Within about two weeks of each other, I attended the Consumer Electronics Show (CES) in Las Vegas and the OneMedForum in San Francisco. Innovation, Obamacare, crowdfunding, accountable care organizations (ACOs) and digital health were important topics seen by attendees through two different lenses. In this article, I report on the trends discussed at CES and OneMedForum and what they mean for the healthcare and medical device industries moving forward.

Digital Health at CES

Las Vegas is an appropriate place for CES. The show floor resembles a casino with the noise, flashing lights and endless competition for eyes and attention. Away from the crowds and the big keynotes are Summit meetings and panel discussions, which this year focused on digital health, fitness tech and Baby Boomers.

The digital health space has gone from not much three years ago to the area where the more interesting tech innovation is happening. The most noteworthy thing offered by the large traditional electronics booths was large curved televisions. The digital health space showed fitness tracking, wellness management, patient management automation and remote point of care devices—more compelling than curved televisions.

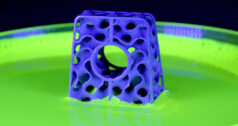

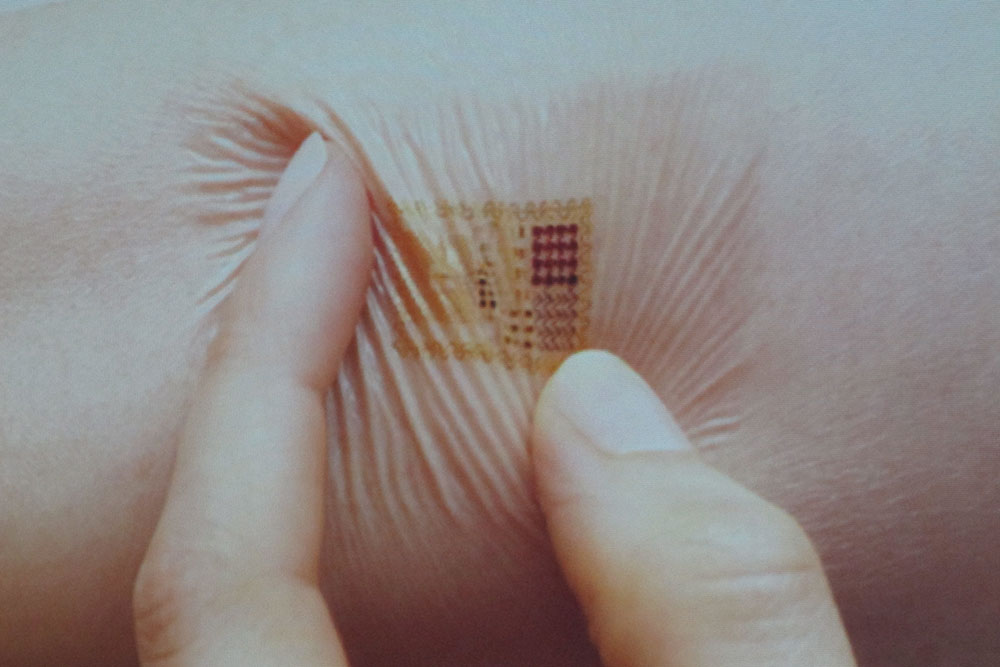

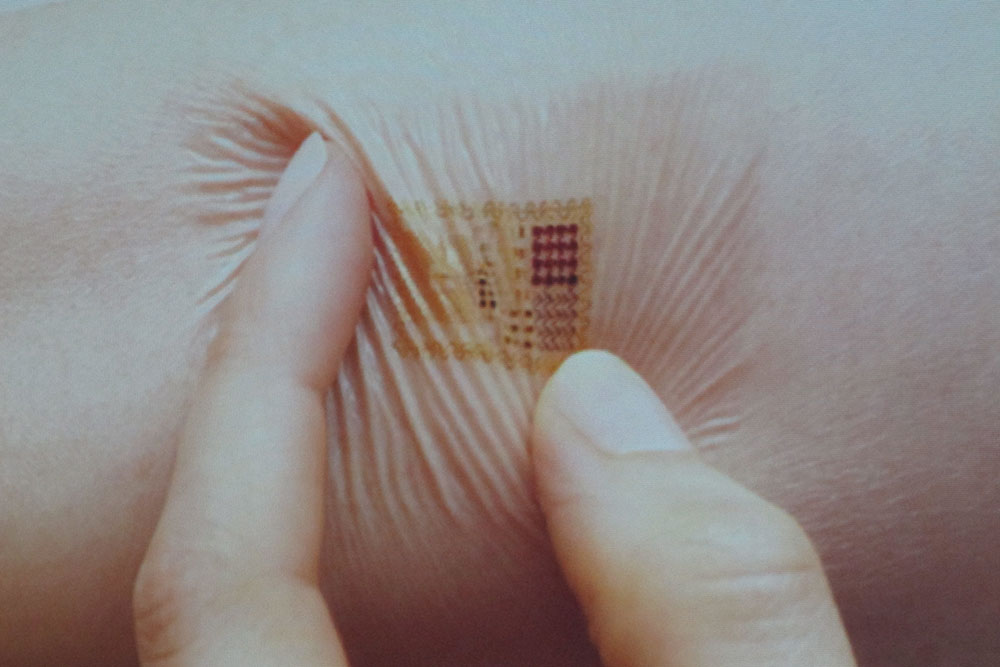

The technological drivers in this space are inexpensive, robust and include small sensors connected to increasingly small, powerful and energy efficient computers. Intel announced Edison, a chip that turns a fully functional computer into the size of an SD card. MC10 is making sensors that are small and flexible, like a Band-Aid. (See Exhibit 1.) These technologies can easily communicate to the cloud and each other in the “Internet of things” and even a step further, with multiple connected people streaming biologic data to an “Internet of you.” This data monitoring and gathering reaches into the brain with inexpensive and sophisticated brainwave monitoring from companies such as InteraXon and NeuroSky.

Exhibit 1: Concept model of a flexible sensor patch by MC10

In addition to the sensors and data gathering devices, on display at CES were adaptive mobility technologies by Ekso Bionics and AlterG that assisted individuals with lower extremity weaknesses. Battery technology has advanced to the point where these powered suits have become light enough to wear, and have sufficient battery life to be practical. Other applications for robotics in healthcare seek to reduce labor costs as more patients in the developed countries age and require home-healthcare services.

Paul Thacker, Ambassador for Ekso Bionics demonstrating the Ekso powered suit at Robotics on the Runway, CES 2014.

The technophiles at CES foresee a bright future as Obamacare mandates “wellness” and “prevention,” anticipating that digital health tech makers will be able to capitalize on Electronic Medical Records (EMRs) through “Big Data” type capture and data mining, and that this will drive the implementation of ACOs. The expectation is that wellness, prevention and pricing transparency are ingredients for a magic formula to drive costs from the system.

All seems rosy for digital health in consumer electronics land. Insurance providers such as UnitedHealth see digital health tech as a way to intercept health problems earlier and cheaper, and to avoid costs through wellness management, especially from lifestyle issues like obesity and diabetes. Insurers also expect EMRs and data management to allow price-transparent shopping for procedures, the way cars and airline tickets are purchased, with the expectation that this will drive down pricing. Companies like GreatCall have branched out from big-button phones for grandma to remote and automate eldercare management.

Digital health technologies will touch how we live and how we age. They will give us information about ourselves in quantity and quality never before available (“quantified self”) and be able to set up feedback loops to monitor and incentivize being active instead of sedentary. What remains to be seen? How much this will actually save the healthcare system in the long run, who will pay for these technologies, and whether the technologies are sticky enough to be used by consumers for more than a week or two.

Dr. Daniel Kraft, Dr. John Nosta, and Robert Scoble showing off sensor-enabled health and fitness gadgets at a CES 2014 panel.

Now that we have had a quick tour of CES in Las Vegas, let’s travel to the OneMedForum in San Francisco. This conference runs parallel with the larger J.P. Morgan meeting. The differences between the consumer buys/consumer pays non-therapeutic health monitoring environment and the facility buys/third-party pays traditional therapeutic medical device markets stood in sharp contrast.

Clearly apparent were the inroads of digital health into the medical device space. At OneMedForum, 60 percent of the medical device presentations covered health information, mobile products or services. Only 40 percent addressed traditional “gadget” medical devices.

Pressures from reimbursement, regulation, comparative effectiveness and the medical device tax were apparent in the traditional medical device space. Noticeably absent was the sunny techno-utopianism of the CES crowd. The realities of developing medical technologies in an era of ever more restrictive regulation, constrained reimbursement and challenging funding set the tone.

Alternative Funding for Medtech

Fundraising continues to be difficult in the device space. There is a yawning gap between angel and venture capital (VC) funding and an even bigger gap between VC funding and IPOs, leaving a merger and acquisition as the one viable liquidity exit. Bill Hambrecht, formerly of Hambrecht and Quist, gave a lunch talk at OneMed about moves toward a “Tier 2” Reg A where a company could raise up to $50 million and have a company public listing, but without the restriction on solicitation required by the SEC rules dating to 1933 and the more recent high expenses and capitalization requirements under the Sarbanes-Oxley rules. This is receiving some bipartisan traction, even in the current polarized political environment.

Hambrecht mentioned that while an M&A is a viable liquidity option, it reduces net jobs. By his estimate, the absence of the small cap IPO market that existed in the 1990s has cost the economy about 20 million jobs due to the consolidation that typically takes place with M&As. Also, many innovative companies could not obtain capital in the public markets to pursue an independent growth path.

Anne DeGheest, veteran healthcare VC, in a recent Wall Street Journal article described a developing “Series B Crunch” in the health IT sector, where there is difficulty gaining funding from sophisticated Series B investors after the less-sophisticated angels and private equity investors fund the new companies. She mentioned that some have built demonstration-level interesting technology on seed funding. They lack solid growth business plans and face attacks from companies with similar opportunities.

Some large players, such as Google, Apple, Qualcomm and Samsung, also are entering the space. Add these to the ecosystem of small companies and you have the makings of a disruptive environment.

Conclusion

Observing this tale of two cities shows how consumer tech/healthcare IT and the therapeutic device industry operate in different worlds.

Consumer medical technology and healthcare IT seems to be about fitness monitoring, giving more data to the “worried well,” setting up monitoring and feedback to manage “wellness,” Big Data and data mining of EMRs to identify and attack cost drivers. Some players want to provide health record data to the consumer; however, it’s not known whether most consumers will be able to do much with this data.

Most consumer and IT products and services have carefully avoided FDA regulation and scrutiny, especially after FDA dropped an anvil on the tech darling 23andMe. Though, there are several companies that are venturing into the regulated diagnostics space.

The hands-on activity of actually providing therapies to patients by human providers who are extensively (and expensively) trained, who use products built by companies requiring specialized and manufacturing expertise and regulatory compliance remains the same, and that part of the equation is being squeezed by FDA, the medical device tax and reimbursement margins for innovative therapies.

What does the future hold? Looking at the trends from these conferences, one sees two different cultures emerging, mixing and permuting, addressing healthcare with different approaches, different expectations and different levels of experience dealing with the ever-present pressures of regulation. Add to this the shifting landscape of the healthcare market and the rapid expansion of sensor technology and Big Data, aggregation and mining of EMRs. Add to this healthcare regulation that is fundamentally disrupting the traditional relationships of doctors to hospitals, patients to doctors and both of these to payers. These are the ingredients of a turbulent future where there are sure to be big winners but also some inevitable losers. There will be disruption, and the disrupted.

Ted Kucklick is co-Founder and CEO of Cannuflow Inc., San Jose, California, and the author of the best-selling title, Medical Device R&D Handbook Second Edition (2012 CRC Press/Taylor and Francis).

Photos Courtesy of Ted Kucklick.