Long lead times have led to contention in the orthopedic supply chain over the last year, summoning questions about why and how the industry faces months-long waits for products to be manufactured. We’ve been in this situation before, and need to look no further than the orthopedic business model to know that we’ll likely be in this situation again.

Is the orthopedic industry really different than other industries? Imagine standing in a distribution center of any large or medium-sized orthopedic company. What will you see? Millions, tens of millions, hundreds of millions of dollars in inventory: implant and surgical instrument sets being staged for shipment, piles of sets that have been returned and endless shelves of replenishment inventory. This violates everything taught in business school. Good companies turn their inventory 10 to 12 times a year. Orthopedic distribution centers house years’ worth of inventory, not weeks’. How can it be? A combination of factors makes this the reality of the typical orthopedic business model.

The Model

Imagine this conversation with an auto parts store. “This is Sam over at City Auto Complex. Tomorrow I am replacing an alternator on a Ford F-250. Send over a 110 amp alternator, a 140 amp alternator and also the 150 amp with the lifetime warranty—not sure what the customer will want. I’ll also need the zinc chromate carbon steel, stainless steel and titanium mounting bolt sets. Send the extended set of top-of-the-line mechanic’s tools that I’ll need for the job, too. While you’re at it, send a power steering pump and the tool set for that; last week I replaced an alternator on a truck and the pump was leaking—cost me an afternoon waiting to get the pump. I am planning on starting this job at 9:00 a.m. so have your rep at our place by 7:30 a.m. And make sure the tools are clean.”

Seems crazy, right? This happens thousands of times a day in the orthopedic industry. All over the world, sales reps and distributors are delivering implants and instruments to customers in a similar fashion, backed by years of supporting inventory.

Surgeons demand an extensive array of products so that they can effectively treat many possible conditions. As a result, wide ranges of implant sizes are provided with multiple quantities of each. A typical trauma or spine set may contain 10 to 20+ times the screws that would actually be used during a surgery.

How is it Possible?

Why are orthopedic companies still in business? There are a number of factors. The most notable is high margins. The high profit obtained from one surgery justifies the cost of the inventory needed to support this kind of business model. High margins also contribute to the “we never want to miss a surgery because we don’t have products” mentality. In addition, customers expect the full complement of implant sizes to be furnished. It’s like a set of drill bits. One may never have a need to use that 21/64ths diameter drill bit, but it’s still expected to be included in the set.

Launching New Products

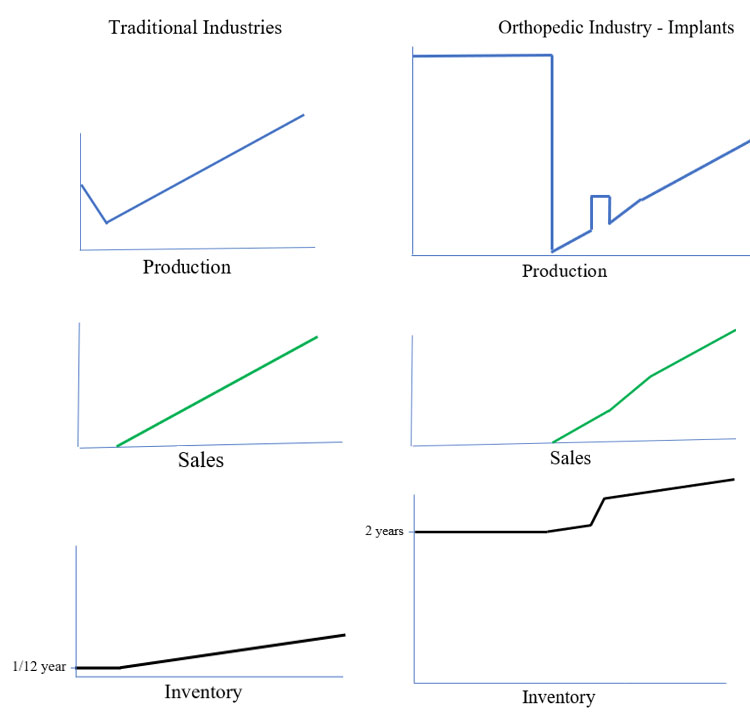

The introduction of a new product in the orthopedic industry is quite different than other industries. In traditional industries, a company will produce products, offer them for sale and then produce more products to support sales. After sales begin, production will increase at the same rate at which sales increase. Inventory levels will increase to account for variability in demand.

In the orthopedic industry, production will begin months before the product is launched. The amount of time needed depends on available capacity coupled with the amount of inventory needed. Traditional industries may only need one or two months of inventory, assuming lead time is four to six weeks. But remember, in the orthopedic industry, a lot more inventory is needed to launch. A launch may consist of a complete array of different types of screws in varying lengths and diameters along with varying styles and types of plates. It will be necessary to produce sufficient quantities to fill the sets with all of the sizes and types, to provide enough quantities for sales replenishment and to ensure some level of safety stock to account for possible inaccuracies in initial sales forecasts. In total, the number of implants needed for initial launch could be the equivalent of two to three years of sales.

After launch, production rates tumble. Following months of producing “as much as you can as fast as you can,” the bottom falls out. Why? The only production needed after launch is to replenish what is sold. Remember, a set may have 20+ times the implants versus what is actually used during a surgery. See Exhibit 1.

Exhibit 1: Traditional Industries’ Product Production vs. Orthopedic Industry Product Production

In early stages of a new product launch, set utilization, usually reported as number of surgeries per set per month, is typically low. There are various reasons for this, from surgeon/sales training needs to reimbursement challenges. No matter the reason for low utilization, initial sales tend to be low, and therefore production needs are low. As sales accelerate and begin to consume inventory, production demand tends to increase at the same rate as sales. The production demand, however, will be for the commonly used sizes and types. During initial launch, production is needed for all sizes and types. Afterwards, production demand for “outlier” sizes will be rare.

Following the initial launch, there can be subsequent needs for production to support additional sets to expand in existing markets or to launch in new markets that have had longer regulatory approval times. As a result, production demand will spike and then drop. If the product becomes “hot” and in high demand, post-launch spikes can be dramatic, sometimes exceeding the initial launch build.

Eventually, as the product matures, demand will stabilize and production will become more predictable.

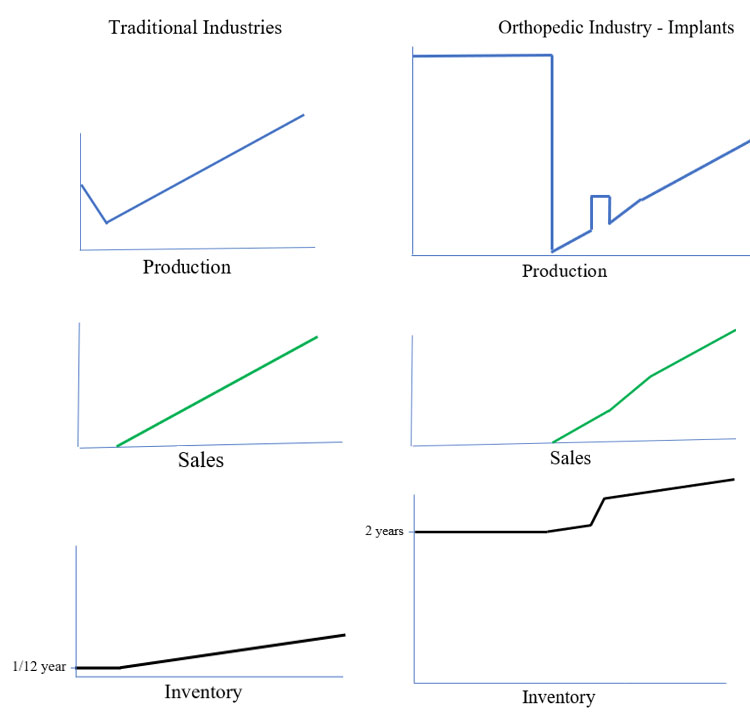

Another distinguishing factor between traditional industries and the orthopedic industry is the concept of furnishing instruments sets that are used during surgery. Reusable surgical instruments are typically not sold. They are typically treated as capital by the manufacturer and offered to customers through consignment or a loan program.

Multi-use instruments can range from simple to extremely complex. Pre-launch production demand will be similar to implants in that sets will need to be filled. But unlike implants, post-launch production demand will drop to near zero. The only post-launch demand comes from replacing worn or damaged instruments and subsequent addition of sets to support expansion in existing markets or new markets. See Exhibit 2.

Exhibit 2: Orthopedic Industry Instrument Production and Inventory Models

Supply Chain Impact

It’s now understood that production demand in the orthopedic industry is characterized by periods of high demand, which are then followed by an abrupt drop. Understanding the dynamics is important for the supply chain. Typically, internal OEM manufacturing capacity is set at levels that accommodate steady volume that reflects sales. As products mature and experience declining sales, capacity becomes available for new products. But often the internal capacity is not sufficient to meet the needs for new product launches. OEMs then look externally to contract manufactures to meet the demand.

For contract manufacturers, it is especially important to gauge whether there are potentially multiple launches from large and medium OEMs occurring at the same time. Production in the orthopedic industry still operates in a “job shop” fashion. There is a limited amount of production capacity in the supply base, and adding more can be challenging. CNC equipment is expensive, with significant lead-time to purchase, install and qualify. It is difficult to add capacity for non-recurring engineering for such things as process development, CNC programing, fixture development, MSA/GR&R, validation and qualification. It can be challenging for the contract manufacturers to react to spikes in demand.

A note of interest to suppliers is that an OEM’s projected revenue increase may not be correlated to demand for products. In fact, if an OEM has a few major product launches one year, the following year is likely to have a lull. Even though the OEM may be projecting significant revenue growth, it should not be assumed that the revenue growth will result in a similar growth in demand for manufacturing of product the following year.

Contract manufacturers are also experiencing cost reduction pressures. Annual price reductions are expected every year. In traditional industries that experience steadily increasing product volumes, there are opportunities to leverage the volume to improve production efficiencies, thereby lowering manufacturing costs. In contrast, the volume drops sharply following the initial product launch in the orthopedic industry. The contract manufacturers face challenges in reducing costs while volume decreases and demand are erratic. Price reductions often come from reducing profit margins—a practice that is not sustainable.

Summary

The orthopedic industry is certainly different than others in certain key areas. High profit margins drive behaviors that would not be viable in other industries. Large scale manufacturing facilities often operate as job shops with expectations that years’ worth of inventory be produced in a few months, followed by a sharp decline in demand.

Eventually change will occur due to pressures to reduce healthcare costs. When high margins are no longer the norm, the current business model will not be sustainable. Until that time comes, understanding the dynamics of the unique orthopedic business model will give industry leaders a competitive advantage.

Dale Tempco is a consultant specializing in product development, operations, quality, supply chain, M&A and finance. His expertise includes low cost sourcing, design transfer, design for manufacturability, special process and cleaning validation, additive manufacturing, failure analysis and cost accounting. Mr. Tempco also possesses extensive experience in China.