When selecting materials, orthopaedic device manufacturers seek a total solution: optimal mechanical performance, osteoconductive, radiolucent, sterile, neither too weak nor too rigid and—a growing factor in the equation—economical. The inclusion of these indicators and more is a shift for the industry.

Materials used in orthopaedic and spine implants tend to enjoy long, dominant runs. Over time, limitations are exposed and new materials enter the conversation. As orthopaedics has moved at a more advanced pace, new material technologies have been a root for innovation. Orthopaedic manufacturers and their supplier partners are adopting different strategies for how materials are surface treated and manufactured in order to enhance device performance.

BONEZONE chose four companies that recently reached milestones, such as clinical studies, regulatory clearance or product launch, with proprietary technologies. Each was queried about their technology, the future of materials and the challenges that companies face in adopting new materials.

Oxford Performance Materials and nanoMag are material companies that believe they have a clinical solution for the orthopaedic industry, while Proxy Biomedical and Titan Spine focus on enhancing a material’s foundation. All four mentioned the importance of proving cost containment, whether at the point of manufacturing or at patient recovery.

Company: Titan Spine

- Product: nanoLOCK™ surface technology

- Applications: Company’s own Endoskelteon® interbody fusion titanium implants

- Status: 510(k) November 2014

- Interviewed: Jim Sevey, Senior Nanotechnology Specialist

How it works: The nanoLOCK™ surface creates an enhanced osteogenic environment to aid in the fusion process. Its topography at micro (10-6 M) and nano (10-9 M) levels, which cannot be seen or felt, interacts with stem cells in a lock-and-key fashion to induce cellular transcription. This biochemical cellular process results in the upregulation of bone growth factors, such as BMP-2, 4 and 7, as well as angiogenic factors necessary for fusion. Therefore, rather than being simply a spacer, the nanoLOCK implant participates in fusion at the cellular level.

The nanoLOCK surface is the first and only nanotechnology cleared by FDA for spinal applications.

Advantages: As shown by Barbara Boyan, Ph.D., in multiple peer-reviewed journal articles in Spine, nanoLOCK technology has a significant competitive advantage because it is designed to harness the body’s natural cellular biochemical processes to induce bone healing. The most common implant material used for interbody fusion implants, PEEK, has actually been shown to produce an inflammatory response that inhibits fusion and leads to fibrous encapsulation, which must be overcome by biologic materials placed within them. The osteogenic nature of the nanoLOCK surface may allow a decrease in the use of expensive biologics to obtain implant fixation and fusion at a lower cost per level. We also back the fusion up with an implant warranty, which nobody else does to my knowledge.

Disadvantages: We are a small company that not only has to blaze our own trail by educating on our subtractive surface nanotechnology, but we also have to defend against misleading marketing and competitors that use our scientific papers to promote their own devices but do not have clearance by FDA to make nanotechnology claims. Just because an implant feels rough to the touch does not mean it will interact in a positive manner with cells at the critical nano level.

Significance: Titan Spine seeks to change the landscape of interbody fusions by harnessing the osteogenic power of nanotechnology. We are also bringing titanium, a material that has a long history of success in orthopaedic applications, back to the interbody space. Due to prior threaded titanium implants, there is a misconception that CT imaging and fusion assessment could be negatively impacted. This is no longer the case with the nanoLOCK implants following advancements in design as well as software advancements in imaging. The other implant material misconception is that titanium devices will subside due to a higher Modulus of Elasticity (MOE) than PEEK. MOE is a material property, and is just part of the equation that determines the strength/stiffness of implants. Subsidence is affected more by implant design, including macro surface characteristics, than the material’s MOE.

Greatest challenge companies face in adopting titanium: The greatest challenge competitive companies have in transitioning to titanium is the massive amounts of PEEK inventory on their shelves. Some companies have responded by coating their PEEK implants with titanium, which makes matters worse due to the potential for the generation of loose titanium particles and/or delamination of the titanium from the PEEK during impaction.

Company: Oxford Performance Materials

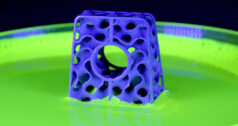

- Product: OsteoFab®, process that combines 3D printing and OXPEKK®

- Applications: Spine, craniomaxillofacial

- Status: Three OsteoFab products received 510(k) clearance, including SpineFab®, a vertebral body replacement implant for thoracolumbar, in July 2015.

- Interviewed: Scott DeFelice, CEO and Chairman

How it works: We have a material (OXPEKK) that is inherently osteoconductive and it has surface deposit reservoirs that are conducive to bone ongrowth; it interlocks.

Regarding the design of SpineFab, one of the things that additive manufacturing (specifically, selective laser melting) allows you to do is create geometries that are impossible or extremely inefficient to create any other way. We have a feature we call OMNILOCK—think of it like towers on top of the implant leaning in all different directions; those support immediate fixation and mechanical interlock for the implant. That is something that is uniquely enabled through additive manufacturing.

You have a highly enabling material, then you have a highly enabling design feature.

Advantages: Everything starts with the right material. As I often tell people who wonder what’s happening with additive manufacturing, a lot of the companies in this space are building with materials that are really useful. Sure, you can build something that looks like an implant with an ABS (acrylonitrile butadiene styrene) and a FDM (fused deposition modeling) process, but you would never put that material in the body. You need to start with a material construction appropriate for the end-use application. In the case of spine, polyketones (PEEKs and PEKKs) have gained favor over the years for their purity, biocompatibility, mechanical properties, ability to be sterilized, and with PEKK, there is the inherit ability to be osteoconductive.

Greatest challenge companies face in adopting a new materials: There haven’t been really fundamental advancements in orthopaedics; they’ve been incremental. I think that’s the combination of the investor community, whether VC-funded or private equity-backed, they’re all risk-adverse with overtones of ”There’s a big market; let’s not change much; let’s just go at that incrementally.” That has been a pressure. Then the regulatory environment, which I don’t think is as daunting as many people think. And there’s a culture and history in the industry that doesn’t want to push too many paradigms—think of things like metal-on-metal; that was an innovation where the materials had an answer that turned out to be the wrong answer.

Company: Proxy Biomedical

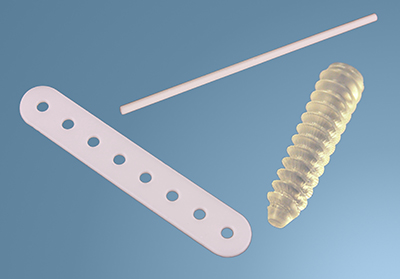

- Product: Bio-XT, a strength-enhancing technology to develop resorbable orthopaedic implants

- Applications: Small bone fracture fixation screws, pins and nails; craniomaxillofacial plates, screws; tissue anchors, interference screws, meniscal pins and tacks

- Status: Launched March 2015

- Interviewed: Niall Rooney, Ph.D., Director of Business Development

How it works: Bio-XT is a strength enhancing proprietary processing technology used to form non-metallic medical implants, such as orthopaedic screws. It avoids the use of standard injection molding or extrusion processes, favoring a controlled forming process in which molecular chain strength is retained and material microstructure is self-reinforced. This serves to harness the maximum available inherent material strength. Bio-XT processing technology is applied to both non-resorbable and resorbable polymers. Furthermore, it has been proven effective with biphasic compounds composed of resorbable polymer and osteoconductive ceramic (e.g. β-TCP, HA, Calcium Sulphate). Indeed, its strength-enhancing properties may be especially attractive for implants that contain osteoconductive ceramic elements, owing to their tendency toward brittleness using standard alternative processing methods.

Advantages and Limitations: Resorbable implants offer aclinician the advantage of improved tissue regeneration at the surgical site, allowing gradual load transfer onto regenerating osseous tissue, and eliminating the possible need for reoperation to remove a non-resorbable implant. The relatively low inherent strength of resorbable polymers has presented a roadblock to new product design.

Future of resorbables: The clinical advantages of resorbable biomaterials are such that increased adoption can be considered inevitable over the next five and ten years. Substantial improvements in both product design and processing technology will target increased implant strength, toward adoption in more load-bearing indications. This trend is already well underway. A number of our customers are reexamining existing indications in which strength-enhanced resorbable implants will provide a marketable alternative to metallic and PEEK-based products, offering improved patient recovery and reduced total healthcare cost.

Greatest challenge companies face in adopting new materials: New product development and commercialization can be a costly undertaking, particularly where a new material grade is introduced. Qualification and validation activities in development, performed to demonstrate product safety and efficacy toward regulatory approval, become more onerous – particularly where the new material is resorbable. Bio-XT, however, is a process that causes no change to chemical composition or degradation dynamics of the extensive range of materials to which it can be applied. Strength increases in the range of 80 percent to 230 percent (across bending, torsional, shear and tensile loading regimes) demonstrated on currently implanted grades of PLLA, PLGA, PLDLLA and biphasic equivalents incorporating β-TCP, HA, Calcium Sulphate.

Dr. Rooney was asked at OMTEC 2015:

Q: Are the benefits of your processing technology maintained as the material degrades?

A: What we’ve seen in an in vitro study of 37 degrees in phosphate-buffered saline was that the strength profile over time, and the inherent viscosity profile and molecular weight profile over time, mapped the standard injection molded. Within mechanical, if you can picture the graph, you’re degrading to zero at the same time frame of around 25 to 30 weeks for the particular material we looked at, which was PLGA 8515. You’re starting, however, from a higher start point in strength, which is over 2x the strength; so the rate of decay in mechanical strength in percentage terms is the same, but it’s falling more quickly from that higher start point.

Company: nanoMag

- Product: BioMg®250, a high strength bioabsorbable magnesium material that fosters new bone ingrowth

- Applications: craniomaxillofacial reconstruction; fixation in knee, shoulder, finger and toe; scaffolding for spine fusion and hip/femur trauma

- Status: 52 week in vitro studies complete; joint development projects initiated with three major OEMs

- Interviewed: Stephen LeBeau, Ph.D., President and Technical Director

Advantages: The density and strength of BioMg250 magnesium alloy is more like human bone than other currently popular implant materials: either plastics or metals. The magnesium implant can supply the temporary structural reinforcement needed during healing while avoiding all of the complications associated with current permanent metal alloy implants. Controlled absorption rates for BioMg implants are based on a combination of proprietary chemical compositions and proprietary processing to dictate both the chemical composition and microstructure of the implant components. Magnesium (Mg), as the alloy base, is an essential element in the body. Mg+2 is the fourth most abundant cation in the human body and is stored mainly in bone tissues.

Limitation: Magnesium alloys are not as strong or as stiff as titanium alloys or stainless steels, so some demanding mechanical fixation devices are not suitable for magnesium alloys. Also, there will have to be device redesigns based on the respective properties of the magnesium to gain the added advantage of being absorbable. That issue can be addressed by applying good fundamental biomedical engineering to device design. Manufacturing of magnesium devices is performed using methods similar to those used for other metals, so we do not see any limitations regarding available geometries (rod, thin wire, cables, mesh, machined plates).

Greatest challenge companies face when adopting new materials: The greatest challenge facing companies working on innovative technologies is the uncertainty regarding the regulatory approval process for new materials. The recent history of extended delays in getting FDA approvals causes both traditional early stage investors and the OEMs to avoid investments in early stage companies. OEMs have adopted the strategy of waiting until early stage innovations are approved and revenues are generated by the small companies before they will consider any investments, and then the preference is via a later-stage acquisition. However, this new model of innovation places small company innovators in a difficult environment to be able to raise sufficient capital to support their innovations.

Dr. LeBeau was asked at OMTEC 2015:

Q: What is the anticipated absorption rate?

A: We anticipate a total absorption of 12 to 18 months. Obviously that will vary with the indications and where it is in the body, vascular flow and the geometry. We’re saying a stable configuration mechanically at 12 to 18 weeks, and total absorption a year.

CL

Carolyn LaWell is ORTHOWORLD's Chief Content Officer. She joined ORTHOWORLD in 2012 to oversee its editorial and industry education. She previously served in editor roles at B2B magazines and newspapers.