To thrive in the healthcare environment of tomorrow, orthopaedic device companies will need to operate within a greater portion of the supply chain, assisting upstream and downstream customers in finding operational value. This will require orthopaedic device companies to forge stronger relationships, focus on internal efficiencies and launch services, not just devices. Ultimately, the business models of orthopaedic device companies must radically change should they want to maintain profitability and increase margins in coming years. This was the message from keynote speaker Bill Tribe, Ph.D., partner at A.T. Kearney’s Health Practice, for OMTEC 2016 attendees.

In order for this to be achieved, it is imperative that you, as a stakeholder in the orthopaedic industry, understand the forces driving these changes so that you can proactively assist your company and, importantly, improve your own chances for success.

Before we get to what the future might hold for you and orthopaedics, let’s start where Tribe began, briefly reviewing how we got to the present day.

The Economic Basics

You’ve probably experienced direct impact from a squeezed company budget in recent years. Margins across the medical device sector have been falling for more than a decade, and will continue to erode by about 5% if unaddressed, Tribe said. Compounding that is the continued negative impact of price pressure, at nearly 3% per year. An average orthopaedic company would need to reduce its cost of goods by 12% or its Selling, General and Administrative expenses by 8%, or some combination of the two, to offset that 3% in price pressure, according to Tribe. The price pressure is consistent; therefore, companies must get leaner each year.

On a positive note, orthopaedics is a $46 billion industry growing in the low-single digits year over year, according to ORTHOWORLD’s ORTHOPAEDIC INDUSTRY ANNUAL REPORT®. Healthy procedural volumes due to a growing and aging population, as well as potential in untapped markets, mean that the industry remains attractive.

On that note, by A.T. Kearney’s estimation, there’s $4 billion to $5 billion in combined operating profit and working capital opportunity up for grabs for orthopaedic companies that are able to respond to the industry’s disrupting factors by restructuring their business models, products, or both.

The Disruptors

Tribe outlined five prevailing industry headwinds: power shift to payors and providers, heightened regulatory scrutiny, unclear sources of innovation, new healthcare delivery models and the need to serve lower socio-economic classes. These disruptors are not new, and because they have presented themselves in various forms in recent years, they are casually mentioned in today’s conversations. Still, these disruptors are acute, they need to be addressed and, importantly for you, they hold strategies for ways to move forward.

Tribe offered context that you may find useful as you make sense of these disruptors.

Power shift to payors and providers

Hospital administrators and committees have largely taken away implant decisions once made by surgeons. These decisions consider several factors, including reimbursement from private and public insurers.

Tribe cited: 70% of orthopaedic surgeons are hospital employees; 73% of all hospital purchases are now covered by group purchasing organization (GPO) contracts and 14 states in the U.S. have one insurer with at least 50% market share (data released before the Aetna/Humana and Cigna/Anthem mergers announced).

Heightened regulatory scrutiny

A multitude of new regulations in the U.S. and internationally have forced companies to shift resources to support regulatory and quality compliance.

Tribe cited: Changes in the 510(k) process, UDI implementation, the now-suspended medical device tax and increased scrutiny of orthobiologics, instruments and sterilization.

Unclear sources of innovation

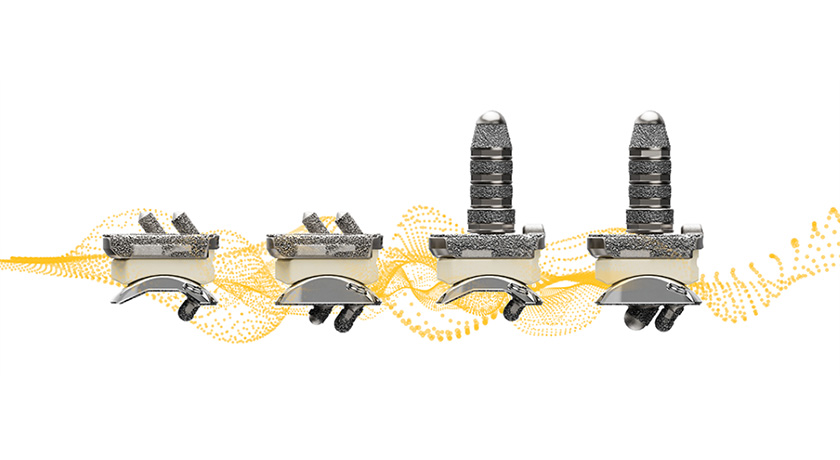

Conversation after conversation at industry meetings turn to lack of innovation in orthopaedics and the continual commoditization of products. Orthopaedic companies continue to focus on product line extensions and incremental updates instead of novel technologies that must undergo stricter and longer regulatory timelines.

Tribe cited: Between 2004 and 2014, orthopaedic Premarket Approvals (PMAs) dropped 8%, while 510(k)s increased 11. At the same time, venture capital has dried up, leaving a hole for companies seeking to develop innovative technology and thus squashing the once tried-and-true model of big companies buying truly innovative technologies.

New healthcare-delivery models

The push from volume to value, and specifically the advent of bundled payments, is a prime example of how orthopaedic companies can impact the focus on reducing procedure costs.

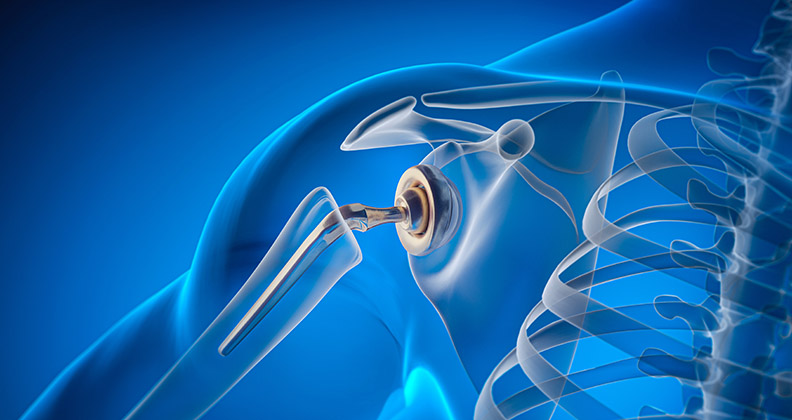

Tribe cited: The implant is 3% of the cost of a total hip replacement. This leaves 22% of the cost associated with the operation, 29% of the cost associated with hospital-based post-operative care and 46% of the cost tied to post-discharge care.

Need to serve lower socio-economic classes

Orthopaedics has primarily served the top end of the population that could afford treatment. Growth potential can be found in underserved portions of the market from developing countries and even underserved U.S. populations now covered by the Affordable Care Act. Tribe said that he expects orthopaedic companies to consider a tiered model of products, ranging from personalized to premium to low-cost products, in the future.

Tribe cited: A $6 billion growth potential in the medical device market, driven by access to different underserved population groups.

How can you help your company adapt?

Tribe asserted that when you consider average operating margins, orthopaedic device company margins (at 20%-30%) are higher than others within the supply chain: contract manufacturers (5%-15%), distributors (1%-2%) and hospitals (3%-5%).

The supply chain is imbalanced. In the future, successful orthopaedic device companies will have business models that help themselves and their partners within the supply chain overcome the aforementioned disruptors to maintain or achieve greater margins. Tribe called out several pilot programs that may or may not prove to be successful, but are demonstrations of this point—Smith & Nephew’s introduction of Syncera, Stryker’s acquisition and subsequent launch of Mako robotic products, Cardinal Health’s expansion into commercializing orthopaedic implants and Millstone Medical Outsourcing’s direct-to-patient and hospital distribution model.

“It’s very clear that these alternative pathways really represent a huge opportunity for those that embrace them, because the companies that sit in the traditional model and provide products are going to fall behind those companies that find alternative ways to operate across the value chain and make their products important to their customers,” Tribe said.

These shifts could mean something different for you than your colleagues, depending upon what you do.

Procurement

Procurement professionals will see their responsibilities expand as their companies introduce not only new devices, but corresponding services, Tribe said. The management of services is different than devices, and will require you to understand a new product lifecycle. You may also see greater requests from the rise of data and analytics teams within more sophisticated companies.

Product Development and Engineering

Engineers, the move from volume to value will impact you as you’re asked to design products with measurable outcomes in mind. Product development teams will also be tasked with tightening the relationships among R&D, operations and supply chain. Tribe pointed to commercial effectiveness. Orthopaedic companies hold themselves back, because they add product extensions without scaling any one product. The businesses that are able to connect their product portfolio with operational scale and supply chain decisions will see greater advantages.

Supply Chain

A focus on tiered product lines and the introduction of services will mean differentiated supply chain models. Your one-size-fits-all fulfillment strategy will not work, Tribe said. This will require supply chain professionals to forge stronger upstream and downstream relationships that focus on win/win situations instead of transactional functions, in order to scale and grow.

None of this will be easy. And even the companies that have rolled out these pilot programs have yet to prove their effectiveness or their ability to scale. Still, as Tribe said, A.T. Kearney’s research shows that companies that are able to focus on alternative business models such as end-to-end management, bundled products and services, the use of data and patient interests will be able to capture a portion of that $4 billion to $5 billion that is up for grabs in orthopaedics.

“It’s a disruptive industry; it’s an industry with challenges, which I’m sure you’ve all seen,” Tribe said. “But it’s also an industry that has great attractiveness and great opportunity. The businesses that take this on will change themselves; will change the roles of the people within them. They will continue to be highly successful, highly profitable businesses within the context of what we think will be a much more coherent operating supply chain.”

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.