Since mid-May, both Medtronic and Zimmer Biomet have announced strategic moves in the 2-level cervical disc replacement and robotic surgery markets. In efforts to invigorate revenue growth, the two have focused on niche technologies that expand their portfolios—but have yet to prove wide scale adoption.

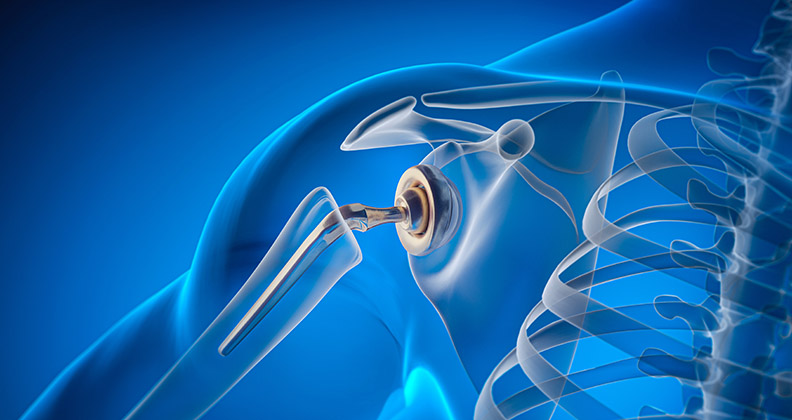

Disc Replacement

Zimmer Biomet’s $1 billion acquisition of LDR and its Mobi-C cervical disc assets and Medtronic’s FDA Premarket Approval for the Prestige LP 2-level application changed the game in the U.S. 2-level cervical disc replacement arena.

Mobi-C had been the only 2-level disc approved on the U.S. market. Prior to Zimmer Biomet’s purchase of the technology, LDR was able to expand reimbursement coverage, update label claims and publish peer-reviewed papers that resulted in Mobi-C’s sales growth, which increased 80% in 2015 vs. 2014.

Further, in April 2016, LDR reported that Mobi-C had surpassed $100 million in cumulative U.S. revenue since its 2013 launch. Half of the Mobi-C units sold address 1-level indications and half are for 2-level indications.

The acquisition of LDR allows Zimmer Biomet to increase its share of the worldwide spine market from 4% to 5%, according to ORTHOWORLD estimates. While the purchase also expands Zimmer Biomet’s traditional cervical and lumbar offerings, Mobi-C is presumably the technology that attracted Zimmer Biomet to LDR, primarily.

Medtronic’s entry into the 2-level market is expected to put competitive pressure on Zimmer Biomet’s purchase. The 2-level discs will be sold in a small market that faces a lack of reimbursement, compared to 1-level discs and fusion. To dive into specifics, >50 million lives are covered for Mobi-C’s 2-level procedure. The total artificial disc market is expected to reach ~$275 million in 2016, according to estimates in the ORTHOWORLD report, Cervical and Lumbar Artificial Disc Profiles.

Medtronic’s clout as the largest player in the global spine market, with nearly 30% market share, could drive increased reimbursement coverage and spur market expansion, analysts have said, but the pace of that growth is hard to predict.

Still, Medtronic clearly sees promise in the disc market. In 2Q16, it released data showing that the Prestige LP 2-level disc demonstrated favorable clinical outcomes and patient satisfaction vs. 2-level anterior cervical discectomy and fusion. Though the company has yet to launch Prestige LP for the 2-level indication, leadership has said that it is one of a handful of new products among its strategies to return growth in its spine business.

The upside for the two companies is that the barrier for approval for a 2-level disc in the U.S. is high—for instance, Medtronic’s study took seven years to complete. Therefore, Medtronic and Zimmer Biomet are only competing against each other in the space for the foreseeable future.

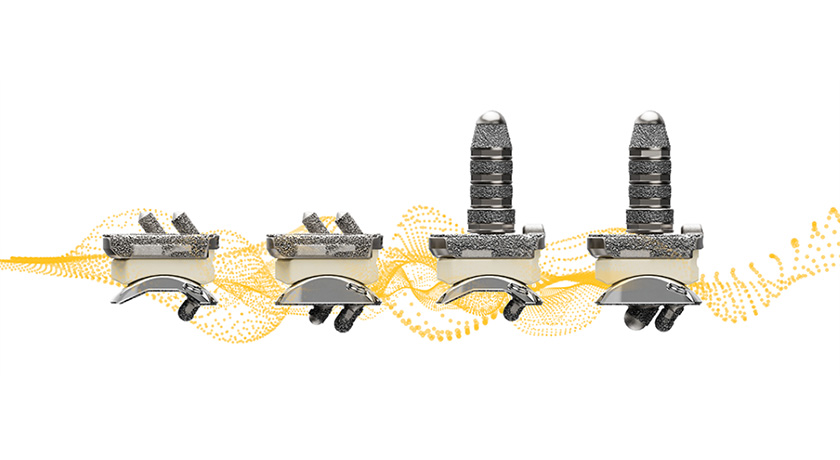

Robotic Systems

Medtronic and Zimmer Biomet announced their adoption of minimally invasive spinal robotic assistance nearly two months apart. Medtronic’s came through a commercial and investment agreement with Mazor Robotics and its Renaissance System, while Zimmer Biomet announced plans to acquire Medtech’s ROSA Spine robotic-assistive device for ~$130 million.

How do the systems differ? First, Mazor’s Renaissance has focused more on spine applications, while the growth of Medtech’s ROSA has mainly derived from brain surgery applications. Zimmer Biomet’s announcement included no indication of intentions for ROSA’s cranial application, and it’s expected that the purchase of Medtech will expand ROSA’s spine application.

Second, Mazor’s Renaissance received FDA clearance in 2007, while ROSA’s clearance for spine applications just came in January 2016. The difference in time on market has, expectedly, led to a disparity in adoption rate. Medtech sold its first ROSA spine application in the U.S. in March 2016, while Mazor’s U.S. installed base is now over 80 per Larry Biegelsen, Senior Analyst at Wells Fargo Securities. As of May, ROSA has been used to complete 100 spine surgeries by four surgeons worldwide, while Renaissance has been used in over 17,000 cases globally by more than 300 surgeons.

Computer-assisted surgery, including robotics, faces detractors voicing concerns about cost, educational training and lack of outcomes data. Also, there are as-yet-unknowns regarding the potential market size for robotics, and Medtronic and Zimmer Biomet will not be the only companies with systems for long. Globus Medical plans to launch products in the coming year; NuVasive has announced interest in the space and lesser-known player KB Medical received approval under the CE Mark for its AQrate Robotic Assistance system in 2Q16.

We perceive the companies’ expansions into 2-level disc replacement and robotics as positive moves that deepen portfolios and open opportunities to reach new segments of surgeons and patients. In order to turn their spine revenue back to black, Medtronic and Zimmer Biomet are demonstrating the need to steer away from commoditized products by leading in what are presumed to be future markets of growth.

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.