Even if it’s small, research and development budgets are expected to get a boost in 2016 and 2017 as companies plan to invest in innovation by reallocating funds from the suspension of the medical device tax.

The 2.3 percent excise tax, which stood in effect from January 2013 through December 2015, has been suspended by Congress for two years as part of a $1.8 trillion spending and tax bill. Prior to and during implementation, the tax was seen by industry as a jobs and innovation killer. Companies of all sizes have said that the tax, which hit each company’s top line, disproportionately impacted smaller companies because it pertained to newly-manufactured products sold within the U.S.

The tax, introduced to offset the cost of the Affordable Care Act, was expected to provide the U.S. government with varying revenues of $20 billion to $30 billion between 2013 and 2019—numbers that were not on track to pan out.

For example, due its high level of inventory, Zimmer said in shareholder statements that it was not impacted by the tax until the fourth quarter of 2013. The company expected to pay $10 million per quarter in 2014, which equaled about 0.86 percent of the company’s total revenue.

Johnson & Johnson, parent company of DePuy Synthes, said that the overall impact of the suspension is not significant to its business. JNJ’s Medical Device business paid $180 million in taxes in 2014, which equaled 1.5 percent of its $12.3 billion in U.S. sales and 0.6 percent of its $27.5 billion in worldwide medical device sales. JNJ leadership noted its plans to reinvest the savings into innovation. In orthopaedics, knee and trauma portfolios are the company’s priorities; plans for hip devices and sterilization will also be a key focus in 2016.

Stryker’s tax was 0.9 percent of its overall company sales in 2013, according to the company’s Annual Report. In the year-end earnings call, Stryker leadership stated that its 2016 R&D budget would see a slight increase. Stryker’s recent investment priorities include 3D printing and robotics.

Multiple factors go into the making of an R&D budget; the device tax is certainly not the only hindrance. To better understand how R&D budgets were actually impacted by the tax, BONEZONE tracked R&D spend as a percent of overall sales for the six largest orthopaedic companies that report such

information.

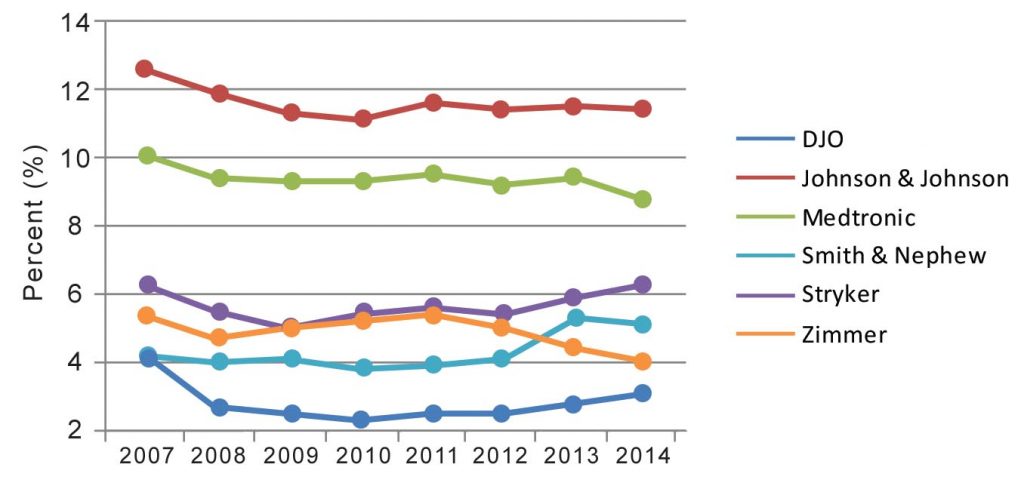

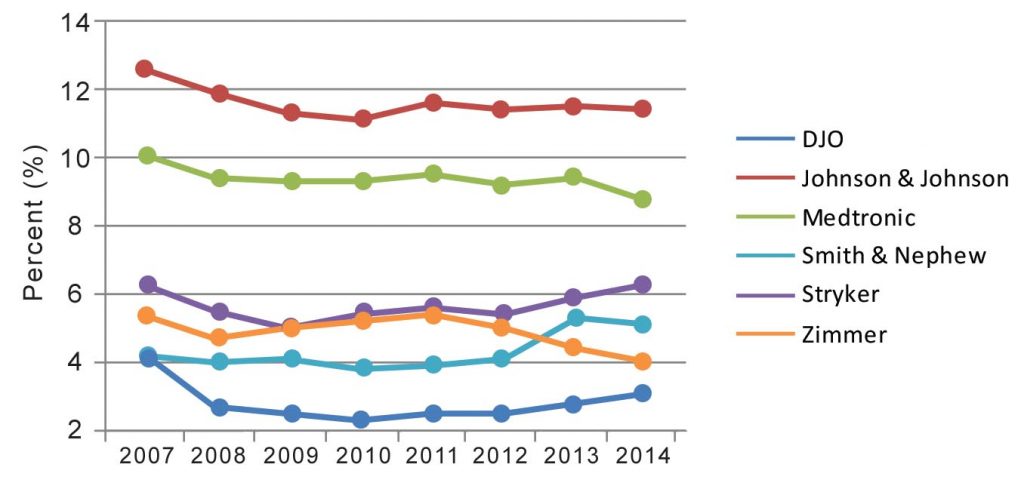

Exhibit 1 illustrates growth or reductions in R&D budgets as a percent of annual sales for six of the larger companies with orthopaedic revenue from 2007 through 2014. This information takes into account the company’s total R&D and sales numbers, not just orthopaedic revenue.

Exhibit 1 takes into account companies’ total sales and total R&D budgets from 2007 to 2014; please note, it is not orthopaedic-specific.

Every company experienced a fluctuation in R&D budgets of less than two percent at some point between 2007 and 2014. Every company’s R&D spend decreased after 2007, but Smith & Nephew’s and Stryker’s 2014 budgets were the same as or surpassed their 2007 spend. As can be seen in Exhibit 1, 2013 and 2014 were not the lowest of years for every R&D budget.

How much R&D budgets grow and whether they maintain that increase will be seen in coming years. The suspension, which is in effect until January 2018, leaves companies with a level of uncertainty that wouldn’t be experienced by a full repeal. This is particularly true for small and pre-revenue companies. BONEZONE estimates that 16 percent of orthopaedic device companies have sales under $100 million. A hit to the top line impacts not only R&D, but everything from hiring to commercialization and distribution.

Analysts have said that companies with a higher percentage of U.S. sales stand to benefit the most from the suspension. Of the 17 largest orthopaedic companies, those with a higher proportion of U.S. sales include Globus Medical, Integra LifeSciences, Medtronic, NuVasive, Orthofix, Stryker and Wright Medical.

Carolyn LaWell is ORTHOWORLD’s Chief Content Officer. She can be reached by email.