In the March issue of BONEZONE, I explained why profit as a percentage of sales is a flawed performance measurement for a manufacturing organization and suggested a couple of alternative measurements—profit as a percentage of value added and profit as a percentage of activity costs—that provide much better measures of a manufacturer’s performance. Both of these alternatives are, however, only surrogates for another somewhat more complex methodology that enables a manufacturer to measure and evaluate the value of each product with much greater accuracy. Under that method, a cost of capital in the form of a targeted return on assets is included in the manufacturer’s costing rates in the same manner as any other operating cost.

Cost of Capital – Investment Base

The first issue that needs to be addressed before measuring a company’s cost of capital is how to measure investment. How much money do the owners of a manufacturing firm have invested in the company? Is it the amount of money they originally invested in the organization? Is it the amount shown in the owners’ equity portion of the balance sheet? Or is it some other amount?

Economics tells us that the amount an owner has invested in a company is the money that investment makes unavailable for investment elsewhere. If $1 million is invested on Day 1, the investor no longer has that $1 million to put into another investment. If by Day 2 the value of that investment has increased to $1.2 million, the investor no longer has only $1 million invested; he or she now has $1.2 million tied up in the company that is not available to invest elsewhere. Similarly, if the value has decreased to $0.8 million, the investor has only $0.8 million that cannot be invested elsewhere; $0.2 million of the original investment has already been lost. If a decision regarding the investment must be made at the end of Day 2, the basis for that investment decision is no longer the original $1 million; it is the value of that investment at the end of Day 2.

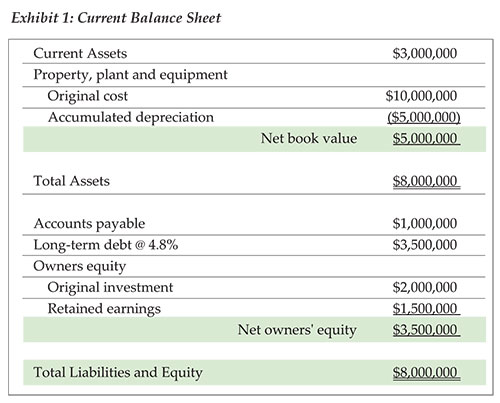

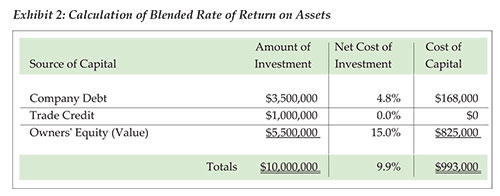

Now consider a company whose property, plant and equipment has recently been appraised at $7 million. The owners’ original investment was $2 million and the company’s current balance sheet is summarized in Exhibit 1. It is the owners’ goal to earn a 15 percent return on their investment. What should be the base on to which they apply the 15 percent to determine the amount of profit that will meet their return on investment goal? Should it be their original investment of $2 million, which means a $300,000 profit will meet their goal?

Should it be the $3.5 million owners’ equity which means a $525,000 profit will meet their goal? Or would it be the $5.5 million they would net if they liquidated the company’s assets ($3 million current assets + $7 million property, plant and equipment) and paid off its debts ($1 million accounts payable + $3.5 million long-term debt), which means an $825,000 profit would meet the owners’ goal?

If it is true that the measure of an investment is the funds it makes unavailable to the investor to invest elsewhere, the owners’ investment is $5.5 million and the amount his company needs to earn to provide its owners with a 15 percent return on investment is $825,000.

There are other ways that might be available to determine the owners’ true investment base. For example, if the owners were recently offered $6 million for their company, they would have $6 million unavailable because it was tied up in their firm. That would indicate that a $900,000 profit is required to meet their 15 percent return on investment target. In any case, neither the $2 million original investment nor the $3.5 million net book value would be appropriate. Another more economically soundmeasure is required. For the remainder of this article, we’ll assume that the $5.5 million “orderly liquidation” value of our example company is representative.

Cost of Capital – Return on Assets

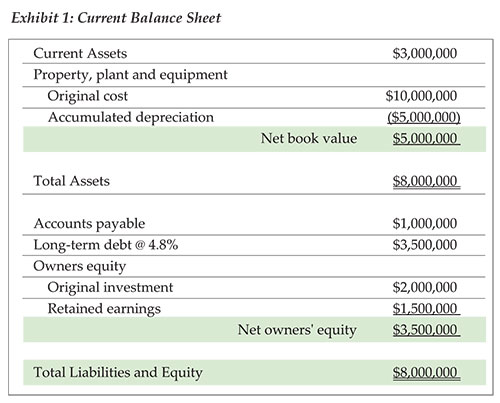

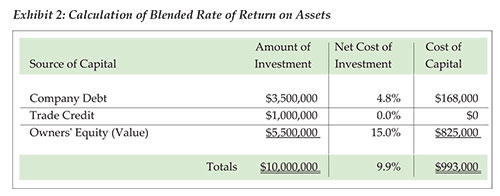

To incorporate cost of capital into the measurement of each product’s value, the blended rate of return on assets (ROA) required to meet the owners’ return on investment target must be determined. The calculation of this return rate for our manufacturer is shown in Exhibit 2.

The total assets employed by the company are $10 million: $3 million of current assets and $7 million (at current value) in property, plant and equipment. Say, $3.5 million is financed by long-term debt with a 4.8 percent interest rate, $1 million by trade accounts payable with no interest and $5.5 million by the owners’ investment with a 15 percent return on investment target. With that breakdown, $168,000 of profit is required to cover the long-term debt, no profit is needed to cover the trade accounts payable and $825,000 must be earned to provide owners with their 15 percent return. The $993,000 pre-interest profit requirement means that a blended 9.9 percent return on the company’s $10 million of assets is required to provide the owners with a 15 percent return on investment. In other words, if they are to carry their own weight, each $1,000 of assets must generate $99 in annual profit.

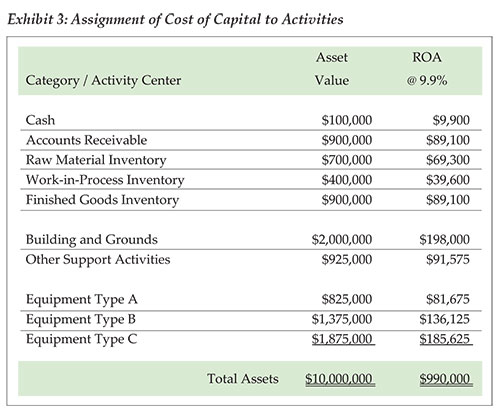

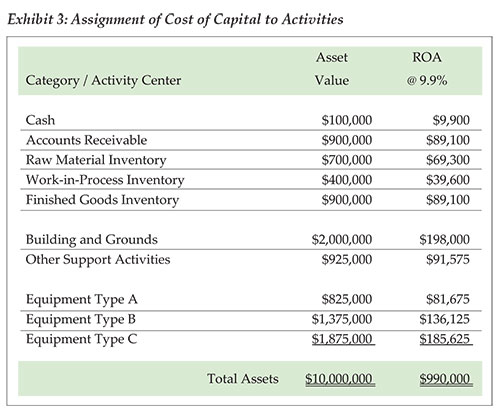

Assigning Cost of Capital to Activities

Once this blended rate of return on assets has been established, it can be assigned to activity centers in proportion to the value of the assets that are included in those activity centers.

Exhibit 3 shows the distribution of our manufacturing company’s assets among its activity centers, as well as the target return on assets that must be generated by the funds tied up within each of those activity centers if the owners are to realize their 15 percent return.

For example, $2 million of value is assigned to Building and Grounds; an activity center that accumulates the cost of owning, operating and maintaining a facility in which the business’ activities can take place and whose costs are subsequently assigned to other activity centers based on the percentage of the total facility they occupy. Ownership of the facility needs to generate $198,000 in pre-interest profit annually if it is to meet the owners’ targets. To determine how well this requirement is being met, the $198,000 cost of capital is included along with depreciation, maintenance, utilities, insurance, taxes and all the other costs associated with the real property to determine a facility cost “per square foot” that is assigned to the activities within the facility based on their “footprints.”

Similarly, the $1,875,000 of value assigned to Equipment Type C indicates that the use of this category of equipment must generate $185,625 in pre-interest profit for it to meet the owners’ financial target. The $185,625 would be incorporated into the machine’s “per hour” rate, just like its occupancy cost (the distribution from Building and Grounds based on its “footprint”) depreciation, utilities, maintenance, consumables and other machinerelated costs.

At the end of the process, the costing rates used to measure the cost of any product will include an appropriate cost of capital based upon the amount of investment required to support that product. By incorporating the company’s cost of capital in its cost model, the cost calculated for each product will represent the revenue it must generate to cover all of its costs, including the owners’ expected return on investment. In the case of our example manufacturer, its product “cost” will represent the price required to generate a 15 percent return on investment. Sales prices that exceed that cost generate a premium profit or add extra value to the company. Those whose prices fall below that cost are underachievers, if not losers, and their deficiencies must be covered by other products with extra value if the owners’ financial expectations are to be met.

For some products, meeting the owners’ return on investment expectations will require a very high profit–to-sales percentage and for others the percentage may be low, but in either case, the profit–to-sales percentage is irrelevant and misleading, because it fails to take into account the investment required by the product to cover its cost of capital.

During more than 25 years as a consultant, Doug Hicks has championed the development of practical, down-to-earth cost management solutions for small and mid-sized organizations. In that time, he has helped nearly 200 organizations transform their history-oriented accounting data into customized, value-enhancing decision support information that provides accurate and relevant intelligence needed to thrive and grow in a competitive world. He shares his experience through seminars conducted throughout the U.S., in trade and professional periodicals and two books, including I May Be Wrong, But I Doubt It: How Accounting Information Undermines Profitability.

D.T. Hicks & Co.

www.dthicksco.com