJAVE PL, the first 3D-printed expandable posterior lumbar interbody on the market; full launch for the latter is slated for early 2018.

- In 1H17, K2M received key product registrations from Japan’s Pharmaceuticals and Medical Devices Agency, including MESA and EVEREST systems and all of the company’s pedicle screws. In 2H, they signed a seven-year agreement with Japan Medicalnext for exclusive distribution of K2M’s products throughout the region.

- Also in 2H, the company acquired exclusive license to use a portfolio of 17 issued and pending patents for expandable interbody fusion devices, which will support development of new products using Lamellar 3D Titanium Technology.

Aesculap

Aesculap Implant Systems’ spinal products include lumbar disc replacement, fusion, MIS and also biologics. Its parent company is B. Braun. Our estimates for Aesculap’s spine revenue have placed it at just above a 2% increase for the past five years.

By the Numbers

Strategic Highlights

- In 1H17, Aesculap commenced a warranty program for Plasmapore XP-coated interbody fusion devices, reported to be the first facility risk-share agreement on a titanium-enhanced PEEK interbody in the spine industry to warrant against delamination of a surface enhancement. (The kick-off accompanied the launch of the TSpace XP interbody system, which is treated with Plasmapore XP.)

- Aesculap also presented long-term data from study of its activ-L artificial lumbar disc. Studies indicate that, at five years, activ-L had a protective effect on the progression of degenerative disc disease at adjacent levels in 91.2% of patients. The data reiterated the role of lumbar total disc replacement in delaying the progression of adjacent segment disease. Previously, lumbar fusion had been reported to be responsible for a rate of ASD as high as 28.6% at 5 years. activ-L has been cleared for U.S. marketing since 2015.

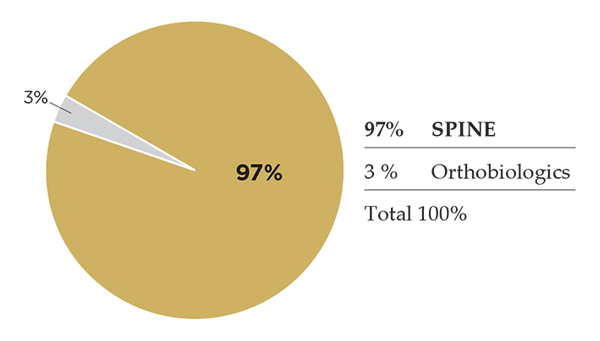

Alphatec Spine

Alphatec was founded in 2005 as a contract manufacturer that evolved into a developer of spine products. Today, Alphatec markets access systems, interbody implants, fixation plates, thoracolumbar and cervicothoracic screws/rods, instruments and biologics that support spinal fusion. In late 3Q16, Alphatec’s ex-U.S. operations were purchased by Globus Medical. Excluding its ex-U.S. revenue, sales dropped in the low double digits for 2015 and 2016; new leadership intends to right the ship.

By the Numbers

2016 Spine Revenue: $108.2 million

2017 Spine Revenue Estimate: $95 million

Strategic Highlights

- Globus Medical’s 2016 acquisition of Alphatec’s ex-U.S. assets cleared the path for Alphatec’s sole focus on U.S. launches of products like Arsenal Degenerative and Deformity systems, Battalion Universal Interbody, the XYcor Expandable Spacer, etc.

- Alphatec is ready to grow again, and leadership sees substantial opportunity to increase its distribution power. The company is underrepresented or lacking representation in many of the largest population centers in the U.S. Meanwhile, industry consolidation is providing a large pool of talent now in search of jobs.

- The company has commenced transition of its sales organization from non-exclusive to dedicated, exiting stocking distribution; the evolution should take three years.

- Product launches are also key; 2017 is Alphatec’s year for devices like the 2Q full launch of Arsenal Deformity and expected late-year full launch of Battalion Lateral that includes the Squadron Lateral Retractor. U.S. patents were recently awarded that protect unique, differentiating features of these technologies in a crowded product field. The biologics platform is undergoing a relaunch to capture that additional piece of procedure revenues, as well.

The spine market is made up of hundreds of players, many of which have made compelling strategic moves this year—such as Amendia (now Spinal Elements), Centinel Spine and Choice Spine. We highlighted these simply to provide perspective on the large players impacting the majority of the market.

Sources: Company press releases, websites, U.S. Securities and Exchange Commission filings, ORTHOWORLD estimates

JAV

Julie A. Vetalice is ORTHOWORLD's Editorial Assistant. She has covered the orthopedic industry for over 20 years, having joined the company in 1999.