Many firms seek growth opportunities to either solidify already solid performance or to bolster sagging revenues. I offer the following insight into some of the primary motivations that would lead a firm to consider new opportunities, as well as some criteria that may be useful in evaluating opportunities on a macro scale.

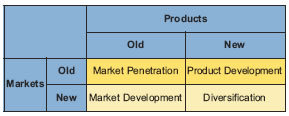

Obviously, a big part of a firm’s motivation to develop new business opportunities lies in the area of growth. Firms are obligated to grow their business either in terms of increased overall sales, increased market share or increased profitability. The first researcher to articulate these motivations was Ansoff who proposed a two-by-two matrix, such as shown in Exhibit 1, in which opportunities were placed into growth vectors based upon a typology of products and markets.

Exhibit 1: A 2 x 2 Matrix of Opportunities

Ansoff postulated that each cell or growth vector could be addressed by some pointed questions. The answers to these questions may well provide valuable insight into the formulation of strategic alternatives.

Market Penetration strategies answer the questions, “How can we get our existing customers to increase their volume (buy more products)?” or, “How can we get our existing customers to pay more for the products they are purchasing (increase profitability)?”

Product Development strategies answer the questions, “What else can I sell our current customers?” Firms adopting this strategy naturally consider line extensions of current products. A better strategy here might be to avoid products that will simply cannibalize or replace sales of existing products and, instead, provide incremental sales. Complementary products might well be the best way to provide incremental sales and, in addition, leverage current customer relationships.

Market Development strategies answer the questions, “To whom else can we sell our current products?” or “Where else can we sell our products?” or even better, “What else can our products be used for?” The whom-else might be combined with the what-else question to develop a whole new set of customers without giving up core competencies in manufacturing. At least one medical device manufacturer also sells products to the veterinary supply industry.

A Diversification strategy answers the question, “What other business can we be in?” While this strategy may yield purely incremental growth, the risks to the firm are also maximized as they pursue opportunities outside their expertise. A number of medical device firms have pursued diversification strategies over the years, including such ventures as land speculation, office automation and even becoming sub-contractors for high-tech aircraft manufacturers, taking advantage of idle capacity in some machining centers.

Choosing one of the growth strategies depends in large part upon a firm’s mission and planned direction. Top management is expected to articulate the vision for the firm, and the development group must be able to choose among alternatives to select the opportunities that both provide maximum return and also support top management’s goals for the firm.

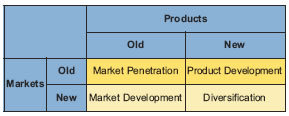

Evaluating opportunities has also been widely written about in the literature. Perhaps the most useful tool on a macro scale is the Boston Consulting Group (BCG) matrix. This model, popularized first in the 1960s, has since been supplanted by other methods but still provides a very useful rubric for considering acquisition opportunities as well as existing portfolios of products, as seen in Exhibit 2.

Exhibit 2: A BCG Matrix of Opportunities

Perhaps the most important facet of this model is the market growth axis. This measure indicates the health of the market as measured by relative growth rates for the category as compared with other competing opportunities. In most cases, entering markets that are growing as fast or faster than the markets that a firm currently competes in is preferable to slow growth markets.

The relative market share axis is simply a measure of the competitive position that a product occupies in a given market segment. Clearly, higher share positions are preferable to low share positions, but a firm can still be quite profitable even while holding a small share position, as illustrated in the case of firms that have carved out a market niche to serve. The market share measure can be deceptive, however, since this term depends entirely upon the definition of the competitive set. For example, does Apple have 70 percent of the smart phone market, or merely eight percent of the cell phone market? Some consumer products firms have gone so far to redefine all of their categories so that they have less than 40 percent share.

This redefinition goes far to combat the complacency that often accompanies high market share.

Business development professionals should focus most of their energies on identifying Stars and Questions Marks as good targets. Stars with their requisite high market share participating in high growth markets are the most lucrative opportunities. Question Marks pose more risk due to the low market share, but we recognize that they are competing in a market with upside potential that may more than compensate for the risk. Most Question Marks have low market share simply because they were late to market. Given adequate support and a development of unique selling propositions, they well may thrive and become Stars in their own rights.

Blending Ansoff’s generic growth opportunities matrix with the portfolio approach suggested by the BCG Matrix provides real power to the new product development process. We must be vigilant to pursue opportunities that provide incremental sales and profits, opportunities that take advantage of our core competencies. Further, we must also focus on opportunities that allow us to be part of new and vibrant markets. These new and emerging markets are the very ones where we can truly cash in on any first mover advantages and establish significant market share early on.

REFERENCES

Ansoff, H. Igor. Corporate Strategy. New York: McGraw-Hill, 1965.

Boston Consulting Group. Perspectives on Experience. Boston: Boston Consulting Group, 1972.

Mark Siders, Ph.D., is currently Associate Professor of Marketing at Southern Oregon University. He received his Ph.D. in Management/Marketing from Virginia Commonwealth University in 1998. Prior to entering academia, he spent over 20 years in the orthopaedic industry, holding positions including Product Manager, Director of Marketing, Senior Market Analyst and Project Leader – Sales Operations. Dr. Siders continues to provide consulting services to a variety of industries.