The future of surface treatments relies not only on how new technologies will encourage implant and bone ingrowth, but on the way that these technologies are smartly manufactured. Additive manufacturing and nanotechnology continue to arise in conversations; surface treatments and coatings are no exception. As you research the best fit for your next device, a handful of experts weigh in on several coating technologies to consider, including their strengths and common hindrance—cost.

Additive Manufacturing

Titanium flame spray and hydroxyapatite (HA) remain the preferable coatings in orthopaedics, says Robert Lynch, Vice President of Research & Development at Tecomet. Looking at the horizon, though, he is struck by the emergence of additive manufacturing (also referred to as 3D printing) in this sector.

“What’s going on now is the integral coating, and that comes from 3D printing. Much of the 3D printing you see today incorporates the bony ingrowth surface onto the implant itself. That is very much in its infancy, but it has legs. If 3D printing is going to take hold in this industry, then I believe that’s where it’s going to get its good roots,” Lynch says.

Implants that are relatively small and need a bony ingrowth surface will be initial targets for additive manufacturing. Lynch believes that the process will work for pieces that can be arrayed and many pieces that can be made in one build. The process will avoid larger components, like hip stems that require flex fatigue.

“That will be one of the later applications for a 3D printer. Right now it’s producing some components for spine, some acetabular shells—things that have fewer strength requirements, all compressive loads, not a lot of flex fatigue and they all need great bony ingrowth surfaces,” Lynch says. “You can add in some beautiful, engineered surfaces that mimic bone almost identically, that bone just falls in love with.”

The method requires refinement before it becomes competitive on price. Lynch says that flame sprays are still one of the most economical ways to apply a surface to an implant.

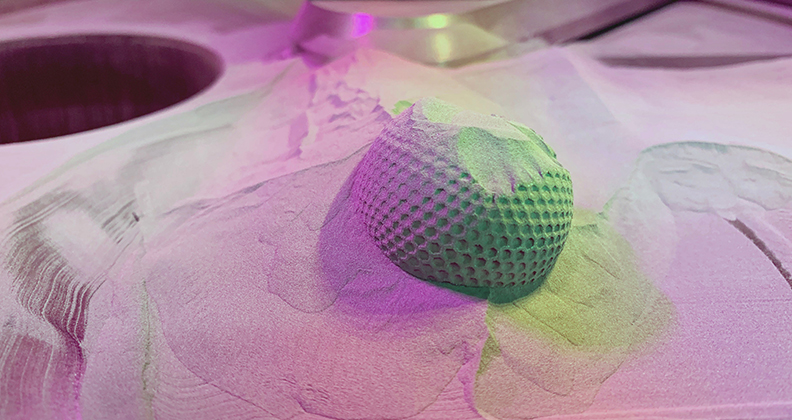

Interest in additive manufacturing may be driven by another trend in the segment: microporous coating that allows for bone ingrowth on a micron scale.

Gianfranco Viola, Director of Global Sales and Marketing for Eurocoating and Surface Dynamics, says that porous coating is popular for a number of reasons. “You provide a structure, but the coating has open pores that go well into the depths of the coating. The bone can actually grow into those pores. In that case, you don’t just have a bone that is growing onto the surface; it penetrates the coating. Bone integration is even better in that case,” he says. “That type of surface treatment is becoming more popular. It’s much better than using cement. You have a bone implant situation that is very stable.”

Viola says that the next frontier for bone/implant interface is providing a porous structure that allows actual bone growth into a porous titanium structure.

On the market, one of those microporous standards is trabecular metal, a metallic sponge that is soldered onto the surface of an implant to provide fixation, Viola says. Trabecular metal has two issues. One, it is proprietary; the technology is owned by Zimmer Biomet. Two, Viola says, trabecular metal can be expensive compared to other technologies.

Other treatments marketed by major OEMs can create a similar effect as trabecular metal.

“Everyone has their own version of trabecular metal—Stryker, Smith & Nephew. They are all proprietary. They’re not open to the market. So, if you’re a new company and want to exist in the same market, you have to find an alternative technology to provide similar results,” Viola says.

Eurocoatings and Surface Dynamics developed Ti-Growth, a spray technique which provides results that aim to replicate the effect of trabecular metal.

“It’s a plasma spray titanium. There are some other specialized companies out there that can provide you with a structure that is porous and less expensive than what is offered by those major OEMs. It costs less, basically, and it’s open to everyone. It’s good business for us,” he says.

Viola adds that more traditional forms of surface treatments and coatings take less time to apply than trabecular metal alternatives. Plasma flame sprays may take as little as a few hours, depending on a number of factors.

How does the growth of microporous coatings and trabecular metals impact the development of additive manufacturing?

You can produce similar results for bone ingrowth and ongrowth by using additive manufacturing. Using that technology, companies can actually build the pore structure from a CAD design.

“You build a whole part, and you can design a surface that is porous. It gives you a functionally similar result. That’s a fast-growing market right now. They’re competitive technologies that bring you the same result,” Viola says.

Bob Lynch says that Tecomet believes strongly in additive manufacturing because, despite its current status as a niche business, the technology will find a good, quality home in orthopaedics. He adds that additive manufacturing printers are capable of feats that orthopaedics has not yet explored; but the technology has found an initial home in printing the bony ingrowth structure.

“Any OEM that has a 3D printer is trying to incorporate the bony ingrowth substrate along with the implant. They’re almost saying that if they’re going to do an implant, the benefit of 3D printing is to produce this beautiful bony ingrowth structure, and below that, you can make whatever the implant needs to be,” he says.

Jason Sikora, Engineering Materials Director for Techmetals, says that additive manufacturing is a fascinating technology with an impact for companies that aren’t printing the porous surface.

“We do see an effect on the coating process from the 3D-printed material, as the 3D printing process shifts the grain structure of the material, whether it be metal or plastic,” Sikora says.

Nanostructures

Sikora says that there are essentially three generations of osseointegrative coatings. The first is AMS 2448 Conventional Grade Titanium Anodized.

“It’s a dendritic structure, sort of like a coral reef, and that enables the bone to grow into it somewhat,” Sikora says. “It’s not fantastic, but it does promote some ingrowth.”

The second generation, according to Sikora, is HA coating. He says that HA is the current bread and butter technology for osseointegration.

“HA is nice because it’s very similar to the crystal structure of the bone itself. You get these needle structures that grow, and the bone will integrate with the coating nicely. But HA has its own disadvantages,” he says.

Specifically, Sikora says that HA can be rather brittle and weak. It doesn’t have the best adhesion to the substrate, so sometimes you’ll get the coating sticking to the bone and the implant separating from the coating. He adds that HA resists certain bacterial strains, but there are others that still grow biofilm.

The third generation is using technology to create nanostructures.

Sikora points out that all of these technologies are designed to create a nanostructure into which bone will grow. But not all technologies offer nano-level control, and each preceding generation of technology went about this mission differently. For example, HA coatings mimic bone structure, but the AMS 2448 is an entirely different crystal phase from bone. Yet, AMS 2448 still promoted osseointegration because of the nanostructure itself

Some of the newest technologies promote nanotube growth in a substrate; the bone can grow into those nanotubes and then lock with the coating.

“The market will definitely shift toward that technology,” Sikora says, who suggests that the market could adopt the new processes in the next five to ten years. “It has certain advantages over the more traditional HA coatings. It is more robust; it gives options as far as preventing biofilm growth. You don’t have to worry as much about infection or rejection.”

Sikora says that Techmetals is working with asymmetrical pulse reverse rectification, a method of precise power control that can let a coater control the structure and properties of a deposit on a nanometer scale. Besides being a mouthful, asymmetrical pulse reverse rectification gives Sikora the chance to control the current being applied to the implant on a nano level.

Sikora explains it like this: the electricity coming from your wall outlet is AC; it is a sine wave back and forth. The power you get out of a battery is straight DC; it is forward current all the time that doesn’t oscillate. With an asymmetrical pulse reverse rectification system, you can basically write a song with the waveform of the electricity.

“You could go forward for .3 milliseconds, dead for .2 milliseconds, reverse for .4 milliseconds and then repeat that pattern,” he says. “With coatings and surface finishing, this opens up a whole new category of experiments and bath modifications and the ability to tailor any kind of properties, from chemical to physical.”

Using asymmetrical pulse reverse rectification, Sikora is able to work with alloys that might be unavailable via conventional means.

“It shifts the whole electrical chemical dynamic of what’s happening on an atomic scale during the plating process,” he said. “Right when I turn on the power supply, the bath acts slightly differently than when the power supply has been running for a fraction of a second or longer. If you can keep it acting in that way, you get all new properties.”

Price Pressures

The various price pressures from payors, hospital customers and suppliers will limit or stall the advancement of coatings technologies. With the rising barriers for reimbursement and manufacturing costs, budding technologies are one of the most impacted segments of orthopaedics, simply based on rise of cost.

“People are doing some interesting things with nanoparticles, but you have to look at cost and the time it takes to do that, what the efficacy is,” Lynch says. “It will boil down to, Does it have marketing legs? and, Can we do it cost-effectively? Ultimately, the hospital is only going to pay you so much for a hip stem or an acetabular shell, no matter how good the technology in it is.”

Viola says that in this developing landscape, he sees orthopaedics moving toward a commoditized implant versus a premium product. As the segment leans in that direction, new coating technologies will have to drastically improve outcomes to ensure reimbursement, or help to reduce cost; otherwise, the technology will likely be left on the shelf.

Viola says that reimbursement issues in Europe and the U.S. have affected Eurocoating’s business. In Europe, he says, 90 percent of revenue for OEMs comes from the government.

“Governments are reducing their budgets for health services and have been doing so year over year for the last decade. Basically, there is less money available in the market,” he says. “They’re buying implants at a cost that goes down annually at a rate of roughly four or five percent. That’s high cost pressure.”

That type of cost pressure causes OEMs to reduce their selling prices for implants. In turn, those device companies look for ways to cut costs wherever possible, such as leaning on their suppliers to reduce costs. Viola says that a similar pattern is starting to take hold in the U.S., but reimbursement struggles have not reached European levels.

That environment frequently stifles innovation and development. Until new technologies, like additive manufacturing and nanotechnology, can prove efficacy and cost-cutting power, they will likely remain prospects for the future, while plasma flame sprays and HA coatings continue to reign.

Questions on this article? Email Julie Vetalice.