Orthopaedic industry revenue reached $48.1 billion worldwide in 2016 and grew at 3.2%, ~$1.5 billion over 2015, according to our estimates published in THE ORTHOPAEDIC INDUSTRY ANNUAL REPORT®.

Every market segment and every company has a different performance story. Two narratives that are intertwined are the performance of the top companies —DePuy Synthes, Zimmer Biomet, Stryker, Smith & Nephew and Medtronic—and their correlation specifically to the two largest markets—joint reconstruction and spine. In 2016, joint recon performed 3.6%, +4% vs. 2015, while spine remained flat at 2%. For further clarification, Exhibit 1 below covers product segment revenue performance for 2016 vs. 2015, while Exhibit 2 illustrates market share for each product segment.

Exhibit 1: Product Segment Performance ($Millions)

2016 | 2015 | $ Change | % Change | |

| Joint Reconstruction | $17,506.3 | $16,897.6 | $608.7 | 3.6% |

Knee | $8,540.6 | $8,237.4 | $303.2 | 3.7% |

Hip | $6,983.6 | $6,825.1 | $158.5 | 2.3% |

Extremities | $1,982.1 | $1,835.0 | $147.1 | 8.0% |

| Spine | $8,883.7 | $8,711.4 | $172.3 | 2.0% |

| Trauma | $6,614.8 | $6,356.3 | $258.5 | 4.1% |

| Arthroscopy/Soft Tissue | $5,009.0 | $4,744.6 | $264.4 | 5.6% |

| Orthobiologics | $4,946.2 | $4,800.1 | $146.1 | 3.0% |

| Other* | $5,198.3 | $5,147.2 | $51.1 | 1.0% |

Total | $48,158.3 | $46,657.1 | $1,501.2 | 3.2% |

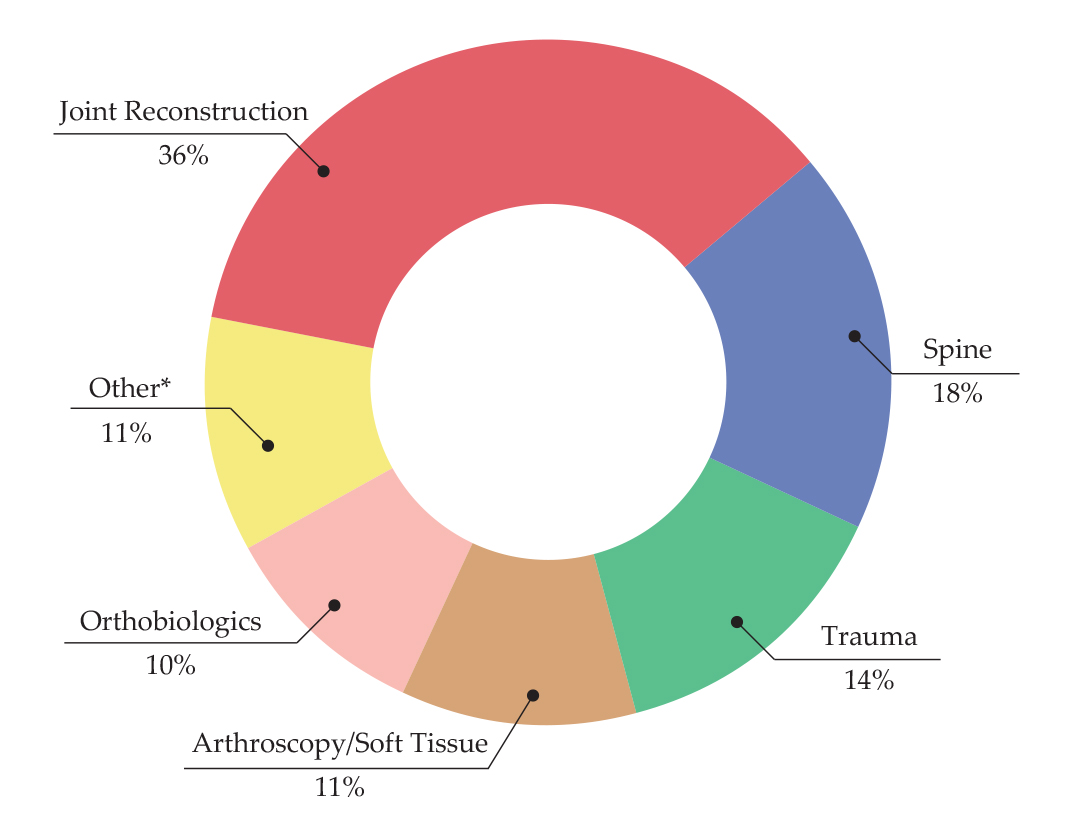

Exhibit 2: Market Share for Orthopaedic Product Sales

We cover all market segment findings in greater detail in the Annual Report. Within this article, we share a few highlights from the joint recon and spine segments, offering a glimpse of the top-ranked companies by revenue and market share, along with a brief description of main drivers for that segment. The number of companies listed varies from segment to segment, because we wanted to show where the top five companies fell within the ranking, as well as their percent of market share. We know that hundreds of companies impact the orthopaedic industry every day, and we will cover more of those successes in the months to come. For us, a separate look at the top five companies by revenue—DePuy Synthes, Zimmer Biomet, Stryker, Smith & Nephew and Medtronic—is useful alongside the overall industry numbers, because their size offers a high-level view of segment health and most heavily impacts industry performance, and therefore warrants extra attention. For example, the top four companies in the joint recon are the top four companies in the industry. They hold nearly 75% of the joint recon market.

Before we jump into the market segment review, Exhibits 3 and 4 provide guidance on company performance. Of note, DePuy Synthes and Zimmer Biomet achieved sales growth in 2016 after posting a drop in 2015.

Exhibit 3: Total Sales Performance ($Millions)

It’s no secret that the top five continue to execute on the strategy that the deeper their portfolio, the greater their likelihood to secure contracts with hospitals that continue to consolidate vendors. While the top five have prioritized internal restructuring, acquisitions and breadth of product offerings, several companies in the next tiers are seeing success in specialization. Exactech, NuVasive and Wright Medical are top of mind.For a more detailed look at the activity that drove growth, we provide a brief overview of joint recon and spine.

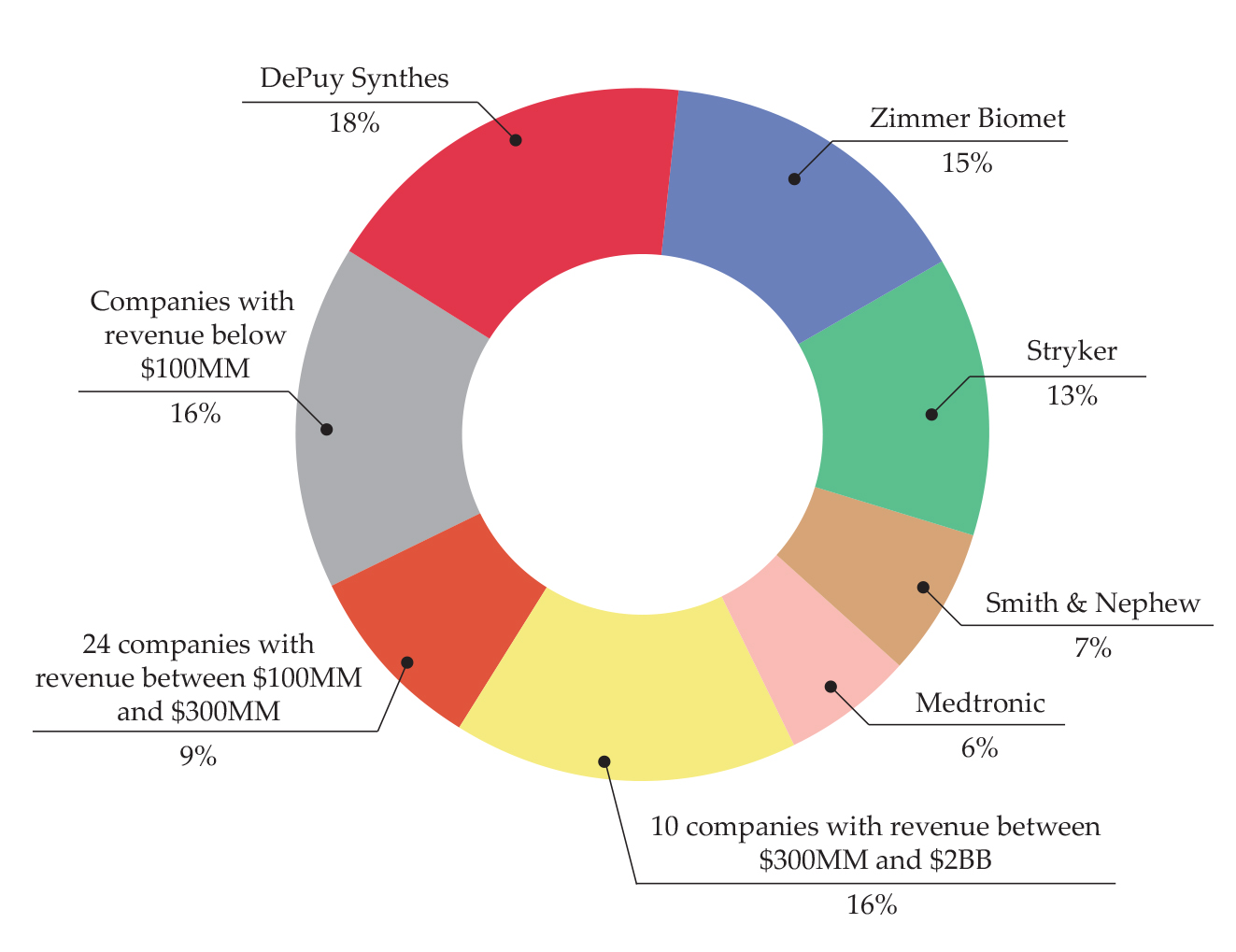

Exhibit 4: Total Market Share

Joint Reconstruction

Stable U.S. and strengthened ex-U.S. markets plus new product launches returned the joint reconstruction segment to growth in 2016. Declining hip and flat knee sales were the primary factors underlying 2015’s performance. We did not expect the market turnaround to occur by close of 2016, but we’re pleased to report that companies outperformed our projections. For 2016, joint reconstruction sales came in at $17.5 billion, a $608.7 million or 3.6% increase over 2015.

Joint reconstruction remains a priority segment for the industry’s largest players—DePuy Synthes, Zimmer Biomet, Stryker, Smith & Nephew and now, with the acquisition of Responsive Orthopedics, Medtronic as well.Of note, the top five joint reconstruction companies listed in the chart on the right hold 79% of the market share.

Moving forward, the trends in joint reconstruction remain similar to previous years, with surgical assistance technologies, e.g. robotics and navigation, remaining a focus in hip and knee product launches, and total shoulder and ankle replacements driving the extremities recon market. We expect that companies will continue to roll out solutions for bundled payments, whether that be to track the full episode of care or portions of patient engagement.

Spine

The spine market grew to meet our projections of 2% growth in 2016, reaching $8.8 billion (excludes biologics). Spine continues to be a slower-growing market, yet one with high activity.Our estimates show that Medtronic and DePuy Synthes, the two largest players, posted flat and declining sales in 2016, respectively. The two companies lost market share for a second year, while NuVasive jumped Stryker to take the third position in the segment.

While Medtronic and DePuy Synthes have projected turnarounds for their spine businesses, other leading companies in the segment seek to take share through acquisitions and new product launches. NuVasive, Stryker, Globus Medical and Zimmer Biomet, companies three through six in segment ranking, closed spine-related acquisitions in 2016. Our ranking and 2016 revenue estimates for the top six players in spine can be found in the chart below.

Spine has been a rich arena for M&A (see M&A article on page 10), collaboration and funding activity in recent years, making the segment attractive for small companies seeking to enter and potentially exit the market. We believe that market share will continue to shift in this segment. At the same time, we believe that spine will remain attractive for smaller companies that are able to develop innovative and differentiated technologies.

Based on your company’s size or the segments within which you play, you may have felt the growth drivers differently than those that we outline here.The truth is that companies of all sizes will benefit from a plethora of opportunities waiting to be embraced, including in the trauma, arthroscopy/soft tissue and orthobiologics markets. We fully expect new technologies and new business models to continue to be adopted as companies respond to orthopaedic changes throughout the world.

Clearly, this is just a glimpse of the joint reconstruction and spine markets. The Annual Report provides a fuller overview of activity in each segment, as well as projections and predictions through 2021.

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.